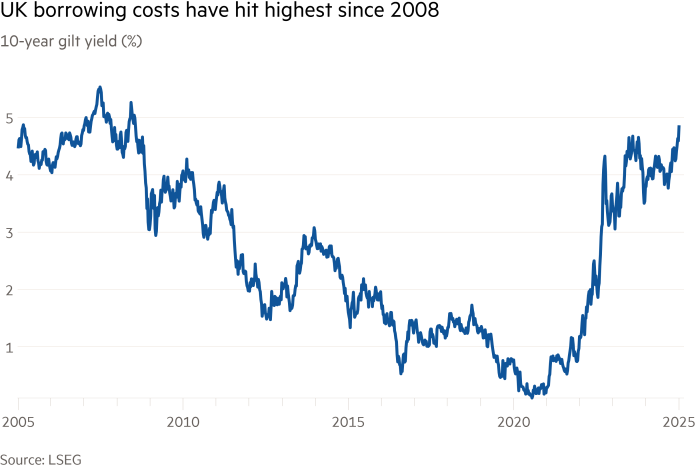

British government borrowing costs are hovering near their highest level in 16 years

Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

UK government borrowing costs rose on Friday but remained below Thursday’s peak as investors await a key US jobs report later in the day.

The 10-year gold yield rose 0.03 percentage points to 4.84 percent, but was still below the 4.93 percent level touched on Thursday, which was the highest since 2008. Yields move inversely with prices.

Sterling fell against the dollar, falling 0.2 percent to $1.229.

Gilts have suffered in recent sessions amid a global rise in government bond yields fueled by sticky inflation in some major economies.

Analysts say closely watched U.S. jobs data for December, due later on Friday, will help guide bond yields, including gilts.

The UK has been particularly hard hit by the global sell-off as investors worry about the government’s large borrowing needs and the growing threat of stagflation, which combines anemic growth with persistent price pressures.

The credibility of the government’s economic plans is vulnerable to tensions in the bond market after Chancellor Rachel Reeves left herself just £9.9bn of headroom over her revised fiscal rules in last year’s Autumn Budget.

Rising nazlata yields have since threatened that budgetary wiggle room. The level of bond yields is an important determinant of budget space, given its implications for government interest rates, which exceed £100bn a year.

Labor sought to reassure investors this week, with Darren Jones, the UK Treasury’s number two, telling MPs on Thursday that the government was committed to “economic stability and sound public finances”.