ETFs are killing 2024

Coin Stories podcast host Natalie Brunell discusses whether Michael Saylor’s bitcoin strategy will pay off on ‘Making Money’.

Global the mutual fund industry is coming off its best year ever, with a record $1.4 trillion in inflows through the end of December, bringing total assets to $14 trillion, according to Matthew Bartolini, head of SPDR Americas Research at State Street Global Advisors.

“Within active, both active equity and active fixed income, as well as active “other” strategies, had record flows of $150 billion, $100 billion, and $20 billion, respectively.” Bartolini remarked.

Along with the rise of active funds, investors have been looking for new ETFs on the scene.

“Another reason has to do with the launch of crypto ETFs. You’ve seen Spot Bitcoin ETFs come out now in January, the inflows have just been crazy,” Sumit Roy, senior ETF analyst for ETF.com, told FOX Business.

Since launching on January 5, 2024, the iShares Bitcoin Trust ETF, or (IBIT), has added more than $50 billion in assets, according to the firm, making it the best-performing exchange-traded product in history.

THE IRS IS READY TO SEND REFUNDS TO MILLIONS OF AMERICANS

iShares Bitcoin Trust ETF

“Inflows into IBIT since launch highlight investors’ willingness to gain exposure to bitcoin through the convenience and quality of an exchange-traded product. The market has seen a renewed sense of optimism in anticipation of positive regulatory action for bitcoin and crypto. We remain focused on educating investors and providing access to bitcoin with practicality and transparency,” a A BlackRock spokesperson told FOX Business in November.

Bitcoin has advanced over 122% this year.reaching an all-time high of $106,734 and has since retreated from that level. The crypto industry got a boost after President-elect Donald Trump won the White House and promised a more crypto-friendly regulatory environment.

Trump nominated former SEC official Paul Atkins, an industry favorite, to replace incumbent SEC Chairman Gary Gensler in January.

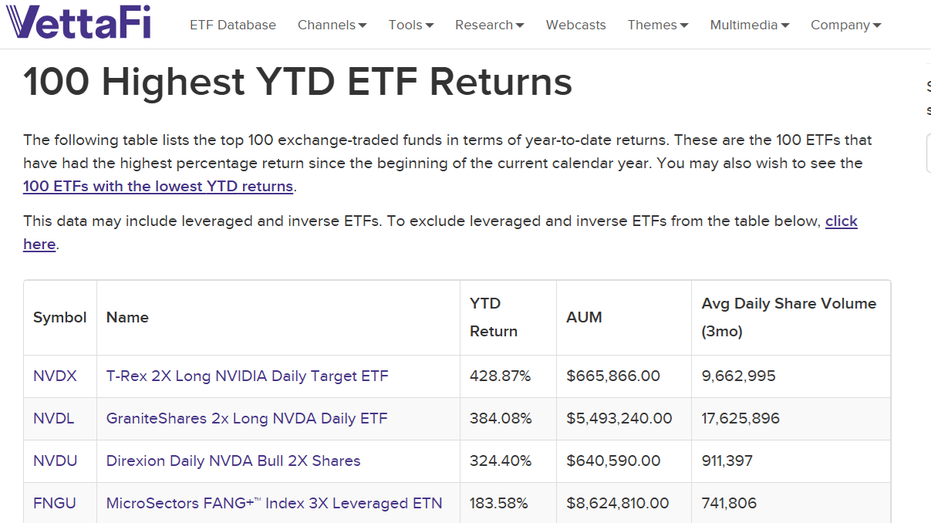

Another driver, those ETFs that are considered more “tactical” that allow you to have a position on both sides of the trade. These four top-performing ETFs in 2024, tracked by VettaFi, are up between 428% and over 178%, far outpacing the S&P 500’s 26% gain through Monday.

The most successful ETFs in 2024: 29.12.2024 (VettaFi)

“Whether someone has a view that the market is going to go up or down in the short term, we have those tools for them,” Ed Egilinsky, director of Direxion, told FOX Business.

Direxion Daily NVDA Bull 2X shares are up over 300% this year. It helps investors track the rise and/or fall of AI chip darling Nvidia. “One stock, leveraged inverse single stock, we actually shaded six billion with the franchisee,” he added.

CLICK HERE TO SET FOX BUSINESS IN CRETE

The company now has 13 single-stock ETFs, with likely plans to expand in 2025.