Great technological pressures with huge consumption plans for AI for 2025

High technology of enormous consumption on artificial intelligence should take place in 2025, after Amazon surpassed his Rivale on Thursday with a planned investment of $ 100 billion in infrastructure this year.

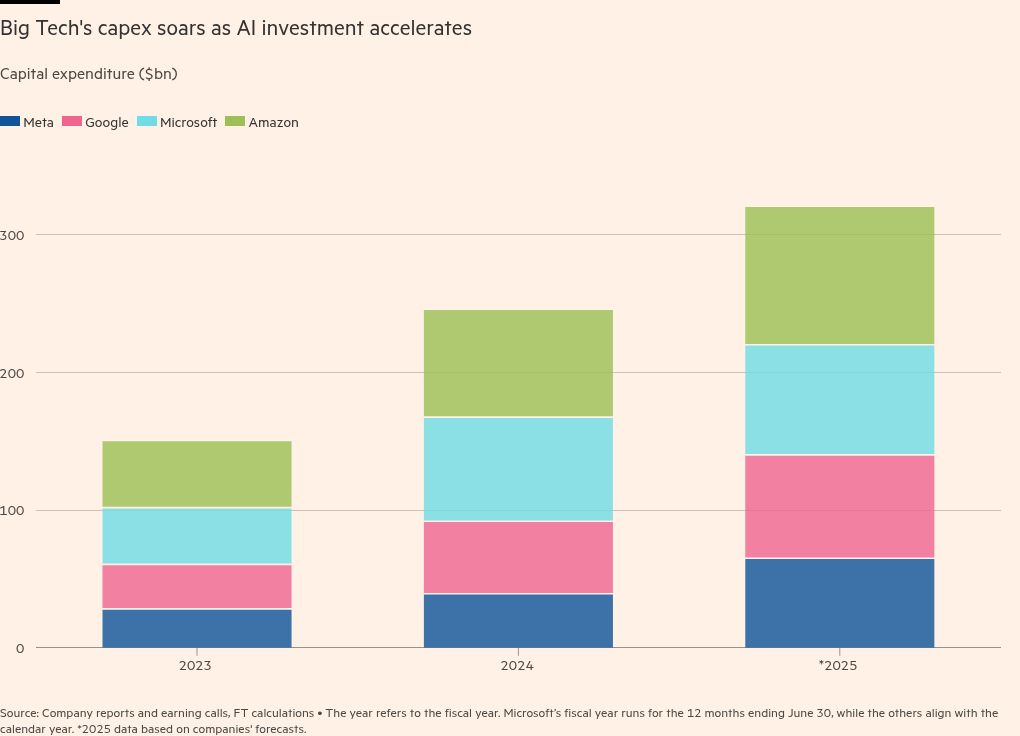

Consumption of four leading American technological companies has already increased by 63 percent to historical levels last year. Now the executives are promised to accelerate their investments in AI, rejecting concerns about the huge amounts that are betting on initial technology.

Microsoft, Alphabet, Amazon and Meta reported a combined capital expenditure of $ 246 billion in 2024, which is $ 151 billion in 2023 compared to $ 151 billion. They predict that consumption could exceed $ 320 billion this year because they are competing for the construction of data on data and fill them with bunches of specialized chips to remain at the helm Ai Researching a large linguistic model.

The scope of their consumption ambitions with earnings in the fourth quarter-has expanded the market and worsened with a sale caused by the publication of an innovative and cheap AI model from the Chinese start-up Deepsek at the end of January.

Microsoft and Google Parent Aphabet each recorded $ 200 billion deleted from their market value after reporting to the weaker than expected growth in their cloud computing divisions, with a steep increase in capital consumption. Google’s 8 percent falling on Wednesday was his fifth trading day in the last decade.

“Unhappy enthusiasm throughout the ‘magnificent seven’ was replaced by the pockets of skepticism and created some” show me “of the situation,” said Jim Tierney, head of the concentrated American growth fund in Allianceberntein. “The concerns I’ve had since the summer are magnified today.”

In the midst of Hype about AI’s transformation potential, shareholders take care that consumption of consumption without proportational increase in revenue could be eaten in capital that would otherwise return in the form of buy and dividend, at the same time starving business lines not AI.

Google was opaque about the use and revenue from his twin Chatbot, while companies were careful to accept Microsoft’s nibbling and expensive “agencia” co -imprisonment for improving labor productivity.

“If or when we see the acceleration of cloud growth on Google or [Microsoft’s] Azure, or see how the co -container intake improves, will be more comfortable for investors to consume on the alphabet or microsoft, “Tierney said. “The cheaper and more comicized AI models are likely to enhance investors’ problems in the meantime.”

Deepseek model R1 He was emblematic for such fears. The Chinese Ai Lab’s Claim to Have Built A Reasoning Model with Similar Capabilities to Google and Openi’s Products at a Fraction of the Price – and Without Access to Nvidia’s Most Advanced Graphic Processing Units – Caused The Chipmaker’s Stock to Plunge 17 In one day, from which he only partially recovered.

Big Tech bosses kept their nerves. On Tuesday, Google’s Sundar Pichai said in defense of his plan to spend $ 75 billion in 2025. that moment. ” Deepseek would add demand, showing that new techniques could be cheaper and encourage new research lines, he said.

Microsoft’s Satya Nadella said two weeks ago in Davos: “I will spend the construction of $ 80 billion azure, customers can count on Microsoft.” He reiterated his belief in the craziness of slowing down and failing to use his early support of an open-up driver.

And on Thursday, the Amazon CEO Andy Jassy surpassed Google and Microsoft forecast more than $ 100 billion In capital expenditures this year, compared to $ 77 billion in 2024 and more than double the USD $ 48 billion in the previous year. The vast majority will go according to data centers and servers for the Amazon Web Services, and Jassy said it simply responds to “significant demand signals”. The stocks dropped as much as 7 percent in the shop after working hours.

“Growth is cooked a little, but the investment for investment is not diminished,” said Jeff Pearson, Vice President of the Cloud Strategy at Consultancy. “They plow in advance, even if the refund of investment seems distant.”

Meta received a more positive reception on his earnings, with his shares rose even while boss Mark Zuckerberg committed to spend “Hundreds of billions” More about Ai, above $ 40 billion invested in 2024.

“Investors have accepted the target, although their chapex is growing, because there is an improvement of a real -time investment in the consumption of clients, which is measurable,” said Tierny, referring to the target of use of AI to improve the target of ads on Facebook and Instagram.

The success of the target in showing tangible yields from AI investment was unlike Google, which faces new competitors and a difficult task of integrating AI -AU searches without cannibation of basic advertising.

The search giant introduced short answers or “AI reviews”, at the top of the search results, but they change its liaison lists, the first of which are lucrative sponsored.

Still, “if there was a crack in the Google Empire to search, it certainly doesn’t appear yet,” Bernstein said analyst Mark Shmulik, pointing to a $ 13 percent increase in $ 54 billion in the last three months of 2024. “Google has not missed the search expectations anytime since Chatgpt started nine -quarters ago.”

Consumption among the “magnificent seven” – including Apple, Nvidia and Tesla – dwarf rest of the US S&P 500 reference value. Their capital consumption increased 40 percent compared to 3.5 percent among the remaining 493 companies, according to Société Générale. The profit among the elite group increased by a third in the same period, opposite 5 percent among other things.

Consumption is not limited to publicly listed companies, nor is the deep search or fear of AI bubbles slow down the flow of capital into a start-up in a silicon valley.

Openai’s Sam Altman founded a partnership with SoftBank and Oracle to invest $ 100 billion in US AI infrastructure, which could rise halfway through the trillion over time. The Japanese investor talks with the role of $ 25 billion in a start-up with a value of $ 260 billion.

“Can there be winter ai at some point? Certainly,” said Rishi Jaluria, an analyst at RBC Capital Markets. “But if you are in a position to be a leader, you can’t take your leg off the gas.”