The biggest founder of Hedge Fonda tells us in ‘spiral death’ if the debt is not reduced

The United States is currently in the “death spiral” debt that could lead to an economic “heart attack” if both sides do not work together Start cut immediatelyAccording to Ray Dalio, the founder of the world’s largest Hedge Fund.

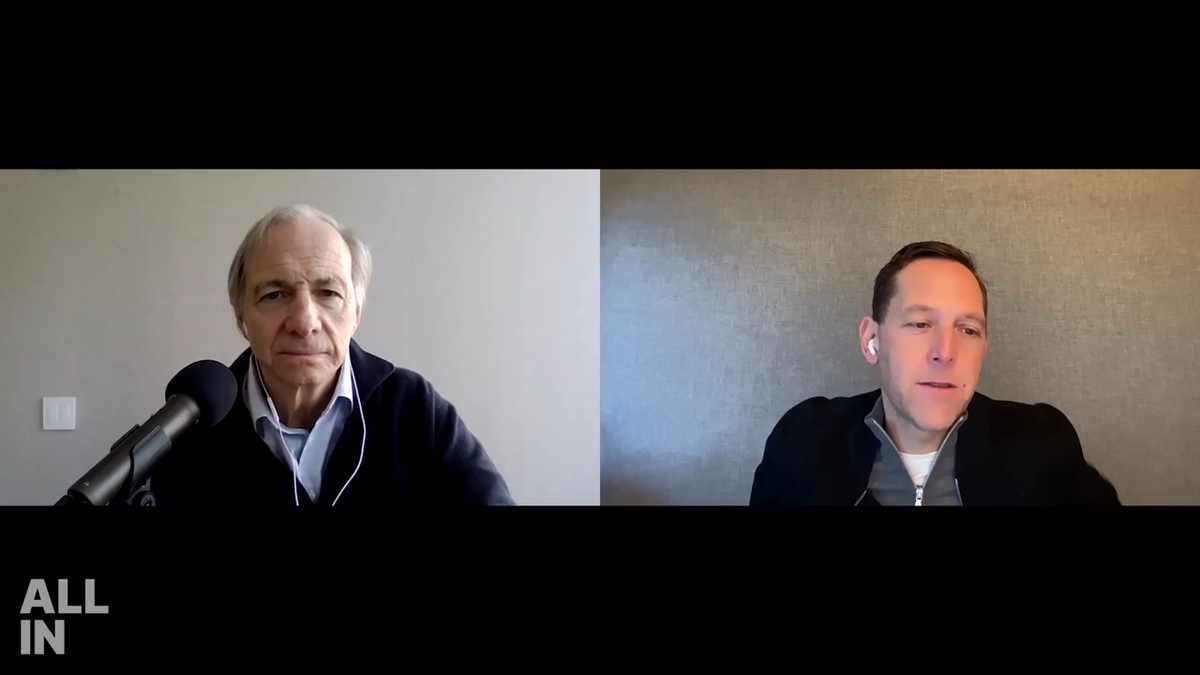

During the recent conversation about “All-in Podcast” With co -organizer David Friedberg, he noted that “spiral death” usually refers to when a company or government had too long and must borrow to serve it. According to Daliou, investors are aware of this, which is why the loan worsens and increase interest rates.

Dalio, the editorial director of Bridgewater Associates, says this is the worst thing that can happen a strongly indebted entity. He notes that the key question is whether the debt creates a great enough income to alleviate this issue.

“It’s like, I don’t know, eat vegetables or something. It’s a healthy process. And if not, the loan starts to build this debt, starts becoming like a board in the arteries. And you can measure it just like you like you could measure it in The arteries, and you can see how it limits that circulatory system, “Dalio said” All-in “.

Shoop: Key Conservative MP draws a red line on a budget plan of a house

Ray Dalio, founder of the world’s largest Hedge Fund, warned the co-organization of “All-in Podcast” by David Friedberg of serious economic consequences, the national debt is not resolved quickly. (All-in Podcast)

If the interest and debt service continuously limits the government’s money, it claims that it can lead to a “heartbroke of economic debt”.

A large amount of debt creates a need for someone to buy it. Due to risks, not only are they creating urgency to offer a new supply, but the owners can also sell that debt property, which leads to a huge offer in relation to demand, Dalilio states.

In case the debt load increases or there is a high imbalance of supply and demand, the central bank of the Government may print more money and buy it. If they do not, the price of the debt must rise to limit borrowing, snowballs to narrowing a non -existent loan, in return, weakening the economy and causing poor economic conditions.

Dalio says the government can allow or print money and buy debt to bring it in. However, this will cause inflation and lower the value of debt.

“In both cases, you do not want to keep that debt because there is a problem with the debt service or there is depreciation,” he adds.

The Black Calcles Chair accuses Trump of ‘purification’ for ‘minority’ of federal workers

US national debt exceeded $ 36 trillion. (All-in Podcast/Jemal Countess/Peter G. Peterson Foundation/Chip Somodeville/Getty Images)

Now there is $ 36.4 trillion federal state debt and a gross domestic product (GDP) of 29.1 trillion, giving debt ratio and GDP of 125%. This ratio has constantly climbed since the pandemic began in 2020, when the debt of the Federal Government was $ 20 trillion and GDP only $ 21 trillion. From pandemic, the debt of the Federal Government increased by 80%, while GDP climbed to 38%.

Despite the recent efforts to reduce interest rates again, the markets traded the cash registers, causing long -term interest rates of the US debt to increase to a level they do not feel before the 2008 global financial crisis. In order for the economy to grow, the US government manages almost $ 2 trillion annual deficit, almost 7% of GDP, while it pays more than $ 1 trillion a year, only to interest on the existing unfinished debt.

Dalio expressed a sense of urgency in relation to assembly debt, falling into potential benefits Government Efficiency Department (Doge) and that the need to reduce costs will inevitably emphasize the already rooted political divisions.

By taking away his personal solution, he said that a deficit, which is an equivalent to sales of bonds, must be reduced from 7.5 percent to 3 percent of GDP.

Doge announces more than $ 1 saves after the termination of 104 federal dei contracts

Congress is racing to make the recommendations of Trump’s new Doge Commission. (Getty Images)

“Different people have different views of how to cut it. Forget. I really don’t care,” Dalio said. “Only, you have to have a united agreement. Everyone in the congress and the president and so on should be pledged for it. And then the question is how to do it. But they should know that number (equivalent to about 900 billion a year).”

He cares that the time tape to close this gap may may have been too long. He says that this is not only a matter of reach, but also less changes in regulation and productivity, which could partly come from artificial intelligence (AI) or even revenues that have produced tariffs and translated into profit.

When asked if America is better with President Donald Trump Opposite former President Biden in a financial context, he said, “Yes, I believe we are.”

“As for profitability and the likelihood of reduction, I think Republicans are likely to make these moves than Democrats. But you also have to consider influences, social influences and other influences that will come from this we are in the Civil War and at the same time we are in international continued.

Pie chart on state consumption. (Fox News)

But these cuts will be brutal, according to Dalio. He notes that “as the pie is divided”, given the state budget, will be very political and the “devastating effects will be huge.”

“Indeed, we all speculate how devastating these effects will be. It’s too much – but you are absolutely right. There will be a lot of jobs lost,” he said. “A lot of change will happen in terms of turbulence. And do we have a plan? How can we agree at all about the plan on how to deal with it? I don’t think we’re in time, maybe it’s the rest of our life, where that agreement will be easy. “

Click here to get the Fox News app

Economic Policy Innovation Center (EPIC) Published a new model In December, it was said that it was “possible” that the US government would exhaust the possibility of paying debts by June 16, 2025.

“It is predicted that the Government will run for two trillion deficit next year. And that means that the obligations of consumption that Congress and the Government have been created much more than what we will bring tax revenues,” Matthew Dickerson, said the director of the budget policy in Epic -in Fox News Digital. “In order to pay for the things that the Government promised to pay on time, you must increase the limit of debt.”