Retail traders take over Hedge funds in the response of Europe at the ‘Meme Stock’ mania

Several European stocks have become a battlefield for retail retailers that take over the short sellers of the Hedge Fund, in the campaign with the “Meme Stock” craziness campaign that captured Wall Street during Pandemia Coid-19.

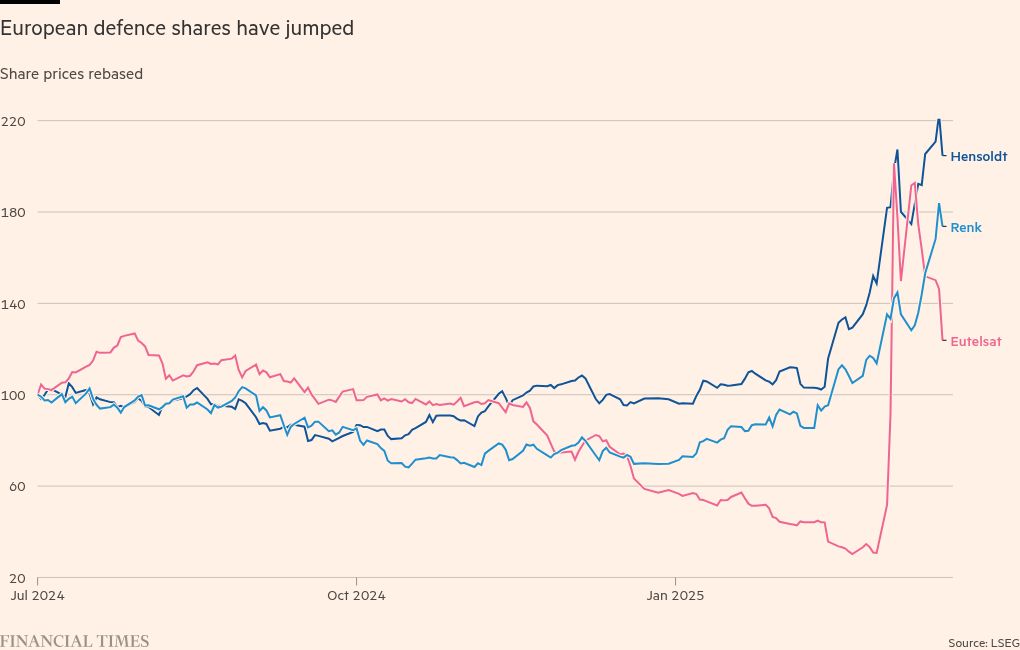

Companies, including Germany Hensoldt and Renk Group and the French satellite business Eutellsat, have rose in recent weeks, which is far outweighed by a wider gathering that led the defense sector, as investors predict an increase in military consumption across Europe.

Analysts say that small-scale traders are sometimes coordinating their efforts on the forums of social media such as Reddit-have made gains intentionally buying supplies in shorts Hedge funds including Marshall Wace and a millennium.

“A tectonic shift occurs in Europe,” said Roland Kaloyan, a capital strategist from Société Générale, comparing the recent popular retail interest in Mania Mania for Meme shares 2021.

The traders then inspired Reddit aimed at strongly short supplies-the suture of the Gamestop-Koji video game seller sent the shares of the Racketing and forcing Hedge Fund Melvin Capital to close after suffering huge losses.

Recent stretches of shares in Europe were less extreme, and the shares did not hit the same stratospheric estimates reached by Gamestop. But the “short squeeze” encouraged by retail customers included the “same mechanics” as the meme shares, Kaloyan said.

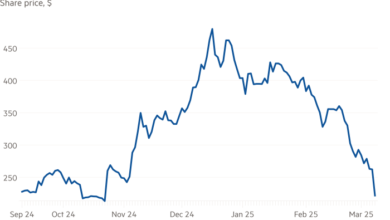

Hedge funds such as Millennium, Qube Research & Technologies and Marshall Wace have been in their negative bets in Renk Group in recent weeks, according to data provider data. Renk’s share price has climbed to almost 50 percent in the last three weeks.

Stocks in French suppliers of Latecoere aircraft, another popular Hedge Fund, have increased 80 percent from the end of February.

In contrast, the wider aircraft and Stoxx Europe defense index increased by about 16 percent in the same period.

Nearly 300 percent of the Eutetsat increase cost short sellers of approximately $ 187 million losses from marking to markets in three weeks to March 14, while Hensoldt’s short sellers suffered $ 110 million losses as its shares climbed to 40 percent in the same period, according to the S3 partner.

One poster at the Boursorami-French forum on the stock market-said Eutetsat had an “enemy” in Darsani, an American Hedge Fund holding short positions in Eutetsat and its rival SES based in Luxembourg.

Another said, “If no one sells, short sellers will have to buy more. Keep your shares and you won’t lose.”

Blakkrock, the world’s largest property manager, also had significant shorts in Eutetsat, before producing them under the threshold of publishing of 0.5 percent in recent weeks. “Blackkck is now completely out,” one user joyfully informed the forum last week.

Investors have also moved to “R/ACTIEN” and “R/WALLSTRETBETSGER” on the Reddit-German version of the Reddit Forum R/Wallstreeetbets-aspiring whether it is “time to buy” small and medium stocks listed in Frankfurt.

One user said, “On this wonderful day I went to Renk for a long time. I hope the lights will turn off in the heads of thick cats and see what will happen here soon.”

Marshall Wace, Qube, Darsana, Millennium and Blackkrock refused to comment.

Trade platforms for retail are reporting a large takeover of activities. Flatexdegiro, a German retail mediator, said he had solved 70 times in the last month of Eutellsat shares with comparison with a month before, while the stores in the Renk group rose more than fourfold.

Etoro, a retailer undergoing the UK, said the merchants had opened 18 times more positions in Hensoldt in the last month as they had the previous month.

The sudden burst of interest in European small shares comes because the unpleasant tariff announcements of President Donald Trump launched the US capital markets in the last few weeks, which has referred to concern about slowing economic growth in the world’s largest economy.

European stock They were among the main users of the Rotation of investors from US shares, and the odds of the region were further enhanced by Germany plans for the release of military consumption and transfer of its infrastructure.

Some traders aimed at Trump’s administration and sought to portray their activity as an effort to enhance the European conquest drive after the president’s insistence that the continent should no longer rely on the US for defense.

“I don’t care about the profit, I just want to combine some of my money to help and move away from US property managers and property,” one poster wrote on the R/Eupersonalfinan’s Reddit Forum.

In contrast to the US, which is limited detection of short bets, Hedge funds and other investors must discover when they shortened more than 0.5 percent of the EU -UK shares, which facilitates retailers to target the Fund’s positions.

Eutetsat had almost 100 percent of his loans on loan last year – powerful for short interest rates – before it fell to 80 percent in the last two weeks because some of the funds had bought their positions, according to S&P GLOBAL.

It seems that the recent increase in the prices of shares has encouraged hedge funds to quickly emerge from other negative bets when the shares began to gather, according to Alexander Petercu, the head of the small and medium capses in Bernstein.

“There were very high short positions in small stocks,” he said. “The alarm bells ring when Eutetsat was squeezed, so [hedge funds] They killed their short positions and in other companies, very quickly. ”

Additional Costas Mourslas and Ray Douglas