Narry bonds slide us as a Donald Trump tariff pretty economic concern

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

US corporate bonds that have issued a risk borrower’s borrings to the Klizija that they are increasing concern about President Donald Trump’s tariff Donald Trump to overthrow the US economy.

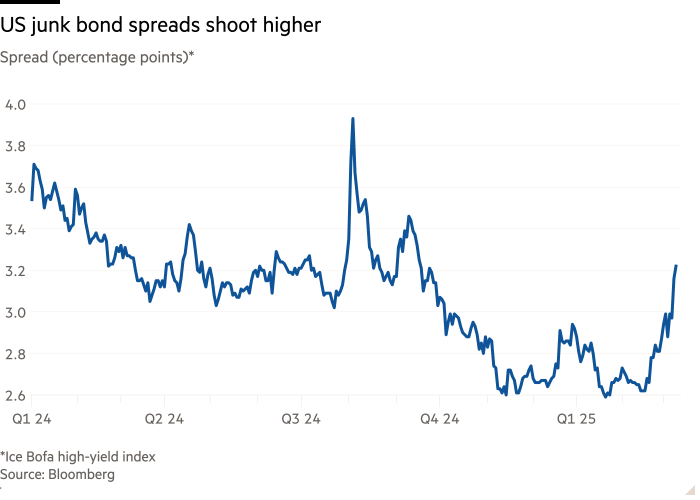

Expanding-or additional borrowing costs compared to US treasury-which have been paid by US companies with a rated worthless rating by 0.56 percentage points from mid-February to the highest six-month maximum of 3.22 percentage points, according to a carefully observed intercontinental exchanger collected index.

Growth of widespread bonds, an important measure of perceived risks in US markets, draws worries on Wall Street that Trump’s aggressive tariffs At the largest American trade partners, they will cool American growth or even transfer the world’s largest economy to a recession.

“Credit wider has spread over the last few weeks, guided by fears due to US recession and insecurity of tariffs,” said Eric Beinstein, head of the US credit strategy in JPMORGAN.

Beinstein added a recent decline in “swinging”, companies such as Tesla and Palantir Technologies that helped to power together in capital 2023 and 2024, “worsened” the fall of garbage.

OUR corporate bonds They managed to demolish volatility that affects the capital market until February, but as the distress of the shares withdrew, the “small cracks” that began to form in March grew in Natura, said Neha Khoda, a credit strategist at the Bank of America. “It’s a refund of the lack of movement in February.”

Earlier this week, analysts from Goldman Sachs revised their forecast for the spread of worthless bonds to 4.4 percentage points by the third quarter of 2025, which is previously than 2.95 percentage points. The Wall Street bank noted that the spreads were still too low despite the recent increase in the risks of “significant exacerbation” in economic prospects.

High quality US corporate bonds were also under pressure from the ICE ICE to expand debt investment in 0.13 percentage points in the last month to 0.94 percentage points, which is the highest level since mid-September.

Despite the recent ups, it is expanding to bonds in investment and worthless bonds remain low in historical standards. However, bankers say that recent discomfort has encouraged investors to be picky with corporate bond contracts.

“Investors get away from transactions faster if they think prices are too strong,” said Maureen O’Connor, a high -level high -debt union chief at the Wells Fargo.

A more stable effect on European credit markets this year also led to some American groups issued debt in euros, not dollars, Beinstein said. This year there were $ 37 billion in publishing “reverse Yankee”, on the way to the biggest first quarter for such offers since 2020.