Price of gold hits record high at the underground of the American tariff

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

Gold reached a record maximum on Thursday, while investors overturned because of potential US tariffs and, such as growing levers in New York, created a disadvantage in London.

The reference price increased to $ 2,798 per three, surpassing its October record and gained a gain at 7 percent this year because traders are protected from potential shifts in Us trade policy.

US President Donald Trump threatened that from Saturday 25 percent of tariffs to all imports to Canada and Mexico, which caused fear in the market to be able to apply to tariffs goldwhich was historically released by imported duties.

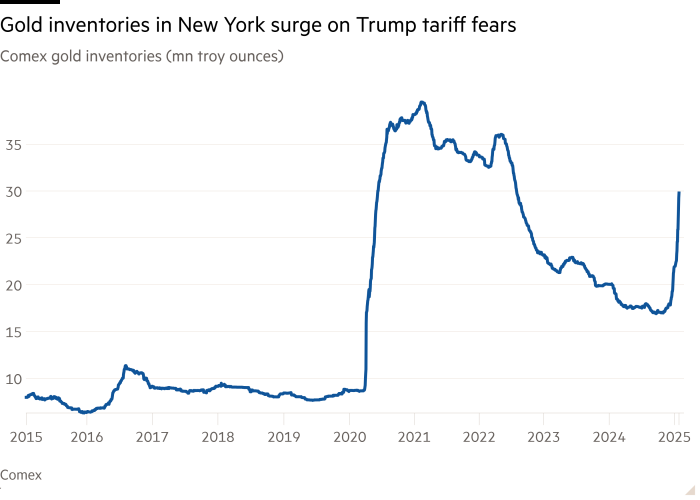

Merchants have collected levers in New York at Comex, in New York, in New York, where supplies increased by 75 percent of the USA choices. The value of the stock increased on Thursday to $ 85 billion, which represents more than 30.4 million Toy Unc, according to Comex.

A rush to New York spent supplies Easily accessible gold in Londonwhere there is currently a turn of four to eight weeks to withdraw it from the bank of England.

The weakening US dollar also helped to encourage a golden rally, as it makes the levers cheaper to buy other currencies.

By undergoing a market, short positions for the golden future have fallen to the lowest level since April 2020, according to data from the commission trading commission, the US derivative regulator.

“There is a lot of concern about the tariff,” said Suki Cooper, an analyst from Standard Chartred. “A gold appeal with a safe haven really begins, when there is a widely grounded risk of assets.”

Usually gold benefits from lower interest rates, because Bullion is non-privileged assets, however, this correlation has broken down in recent months.

The golden rise on Thursday came the day after the US federal reserves held interest rates stable, and Chairman Jay Powell signaled caution for further reduction in the rates.

Cooper said that, although gold, he would probably guess fresh peaks in the coming weeks, the rally could slow down later in the year. “If we see a further reduction in the footsteps in the first half of the year, it would support gold, and then such a wind will be extinguished in the second half of the year,” she said.

MUFG analysts also told clients that Gold “had an incentive to go much further in the short term,” because the market has turned gold as geopolitical protection against the uncertainty of Trump’s administration.

“Also, the central emerging market banks continue to buy levers,” they added.