Indian supplies of consumption await tax cut

Customers buying foods in Thirvananthapuram (Tivandrum), Kerala, India, 8 April 2024.

Creative touch | Nurphoto | Getty Images

This is a report from this week’s newsletter “India” CNBC that brings you timely, discerning news and comments on the market at a new power plant and large companies behind your meteoric climb. As you see? You can subscribe here.

A big story

It’s been over a month since India revealed its union budget, which offered a huge tax relief aimed at strengthening Urban consumption. This move, however, did little to raise consumer supplies.

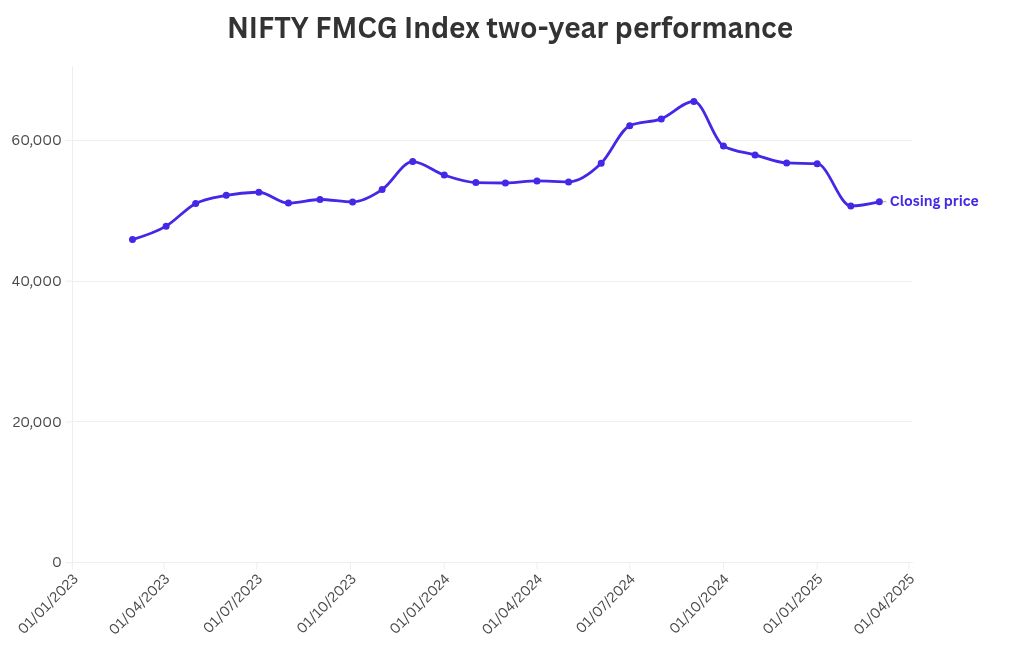

Nifty FMCG (quick movement of a wide consumption of goods) -s It records 15 shares Led on the Indian National Stock Exchange – increased over 3% because the budget was presented on February 1st. This set, however, was quickly thrown out.

The index has decreased in 18 of 23 sessions after the budget encourages and has so far dropped almost 9%, compared to a drop of 4.72% in the NIFTY 50 index.

The expectation was that the shares were gathering because investors were entered in higher consumption after tax reduction in force in April. However, investors had to suppress their enthusiasm due to the mouth of the factor.

Many consumers are likely to earn a larger available income that is a consequence of these tax reduction or spend money on goods that are not FMCG, such as motor vehicles, according to Kranthi Bathini, director of capital strategy at Wealthmills Securities.

“This is not a thing overnight, where the FMCG supplies will now grow with a reduction of taxes and Rbi [Reserve Bank of India] cut off. It will take a while to see the influence, “Bathini said.

Larger estimates also muffled the appeal of many FMCG supplies, analysts said.

Another reason for their weaker effect is “a reasonably high level of penetration of certain personal and home products, said Pramo Gubbi, co -founder Marcellus Investment Manager. This implies that companies have already won a considerable market share, leaving some space to grow further.

Source: NSE statistics

“The Indian FMCG companies had anemic volume growth even before the recent slowdown of consumption was set up in a quarter from July to September,” Gubbi added.

Companies like Nestle India – with popular brands like Maggi, Nescafé and Kitkat under their umbrella – have also targeted consumers with higher available revenues that can be spent on premium products.

World Bank data Shows that Indian GDP per capita increased 7.1% in 2023, and a year ago to $ 2,200.

Many companies were banished to “Premimization wave. “

They expected consumers to look for better products because they became more wealthier, but sales did not meet expectations, Gubbi told CNBC within India.

The growth of companies directly to the consumer also confiscated revenue from FMCG companies with traditional sales channels, he added.

Since February, shares in ITC – Top holding in the Nifty FMCG index with a weight of 30.7% – reduced 12.3%, while Hindustan Unilever (20.2% weight) lost 11.4%. Other best weighted companies like Dad products for consumers and Nestle India They reduced 10.5%and 5.4%.

Strong chances

Bathini Wealthmills Securities’ Bathini noted that the prospects of earnings for FMCG company are not particularly bright.

“Consumer supplies like Hindustan Unilever, Consumer Products and others faced some kind of margin pressure due to poor demand – which also saw in GDP numbers in the second quarter“Bathini told CNBC within India.

However, he added that faster growth recorded in Fiscal GDP in the third quarter could signal “some improvement” in the results of companies aimed at consumers.

Indian data GDP for a quarter ending December have shown a 6.9% of annual private consumption growthcompared to 5.9% three months earlier.

The question for investors is whether they need to bet on the FMCG sector – or look somewhere else.

With the “at best at best,” said Harsh Padfhyaya, the Chief of Investment Director Mahindra Asseta Management, adding that FMCG shares “will need better growth and/or lower performance assessments.”

“Without this, shares can be related to the range or in accordance with the movement of the market,” Padphyyaya told CNBC India.

For example, Hindustan Unilever trases at a price and earning ratio of 48.5, compared to the NIFTY 50 Index P/E of almost 20.

Marcellus Gubbi is positive for specific segments within the consumer space, not to the sector as a whole, highlighting food and drinks, as well as kitchen accessories-which are still growing, given the lower obstacles to entry and sell on e-trade platforms.

Perhaps investors who want to find offers in the Indian consumer sector are equally insightful in their selects of shares as well as their weekly food shopping.

You need to know

India Minister of Trade and Industry Piyush Goyal visits Washington on Monday. A minister is expected Meet the US Trade Representative Jamieson Greer and US Trade, Howard PourAccording to the officer. Goyn’s visit happens only a few weeks before the reciprocal tariffs from the USA comes into force, which means that Indian goods imported to the US would face high levies, leading to about $ 7 billion annual losses for India, Citi estimated.

Now they want zero tariffs on car imports in India. As part of a potential trade agreement between Washington and New Delhi, Trump’s Pressure Administration Remove his tariffs on car imports. However, India is reluctant to approach this request, although it is open to further reduction of the levy, Reuters reported, citing three sources you are familiar with the issue. Removal of car tariffs in India – which are as many as 110% – will starve to Tesla’s entry into the market. The company founded by Elon Mosk is preparing to start the sale of its electric vehicles in India.

India will remain crucial for the global supply chain. The South Autasical nation has the most average tariffs on US goods, so it is a little surprised that US President Donald Trump threatened to stun with India with retaliatory calls. However, India is becoming more and more important for manufacturers who are diversifying from China, which means Tariffs may not diminish the importance of New Delhi as a production centersaid Charles Van der Steene, President of North America for Maerssk.

British launch of smartphones doesn’t look India. Nothing, which launched its new phone (3a) on Tuesday, targeting the Indian market, according to Ben Wood, the main analyst of the CCS Insight Market Research Company. The company experienced 557% last year compared to one year in India, making it Nothing the fastest growing smartphone brand in 2024.said founder Carl Pei in January. Furthermore, Akis Evangelidis co -founder plans to move to India to start jobs there later this year.

What happened in markets?

Indian stocks show the signs of download, after NIFTY 50 The index closed to 22,544.70, increasing just under 1% compared to the week before.

The reference 10-year-old Indian Government’s yield decreased slightly to 6.687%.

At CNBC TV this week, Michel Doukeris, the executive director of the world’s largest brewer AB Inbev, said India “One of the big markets for growth in the future. “The South Asian nation is already the third biggest global market of Budweiser with Indian” very young “and urbanizing population that experiences the increase in purchasing power, there is a” huge opportunity “for breweries. However, obstacles such as high regulation and alcohol tax means that the path ahead will not be completely smooth sailing.

Meanwhile, CNBC SEEMA Mody reported that investors reconsider their exposure to the emerging markets due to Trump’s tariffs and taking into account which countries are the most and least dependent on American India, “continues to be the head of scratch. “The results of Indian Prime Minister Narendra Modi’s efforts in the negotiations of the TRUMP agreement are still uncertain, Vagani in Indian supplies. Moreover, shares in the country are overrated with those in China, even after the latter rally in technological shares last week, said an analyst.

What happens next week?

The American economy is focusing on this week, with data on jobs in February this Friday and consumer prices on Wednesday. China and India also announce reports on inflation for February on Sunday and Wednesday.

March 7: US Pay List for February, China Trade balance for January until February

March 8: President of US Federal Federal Reserve Powell Speech

March 9: China Inflating rate for February

March 11: job opening data and traffic work data for January, Japanese household consumption for January, the gross finale of the domestic product in the fourth quarter

March 12: Indian Inflation rate for February, production and industrial production for JanuaryUS Consumer Price Index for February

March 13: US Price Index for February