Wall Street banks sold almost all $ 12.5 billion in debt related to the purchase of Twitter Elon Musk

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

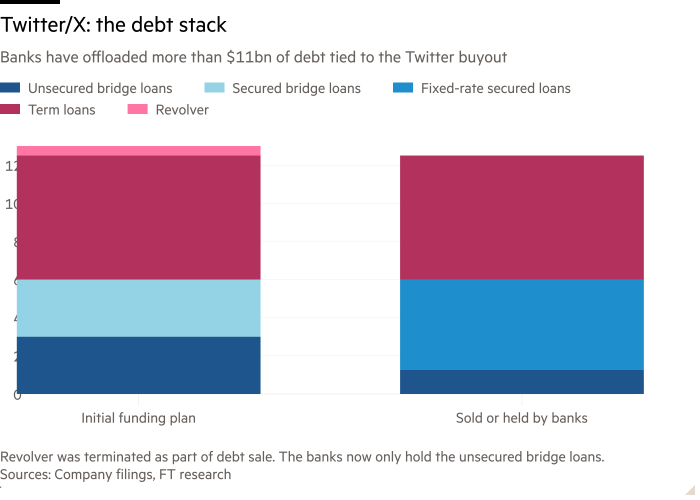

The Wall Street banks got rid of almost all $ 12.5 billion of loans that Elon Musk used to finance his download on Twitter, which has limited the stunning debt assessment since Donald Trump assigned a billionaire role in the heart of his administration.

A group of banks led by Morgan Stanley sold $ 4.74 billion late on Thursday, more than the original $ 3 billion, as investors have provided $ 12 billion in commands, according to people who are familiar with the issue.

The last sale is a boon of seven loans, including Bank of America, Barclays and Mufg, who have been obsessed with long since they increased $ 12.5 billion in October 2022 to finance the Musk of Social Media Purchas , renamed X.

Now they hold just over $ 1 billion for loans after a sale, which emphasizes that men’s proximity to Trump has moved the perception of debt that investors previously considered very risky.

In the further sign of demand, the large loans of the loans were on Friday, which were already traded between 101 and 102 cents on the dollar on the secondary market after sale on Thursday.

Lenders rejected investors’ bids to buy debt with steep discounts 2023 and 2024, instead, betting instead that a possible turnaround in X’s surgery would limit potential losses on loans.

The Investor Investor Investors increased in the weeks after Trump’s victory in November, and Morgan Stanley received plots to buy parts of debt at 75 to 80 cents on the dollar.

The loan appeal increased further after Musk gave a stake in his start-up-up in the form of artificial intelligence. In addition to the amplifier assessment of social media companies, the move provided a new security for everyone who holds loans.

In January, Morgan Stanley sold $ 1 billion in debt to a group of large credit investors, including Capital Partners’ diameter. Followed by a sale in February $ 5.5 billion From loans, 97 cents on the dollar, before the banks sold them this week without any discounts.

As part of the increased sales of loans with a fixed rate on Thursday, X agreed to terminate the revolving credit facility in the amount of $ 500 million, which he had with seven banks.

Investors are now waiting for more than $ 1 billion for the sale of an uninsured loan, the final, most risky part of the agreement. This debt will pay a higher interest rate, but is more exposed to losses if X falls into bankruptcy or is required to restructure its debts.

It is not clear how Morgan Stanley and six other banks will continue to sell. Lenders could market or refinance it with a new preferred capital, given the strong demand for other parts of $ 12.5 billion of loans, to get acquainted with this question.

Morgan Stanley refused to comment. X did not respond to the comment request.