Chief BP aims more than a double -oil -tanning groups on $ 200 billion

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

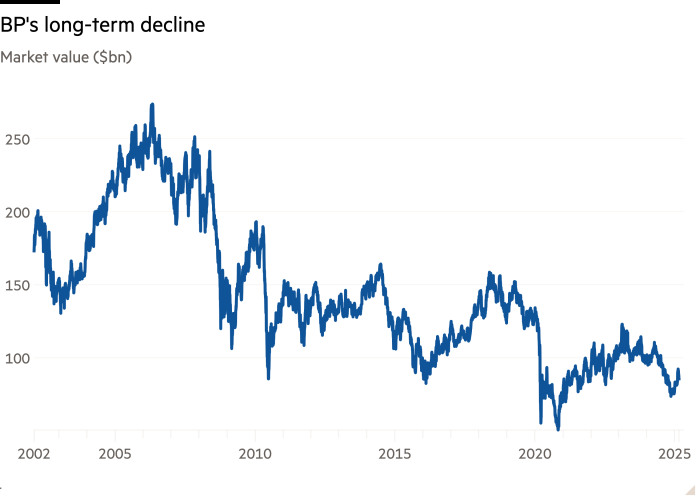

The Executive CEO of BP wants more than double the market value of the oil major at $ 200 billion within five years, returning the company to the level he achieved before the Deepwater Horizon 2010 disaster.

Murray Auchincloss told the Financial Times Yes BPS He would use a “huge” demand for oil and gas after leaving the plan this week to invent as a Green Energy Company.

“At the end of the decade, it would be nice to come back where we were before Macondo,” Auchincloss said, referring to the name of the oil well that blew up, causing one of the worst spilling of all time and leaving a BP with a $ 62.5 billion cleaning account.

He spoke the day after the BP, whose current market value slightly less than £ 70 billion ($ 89 billion) reduced its annual renewal spending by 70 percent and facing your back to their fundamental jobs of oil and gas.

The plan, which has received lukewarm reception on the market, admits that the transition of energy is moving much more slowly than expected.

“The demand of oil and gas will be around for a long time,” Auchincloss said, when asked what the BP would look like after 2050. “It will still be a huge amount of demand for that.”

He said that the growing requirements for electricity of the Datcentra would make gas, especially, the fuel of choice. “The challenge is how to decarbonize these things as you can,” he said, adding that BP is already actively recorded by carbon shows.

While Auchincloss has given up all the goals for renewable sources and wants to move BP and the wind and solar weapons from the company’s balance sheet, he said it would still be “very big” companies.

The BP was criticized for the prelude movement to implement his strategy, but Auchincloss said he did not regret his first year as a permanent executive director. “Nothing comes on top,” he said.

“You do not announce the change of strategy until you change it,” he said, adding that if he announced such a bold turn before he set up any basis, the market would not believe him.

BP was under pressure to improve its performance, especially after it created earlier this month This activist investor Elliott built almost 5 percent of the company in the company and advocated a change.

A person familiar with Elliott’s thinking on Thursday said that the company’s plans did not go far enough after urging her to take great seizure and reduction of consumption on renewable energy. Bloomberg first reported on the dissatisfaction with the Hedge Fund to the new strategy.

Auchincloss refused to comment on whether he had interaction with the New York Hedge Fund.

He admitted that the BP would suffer a certain financial pain in the short term, because after years of pruning on the portfolio, he filled his pipeline of oil and gas projects. But he said he would focus on the promotion of the company to US investors and said that most of the BP growth would come from the USA of the Middle East.

“We are more American than a lot of US companies,” he said.

“I really focus on US investors and show them how attractive we are compared to their domestic capabilities in the United States,” he said, adding that the managerial team would talk to more than a third of the BP shareholders in the coming weeks.

However, he said that the movement of the company’s list in the US is not “on the agenda”.

Auchincloss also defended BP from criticism that he is less valuable, as an oil and gas company, from his peers such as ExxonMobil and Chevron, who have market capitalization of $ 481 billion and $ 279 billion.

“Our size is smaller, but the quality of our property is extremely high,” he said, before distracting the list of oil and gas fields of BP, which he said were the envy of the industry.

“There is an absolutely world -class class and is the envy of other corporations. We have a very, very, very good integrated position that allows trading. And US companies have no trading. We would love. We compete with the head with a shell, which is twice as big [by market capitalisation]. “