British Airways owner’s transatlantic focus takes it to post-pandemic heights

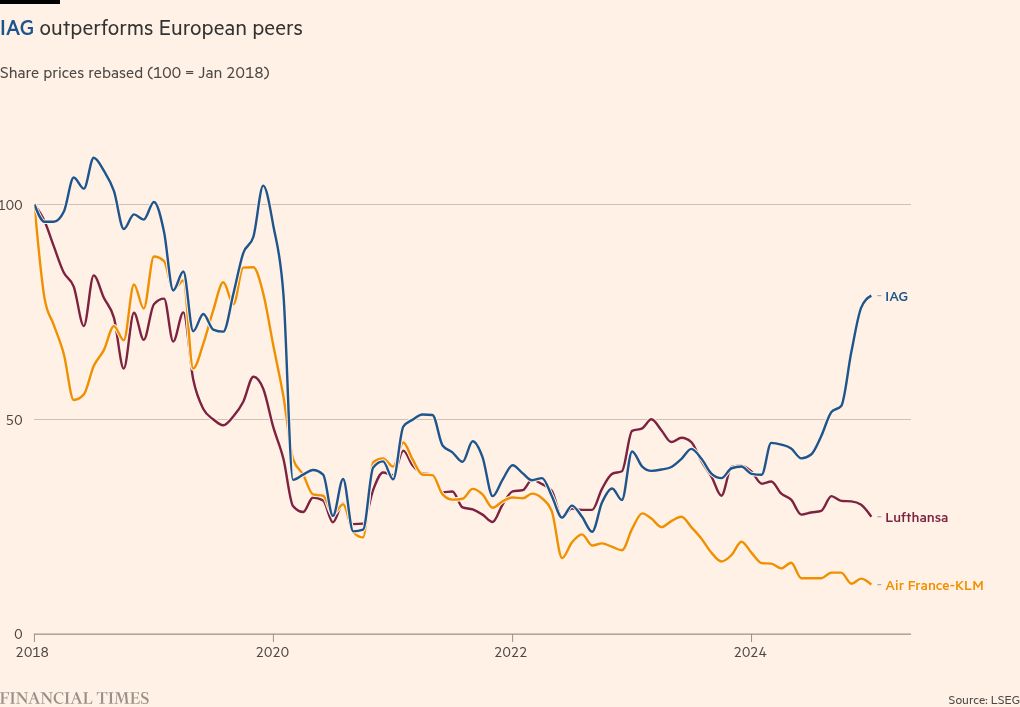

A big bet on transoceanic flying paid off for long-term investors in IAG, the owner of British Airways, as a one-year rally lifted the airline group’s shares to their highest level since the start of the pandemic.

Shares in IAG, owner of five carriers including BA, Iberia and Aer Lingus, closed just below 316p last week, their highest level since February 2020. Shares fell on Monday but have more than doubled in the past year to become the top performer on the London FTSE 100.

The turnaround in the company’s fortunes came as investors cheered a second straight summer of record profits built on lucrative transoceanic travel, which has seen particularly strong demand since the end of the pandemic.

“They focused on where they could fly to win,” said Andrew Lobbenberg, head of European traffic research at Barclays.

This allowed IAG to pay off its outstanding debt during the pandemic and pay back its dividend. He also announced a share buyback of 350 million euros at the end of last year, the first since the pandemic.

“Demand remains strong across the Atlantic and within Europe,” said Nicholas Cadbury, IAG’s chief financial officer, adding that the group’s shares were supported by “significant cash flow and an increasingly strong balance sheet”, which boosted investor returns.

One of the biggest questions now hanging over IAG is whether a £7bn investment plan in British Airways can improve service and reduce delays and other operational problems at its main profit generator.

The airline has faced criticism in the past – particularly from customers and unions – for seemingly prioritizing shareholder returns over customer experience and quality.

BA’s improvement “should be a continued, strong driver of profit momentum for the group”, Lobbernberg said, especially given the airline’s firm grip on Heathrow, one of the world’s most lucrative tourist markets.

“They should be making strong profits. So his performance lately has been very poor because there has been no investment in it.”

IAG’s business model is focused on long-haul travel, particularly its business and first class cabins, parts of the industry that were slower to recover after Covid but are now booming.

“If you want exposure to transatlantic and premium travel, then IAG is the play you want to look for,” said Julian Cook, a partner at ATKA Capital, a London-based hedge fund that focuses on aviation.

ATKA sold its stake in Ryanair to buy IAG last year, which Cook says was a no-brainer.

“We could see that Atlantic was doing well and we wanted to play at the top end of the market,” he added.

Even after the rise, IAG shares still trade on a price-to-earnings ratio of around 6.5 times, which is less than Ryanair and easyJet.

IAG’s main hubs in London, Dublin and Madrid are located on the westernmost edges of Europe, giving it a natural advantage in flying across the North and South Atlantic.

The group has doubled down on those routes since the pandemic at the expense of flights to Asia, where demand has been slow to return and European carriers face the complexity and cost of avoiding Russian airspace.

Three-quarters of IAG’s long-haul routes are to America, more than Lufthansa Group’s 53 percent and Air France-KLM’s 54 percent, according to Bernstein analysts.

This focus on the Atlantic has also allowed IAG’s airlines to avoid competition from wealthy and growing rivals in Turkey and the Gulf, where European airlines struggle to compete on costs and fares, as well as service standards.

In contrast, US and European routes have become more profitable compared to pre-pandemic levels since Norwegian’s collapse in 2020, disrupting existing low-cost carriers.

“Flying west rather than east is a better long-term strategy after the pandemic, especially from London,” said Bernstein transport analyst Alex Irving.

Analysts say other questions now facing IAG include whether demand for flying in its key markets can be sustained, as well as the possibility of increased geopolitical tensions, particularly from a second Trump presidency.

There is also uncertainty about future mergers and acquisitions, after last year European competition authorities rejected a bid to increase its position in the Latin American market by buying Spain’s Air Europa.

IAG’s management told investors it is focused on achieving financial targets set in 2023, which include an increase in operating margin to between 12 and 15 percent, up from 11.9 percent in 2023.

Other targets include increasing flight schedules between 4 and 5 percent annually and a return on invested capital of between 13 and 16 percent. Typically, airlines generate single-digit ROIs, according to Bernstein’s Irving.

“In the context of other European national carriers, they are not only the most profitable, but also the most shareholder-friendly, they have clear financial goals for each of their units and allocate capacity to those units according to their earnings,” said Cook.