Tariffs do not scare the investors, but maybe they should

Unlock the Bulletin on White House

Your guide for what American choices 2024 means for Washington and the world

The most dangerous thing about the tariff is how they simply sound. What could be clearer than hitting a 25 percent levy on all goods from Canada and Mexico? However, the impact and implementation of such trade measures are devilishly complicated. This could explain the muffled market response.

Some shares on Monday followed a predictable scenario after the tariffs were announced. For example, car manufacturer’s shares have fallen, for example. That makes sense: their vehicles consist of parts crossing the boundaries, in some cases, before they arrived in MP. Stellantis is one company that supplies a kit between the facilities on both sides of the border of US and Canada.

Then there are companies that buy live goods from China and sell them to American consumers. This would include the Best Buy electronics sellers or a budget output tree. Now they face an unenviable decision between how much they have increased swallowing costs and how much to convey consumers – at risk of continuing the wrath of the president Donald Trump.

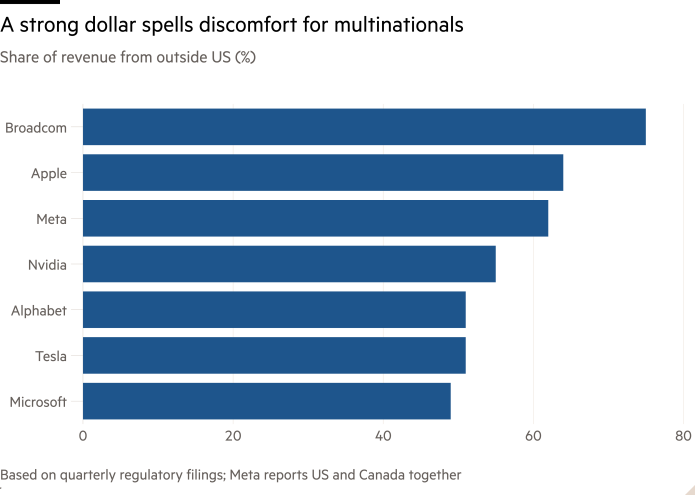

For corporate America, it is spreading, further discomfort. Trump’s tariffs were pushing the already strong dollar even greater. That, by itself, is not a surprise. Study of Trump’s Last Presidency suggested that the tariffs on China have encouraged a dollarand pushed a series of renminba. Citigroup strategist believes that the latest tariffs justify a 3 -pointed blow.

It is a retreat for companies – from internet searches to coffee chains – which receive a large proportion in their revenue and earnings in foreign currencies. It was as if Trump hit the tariff on their foreign profit.

Technology, food and household goods are most affected, considered to be a strategy of Morgan Stanley; at least telecommunications and utilities. The Wall Street Bank has also revealed that the shares with lower sensitivity to earnings in the dollar have surpassed their peers since September.

All this redirects adaptation, not a crisis. 1 percent drop in the S&P 500 index to late morning that Mexico received a one-month return-not even entering the 20 worst trade days last year. Maybe the worst is already appreciated, because Trump is not secret to his plans. BNP Paribas economists note that the tariffs have already been respected into initial economic forecasts.

But it can be equally that investors do not know where to start. The supply chains differ even between companies that are close peers. Trade war, especially when the supply chains that are still recovering from the pandemic are applied, is an untreated territory. One of the permanent characteristics of American exceptionalism is that investors approach American property at a time of chaos, even when uncle is the cause of that clutter.

Either way, market reaction – basically no more than shoulders – is the risk itself. If the prices of the shares were demolished, I would have sent a message to the president that the slap of the tariff is not as simple as it sounds. As is the case, the relatively inactivity of the investor gives him few reasons to show restraint.