Parent guide on how to invest in stock for teenagers

Smartasset and Yahoo Finance LLC can earn a commission or income through links in the lower content.

Teaching a teenager about investment in stock helps to build financial literacy and encourages smart money management. Early learning of these skills can help them make informed decisions about consumption and savings for the future. AND Financial advisor They can provide guidelines on investment and strategies adapted to beginners to help teenagers develop good financial habits.

The beginning of investment at a young age can make a big difference in long -term financial growth. The earlier you invest, the more time you will have to grow through complex interest. This means making interest on his money and interest he has already made over time.

Investing early also helps build good financial habits. Learning how to save, manage risks and bring smart investment to prepare individuals for future financial decisions. It also enables greater flexibility, as early investors can take over long -term strategies without pressing the need for fast yields.

Finally, investing early can better prepare a teenager for large costs such as buying a home, starting a job, or a comfortable retirement. It also reduces the need for large amounts later in life and can provide financial security.

To start investing, your teenager will need a a guardian account. This type of account allows for smaller your own stocks while an adult manages. Most brokerage companies offer custody accounts, making it easier to start.

These accounts may have different investments such as shares, bonds and mutual funds. As a guardian you manage the account until a teenager reaches adulthood when they take complete control. This setting allows them to learn about investment while they have guidelines on their way.

After setting up the account, talk about Investment strategies. Learn your teenager to focus on long -term growth instead of fast profit. Explain the importance of diversification to reduce risk and enter concepts such as average dollar on average. Encourage them to research companies, read financial news and understand market trends to help position future investment decisions.

Teens have several options of investment outside the shares that will help them build a strong financial foundation. Here are four usuals to help them start:

-

Index funds They are a great way to teach teenagers about the benefits of diversification and complex interest. By investing in index funds, they can get exposure to a wide range of industry and companies, which could help inform their financial decisions in adulthood and retirement.

-

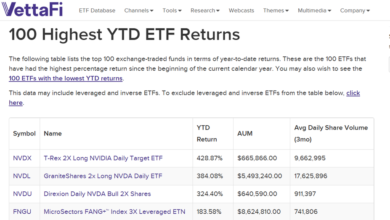

Funds traded on exchange (ETFS) Offer the same advantages of diversification as index funds, but trade such as exchange shares. This feature can be attractive to teenagers who are interested in more active trading.

-

Dividendi shares Pay off part of the company to shareholders, providing a permanent flow of revenue. For teens of dividend shares can serve as an introduction to the concept passive income and the importance of re -investing dividends for the growth of wealth over time.

-

Roth Iras are another usual option to earn revenue. This can offer growth without tax and retirement, which can instill a long -term way of thinking about investing.