Broadco stocks grow like Ai growth of forces of strong guidelines

Hock Tan, Executive Director Broadcom.

Martin H. Simon | Bloomberg | Getty Images

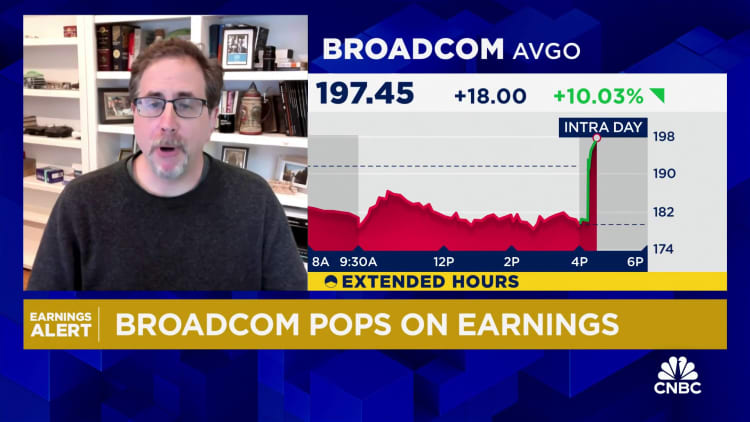

Broadco The shares climbed about 5% after the company posted strongly Earnings and guidelines in the first quarter This signaled the permanent demand of artificial intelligence.

The chip manufacturer has announced a custom earning of $ 1.60 per share at $ 14.92 billion in revenue. This exceeded the adapted earnings of $ 1,49 per share and $ 14.61 billion in revenue that analysts who surveyed LSEG. Revenues increased by 25% with $ 11.96 billion a year ago.

The Bank of America Analyst Vivek Arya called the Broadcoma results “by a convincing update from the AI leader” and a “positive reading for AI feelings”.

Broadcom has benefited from the flourishing of artificial intelligence that has swallowed Wall Street from starting Chatgpt, and the shares are more than doubled 2024. The shares withdrew about 19% from the beginning of 2025, as chip manufacturers relied on the parts outside the US chair tariff under the President Donald TrumpAdministration.

The results offered a refund for the industry that faces with Heavy bar to clean up This season of earnings. Popular names broke the results after prior estimates. Marvell technology was the latest example, Drop 20% on Thursday Due to the fastest fall since 2001 after missing some elevated purchase assessment.

Together with the rhythm in the first quarter, Broadcom offered exciting guidelines for the current period, calling for revenues of $ 14.9 billion. It is at the top of Wall Street at the top of a $ 14.76 billion forecast. The net revenue increased to $ 5.5 billion, or $ 1.14 per share, with a share of $ 1.33 billion, or 28 cents per share, a year ago.

” [quarter] should provide some relief after disappointment of a mrvl -and optimism around [serviceable addressable market]And the potential for customers 6 and 7 … He will give confidence in the profile of Dugi Rock growth, “wrote Morgan Stanley analyst Joseph Moore in a note.

Broadcom is known for creating a solution for infrastructure and connection for data centers that support large linguistic models and advanced AI tools. In December, the company said it developed adapted AI chips for three large cloud customers. The Hock Tan Executive Director also said on Thursday that Broadcom “deeply engaged” with two more hyperscalers and works to create custom chips with four other possible customers.

The revenues from the AI company for that period increased by 77% compared to the year to $ 4.1 billion. Tan said Broadcom expects that $ 4.4 billion in this quarter will be revenue from the AI semiconductor in this quarter. Sales AI is derived from Semiconductor Solutions, which increased 11% from a year ago to $ 8.21 billion.

– CNBC -ov Kif Leswing has contributed to reporting