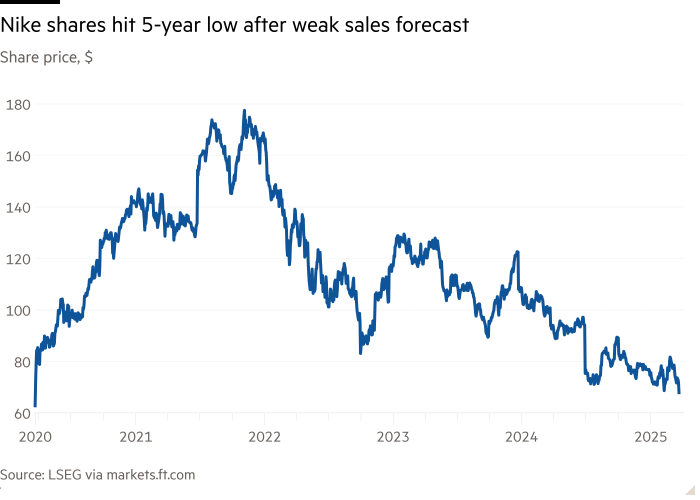

Nike sections have reached a five -year low because the tariffs and caution of consumer threaten sale

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

Nike sections have reached five -year low on Friday, as a group of sportswear has been alerted by a global trade war and caution of consumers who have complicated his efforts to increase sales as part of a turnaround.

On Thursday night, the company predicted more than the expected drop in revenue from three months to May in a fresh failure because it seeks to compensate for the market share of the longtime Rival Adidas and UPSTART Brands.

Nike The shares fell by as much as 9.3 percent on Friday morning, trading on Wall Street, fell to the lowest level in five years and took over the group’s market capitalization below $ 100 billion. The shares recovered slightly to trade 5.9 percent lower by noon.

The drop is on the way to be Nike’s biggest one -day shares price from late June, When he warned Sales would decline in 12 months until May 2025, and in the last five years she would be one of her biggest ones.

Matthew Friend Cinearer on Thursday said that the company was fighting “several external factors that create uncertainty in the current operational environment, including geopolitical dynamics, new tariffs, volatile foreign exchange courses and tax regulations.”

The company announced that it enjoyed the strong holiday season, but that it suffered a decreasing sale in its brand Jordan and a “double -digit” reduction in sales from its classic footwear franchise. He also reported the softness in the demand of Chinese consumers.

Nike predicts a percentage drop in revenue in the current trimester of the “middle teenager”, which lasts until May, citing the impact of a strong US dollar and “unfavorable delivery time” in its main market of North America. The analysts examined by Reuters expect that the revenue in the current quarter will be 12.2 percent lower than the same period a year ago.

“We are not satisfied with our overall results,” said Elliott Hill, who got out of retirement In October to take over the post of executive director. “We can and want better.”

The company was an unsuccessful focus on the sale of direct to the consumer, a strategy that he gave up on part of the restructuring in December 2023. Analysts were also critical of his addiction to life products and her excessive fashion trends.

This resulted in Nike, who ceded in the otherwise lush market of sneakers and athletes towards Adidas and smaller, top competitors such as he, Hoka and Lululemon.

After a stunning market last June with his revenue warning, Nike announced his executive director and withdrew Year -old sales forecast In October, just a few weeks before Hill took the reins.

A friend said on Thursday that the gross margin of the company would be 4-5 percentage points lower in the current quarter of 41.5 percent, which she reported in three months to February.

The odds removed Shine from their last quarter, when Nike’s $ 11.3 billion in revenue and $ 794 million in estimates by analysts with a net revenue.

UBS analysts said there would be a chance of earning risk that could be further aggravated.

They said, “We do not believe that Nike has improved his product range enough or marketing enough, but to ensure that the trends will not worse. The good news is that the company has decided to increase investments in the short term to return healthy growth in the long run.”