Donald Trump coercion descends into chaos

This article is the spot on the spot of our Bulletin on trade secrets. Premium subscribers can apply here To deliver the newsletter every Monday. Standard subscribers can upgrade to premium hereor investigate All ft newsletters

Well, last week was a week and a half. The 25 percent tariffs are imposed by imports from Mexico and Canada. Then they quickly came down quickly. First on cars and then all that is covered by the preferential trade agreement of the US-Moxico-Canada (USMCA), although it was not clear what that meant. Trump said he could impose tariffs Canada on Friday, or maybe on Monday or Tuesday this week. He confused the matter, saying of “reciprocal” tariffs, which are supposedly a different thing.

We have fun this week, and duties should be imposed on steel and aluminum (aluminum, whatever) imports from all over Wednesday. Does anyone believe that will happen? Does anyone believe in anything? Is there such a metal as steel? Is there America? Today I am going through various theories about what Trump is trying to do with all that confusion, and I note that he threatens to do the damage from shipping to everything else. AND The water outlined The section, which considers the data behind the world trade, analyzes the prices of wood in the middle of a break in the US Canada Commercial War.

Contact. Send me e -stell on alan.beattie@ft.com

Clumsy or choreography?

So what the hell is Trump ready? Pausing just to notice our word about these things – I can surely Link to that Without enrollment so far – I see three main opportunities.

-

Trump’s administration has a well -prepared plan with a limited number of goals and at least an equal number of instruments that will hit them, satisfying thus Rule.

-

Trump’s administration follows a version of Madman Richard Nixon theory, doing crazy tariff things to alleviate trade partners in large concessions on currencies and buy American debt. My ft colleague here Explores the question of whether it is a strategy.

-

Trump’s administration is filled with people that their capricious boss has constantly opposed and undermined in public, and in order to save their face, they claim that it is a cunning plan in the same way my cat repeatedly pretends to always intend to fall off the sofa and land on her nose.

So far we can discard 1), because the administration is obviously trying to hit more (mutually contradictory) goals with one instrument. The Great Doug Irwin, with whom I interviewed On the subcast of The Economics ShowIt is known that the tariffs are traditionally focused on three RS – revenue, limit (protectionism) and reciprocity. For Trump, I will add three CS – coercion, clientelism and chaos. (Those cynical dispositions can “replace” clientelism “with a different” C “word with three syllables, implying personal rather than political services.) It seems that Trump is trying to hit at least five of them at once.

It is difficult to distinguish between 2) and 3), because they, as we economists say, are observed equivalent. Extremely professional misconception looks like a true hitting of an uneducated eye. Personally, I’m firmly in 3) camp. Why? First, paradoxically, I don’t think this administration does not have a discipline to do good chaos. It is hard for me to believe that someone like the Store of the Howard Lutnick Store – who said (Eight minutes here) that the EU imposes 100 percent of tariffs on American cars, when the number is actually 10 percent – really plays 4D chess when he says more different things in the day.

Second, it doesn’t seem to me that Trump’s administration is actually so much terror into foreign government as many times hit in the face. Or, if it scares anyone, it is so accidental and unreliable that no one will believe that they will adhere to any agreement on raising the tariff in exchange for currency action or anything else.

As a colleague of this chart on the uncertainty of a trade policy that works by round, you can see below the main index of American, Mexican and Canadian capital from Trump’s inauguration. Given their relative size and openness to trade, the US market is Far more important Mexico and Canada (their exports there equal about 30 percent and about 20 percent from GDP) from the reverse (US export is about 1 percent of GDP each). Yet the US S&P 500 sought to be weaker than the other two. It is quite a achievement to threaten much smaller neighbors, but to cause more damage to yourself. (Yes, yes, I know the shares are an extremely non -talented measure of economic effect. But I have been told for years that Trump has been taking care of the stock market.)

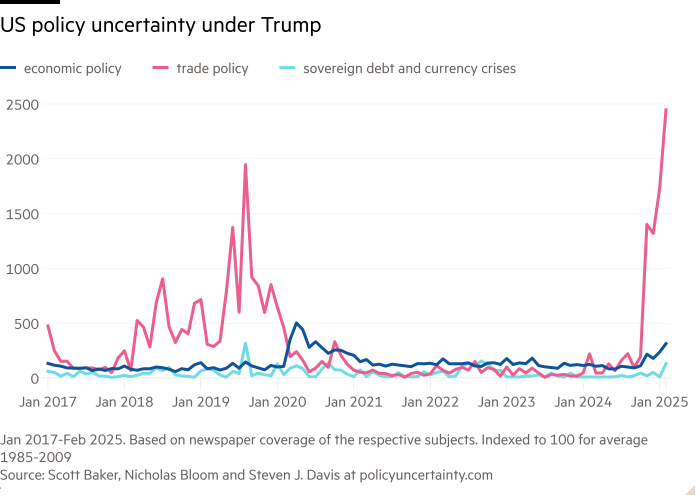

The evidence is that tariff chaos – and especially the uncertainty of politics trade, not economic policy in general – affects the economy. AND Investigation of the Institute for Supply Management Last week, the manufacturing sector showed a big drop in new orders and jump in prices expected, and respondents are full of concern for tariffs. Even Trump himself refused to exclude the idea that they were now moving into a recession.

If the United States continues to damage the tariff type, the emotions of his trading partners will move from terror to confusion in, in the end, perhaps even something close to pity. Now they have stronger forced tools than tariffs, such as removing military security guarantees or removing countries from the dollar payment system. But it already does that first by leaving NATO. It is not a threat that can repeat endlessly, nor is it credible to promise that it will turn in return for cooperation. Blocking countries from the use of dollars would be a truly dramatic move, but again, one more likely that other governments will think that they are now distrustful of anything else.

Any onion in the storm unless you are a Chinese

These are not just big, dramatic things with tariffs that Trump’s administration works on a global trading system, you know. These are also casually harmful things to lower levels. His team seems to have not thought about things well. I know, I was surprised too.

Removal of the so -called de minus addition For imports from China, in which the US postal service was flooded with low -value plots, it was obviously an early ride of the administration to cause damage. But now this has been put on an indefinite date in the future, that’s another one.

This time it’s a crowd New port fees Designed to increase US shipbuilding against Chinese competition. ($ 1 million for each American connection call if a chinese operator is boiling, another mile of dollars if the operator has many Chinese ships, whether it is already in use or in their book book, and $ 1.5 million if the vessel was built in China.) The proposal will gradually increase the hub for the sake of the Vesa in the US.

An American trade representative’s office floated this Shortly after Trump’s inauguration. The comment notifications ends on March 24, and the shipping industry is that it is. Like some of their other bad ideas (the notion of wiping steel and aluminum tariffs for one), the shipbuilding plan was inherited from the Biden administration at the request of the union.

Now, in principle, you can see why the US could now be considered as strategic shipbuilding industry. But, as the World Shipment Council pointed out login to the original proposal from the Biden era and Repeated recentlyNot only will the fee are likely to make the uneconomical of some lower container values, but he perdeses the shipbuilding companies for what shipbuilders do. And it will mostly affect the vessels already built.

Moreover, if they are paid for every visit to the port, the ships will stop working to leave in smaller American ports. In return, these ports will dry and the burden will have to switch to greater distances. Others in the industry have pointed out This, with the opaque structures of ownership in the sector, is often not clear the nationality of the operator.

In terms of requests regarding exports on ships under the US, we know exactly what it will do. It’s an international version Jones Actwhich refers to the shore of shipping and is known to create ineffectiveness. This is a bad, unsuviable idea in the whole circle. This does not mean that of course it will not be implemented.

The water outlined

The postponement of tariffs on imports from Canada has led to a fall on the increase in the price of wood, which is the subject of an existing trade dispute in the US-Kanada that Trump wants to escalate.

Trade connections

-

Europe is in a hurry to Find a replacement For Starlink Elona Musk after being withdrawn by military assistance and sharing intelligence data last week. (AND wrote recently about different satellite initiatives and what they discovered about their government sponsors.)

-

Former Bank of Canada and Bank Governor of England Mark Carney Won the race In order to become the leader of the ruling liberal party and hence the new prime minister of Canada, with a survey of liberals who is a great increased trade war with the US.

-

Japan is trying The exception drive from threatening tariffs of steel and aluminum.

-

Reuters reports This concern about the US-Kine trade war caused the shipping companies to be crossed by operations from Hong Kong.

-

With football fans already relaxed by devastating news That the finals of the 2026 World Cup will show in North America at a half -time show that led the Turgida refrigerator, Trump decided to make things worse claim To add his tariff campaign to the excitement of the tournament.

Trade secrets edit Harvey nriapia