Eskalizing the Donald Trump trade war will harm global growth, OECD warns

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

Donald Trump’s trade war takes a “significant toll” to a global economy, OECD warned, because it reduced growth forecasts for a dozen G20 countries.

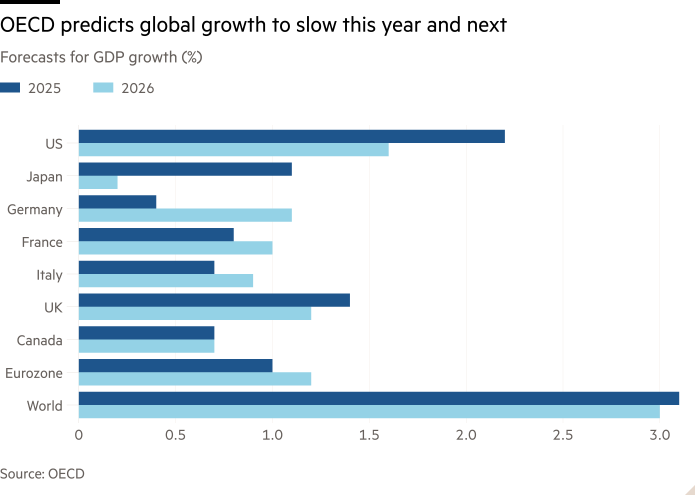

Global growth will slow down this year and the following, from 3.2 percent last year to 3.1 percent and 3 percent in 2025 and 2026, while inflation will be nicer than earlier, the Paris OECD said in its temporary appearances, because it invited countries to avoid “trade retaliation barriers”.

The GDP growth will be established from 2.8 percent last year to 2.2 percent this year and 1.6 percent in 2026, OECD said. Higher trade obstacles will contribute to permanent inflation, which will run the federal reserves to keep interest rates unchanged by mid -2026, predicted.

“The message is obvious that trade uncertainty and uncertainty of economic policy have a significant toll,” the chief economist of OECD álvaro pereira told the Financial Times.

Analysis – The first attempted OECD to quantify economic withdrawal from early rounds Trump’s trade war – It suggests that a little prospect for G20 countries will remain intact, as companies delay investments due to policy insecurity, and consumers squeezed higher prices for goods.

The biggest growth decline is in Canada and Mexico after Trump’s decision to collect 25 percent of tariffs to most imports from US neighbors. The predictions of growth for Canada were more than halved to 0.7 percent of this year and next, while Mexico is now predicted to fall into a direct recession this year, infected by 1.3 percent.

“Consumer confidence has collapsed in quite a few countries – especially Canada, Mexico, now – and a few others,” Pereira said.

Re -inflation or surprises of the growth of growth could start a “quick review” in the financial markets, OECD warned.

Growth in the US this year will be 0.2 percentage points slower than OECD previously expectedand half a point weaker in 2026 than previously forecast. These predictions would continue to leave now as the fastest growing G7 economy in both years.

Instead of slowing down, as previously scheduled, inflation He will now accelerate from 2.5 percent last year to 2.8 percent in 2025. The basic inflation is expected to remain above the goals of the central bank in many countries in 2026, including the US, OECD added.

The growth forecasts for the largest economy of the three eurozons were trimmed, predicting that the currency area would increase by 1 percent in 2025 and 1.2 percent in 2026 in the UK. This year, growth was reduced to 1.4 percent this year and 1.2 percent in 2026.

Despite Trump’s 20 percent additional tariffs on China, OECD abolished the prospect of the Asian country for 2025, with growth was 4.8 percent, followed by 4.4 percent in 2026.

In contrast, the growth prognosis for Japan has refrained by 0.4 percentage points up to 1.1 percent this year, and the growth of India will be half a point lower than it is previously scheduled by 6.4 percent.

“Governments should find ways to deal with their problems in the global trade system together to avoid significant revenge of retaliation of trade obstacles between countries,” OECD said. “The further increase in trade limitations of a widely founded would have significant negative effects on life standards.”

The organization sketched a “scenario down” according to which they are now further enhanced tariffs In all countries with 10 percentage points and equivalent retaliation, they are now being imposed on. The level of global GDP would be 0.3 percent lower for the second and third years of shock, OECD said, with the global inflation increased by 0.4 percentage points per year.

The US consumers would be tiring, which is equivalent to reducing more than $ 1,600 real net available revenue per household revenue. Interest rates should increase by a percentage point compared to the central forecasts of the OECD for the first three years, while an effective course in the US would rise by 1.7 percent.

OECD said that there were “significant risks” ahead. “Further fragmentation of the global economy is crucial concern,” it adds. “A larger and wider increase in trade barriers would hit growth around the world and add inflation.”

Keith Fray data visualization