The global car industry faces anxious check on US tariffs

Car companies are committed to what could be an even greater shock for a global car supply chain in the midst of uncertainty during the duration and extent of the global tariff war of Donald Trump.

Just two days after the US president issued an executive command by applying a 25 percent importer to all imports from Canada and Mexico, as well as 10 percent on the goods imported from China, Trump charged on Mexican imports to wait a month after A ” Very friendly “Talking to Mexican President Claudia Sheinbaum. Shortly thereafter, Canadian Prime Minister Justin Trudeau also reached a contract for eleven hours with the US on a 30-day break on tariffs.

Car manufacturers were careful in achieving significant and expensive strategic changes without greater clarity in the long-term direction of US trade and energy policy, although General Motors, Stellantis and Tesla signaled that they would increase production in the US to compensate for any influence of tariffs .

“If you start an over -response, this is a bit dangerous now,” Michael Lohscheller, the executive director of the traders, a manufacturer of an electric car supported by Chinese Geely, said in a recent interview.

What could be the worst scenario?

Many car executives turned to the experience of Trump’s first presidency in relaxing the risk of the International Tariff War, saying that the US president had not conveyed threats to additional collections against their commercial partners.

Experts from the supply chain say that the worst scenario, which is carried out by American and tariff retaliation, will probably lead to a bankruptcy chain among the weaker suppliers of car parts.

The global car supply chain is so complex and interconnected that the component made in Mexico could end up in an American drive before returning to Mexico at the final assembly and then sold to the US market- what could result situation.

“Mechanics are almost equally bad, if not worse than the actual amounts, because the accounts for accounting and storage of books and paperwork are involved to ensure that compliance is huge,” said Ian Henry, a car manufacturer who leads the consulting car production About autoanalysis.

Henry warned that the supply chain disorder could be worse than during the pandemic if it endured the tariff war and car manufacturers were unable to provide enough financial support for their suppliers to move.

Mikael Bratt, Executive Director of the Swedish Security Belt and Air Pillow Airbuilders, said he would start discussions immediately to convey the costs of higher tariffs to customers if they were implemented against Mexico.

“There is no reason why. “Ultimately, it will be higher costs for vehicles sold in the US.”

Which car manufacturers are most exposed to?

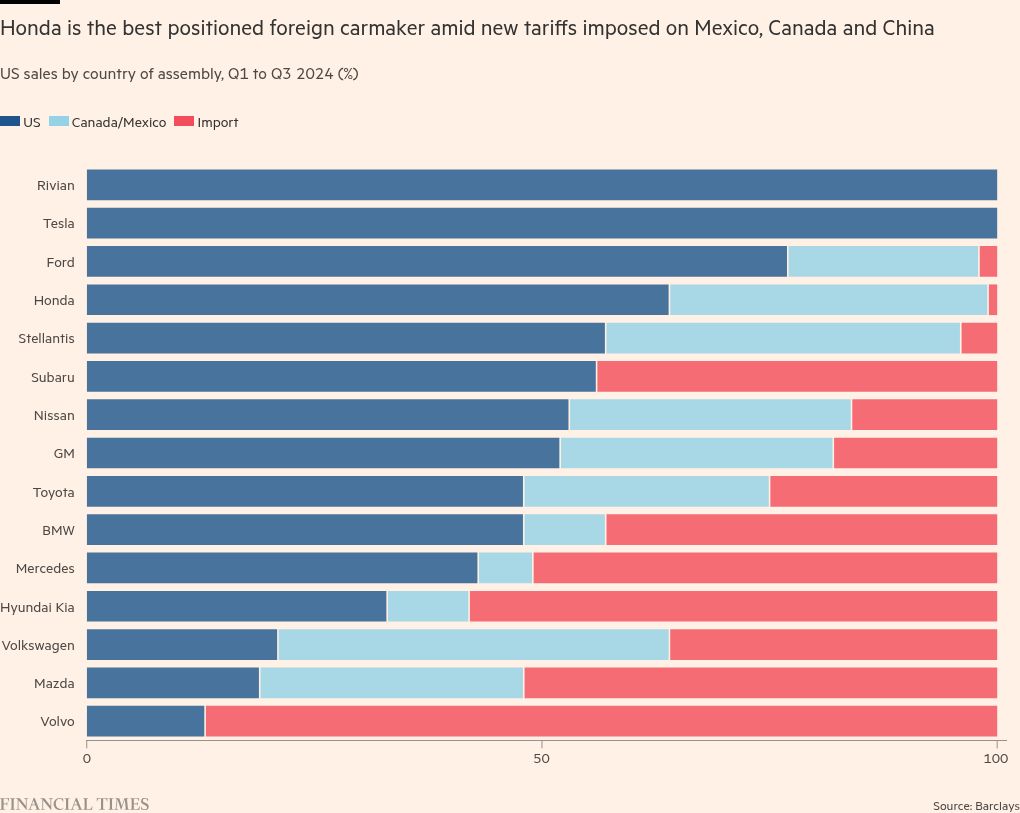

Traditional car manufacturers “Big Three”, which expanded a mark on the entire continent from the signing of the North American Free Trade Agreement from 1994, are most vulnerable to a profit. GM was the most appropriate, analysts said, and the owner of Chrysler Stellantis is not much better. Ford is the least exposed because it imports the smallest proportion of vehicles outside the USA.

GM makes its popular, high -marge chevrolet Silverado marza in its Silao factory in Mexico and Oshaw in Canada, which increases exposure. BNP Paribas Analyst James Picariello said that although the car manufacturer could probably transfer production to the US by about 300,000 of the 350,000 trucks currently imported, such a switch would take 12-18 months because it adjusted the supplier delivery and hired workers.

This would add about $ 1 billion to work costs, he said, because workers earned more in the US than in Mexico. GM operating earnings would hit 7 percent, but that looked favorably compared to a possible reduction of 50 percent that could come from a 25 percent tariff.

“Billion dollars for the wind head looks like a managed scenario,” Picariello said.

Investors and analysts assumed that every tariff on the goods from Canada and Mexico would eventually be neglected, he added, otherwise “numbers become too big for the industry to survive properly.”

Are German car manufacturers spared if the tariffs were not imposed against the EU?

Even before any EU tariffs, European car manufacturers have been exhibited. Volkswagen is in the worst position, and 45 percent of American sales come from a car made in Mexico and Canada, although the US market makes up a small share of the overall income of the group.

With all US vehicles from their luxury brands of Audi and Porsche produced outside the country, Moody’s estimates that the 25 percent Mexican tariff will reduce the global earning of Volkswagen groups before interest and taxes by more than 15 percent.

“We have a factory in Mexico and, regardless of what administration is at work, our plan is to get stronger in the US,” Audi CEO Gernot Döllner said last month. But he added, “We think the tariffs are wrong and we believe in a free trade.”

The German car manufacturer BMW is less exposed, because 65 percent of his US cars are being built locally, while he is also a net exporter from the USA.

“There could be unstable situations that could be less predictable, but I’m really optimistic,” said Jochen Goller, a member of the BMW Committee in charge of customers, brands and sales. “I think it will be one of the growth markets for us in the next year.”

Will Tesla appear as the winner of Trump’s tariff?

Investors have hoped that Elona Musk will protect the close ties with Trump from the fall from the president’s policies, but the world’s largest electric vehicle manufacturer is still exposed.

Tesla assembles all its vehicles sold in the US locally, but sources 20 to 25 percent of its components for Model 3, Model Y and Cybertruck from Mexico, Barclays states.

“Over the years, we have tried to localize our supply chain in every market, but we are still very reliable into parts from all over the world for all our companies,” said the Cinemas, VAIBHAV TANEJA CEO of briefing about earnings last week, warning, warning, warning a hit to his profitability from Trump’s tariffs.

The company could also be the goal of tariff retaliation in Canada. Former Finance Minister Chrystia Freeland, who runs to replace Trudeau as Prime Minister, said Ottawa should take revenge on US tariffs by adding huge levies to Tesla vehicles to punish the musk.

The tariff war also comes as Tesla is grabbing for declining sales in Europe for slowing down the demand for electric vehicles, increased competition and consumer return comparison against Musk political activism.

According to the French Industrial Association of La Platforms, the sale of Tesla in France in January was 63 percent lower than a year earlier.

Which car manufacturers are the least exposed to?

Smaller Japanese car manufacturers, such as Mitsubishi Motors and Subaru, could benefit from a lack of production in Mexico and Canada. Honda is also relatively well settled, as two -thirds of US sales are made locally, according to Barclay.

Taaaaaa Kat, CEO of Mitsubishi Motors, told reporters on Monday that the tariffs would have a little impact on the company and that they could even get a slight “tail wind” from increased exports to the US if the tariffs are not expanded to the rest of Asia.

However, he then withdrew his comment, saying that “on balance, there seems to be more winds,” and explained that Japan could benefit if he managed to get out of the goal of heavy tariffs.

Renault is also unlikely to be hit hard because there is no sale in the United States or Canada. The French car manufacturer’s shares on Monday fell to just 0.6 percent, far below the downs, suffered by other European car manufacturers with a greater presentation in the United States.

Renault, one of the few European brands who has not issued a profit warning last year, was “very good” in Europe, “said Stephen Reitman, analyst from Bernstein. The exposure of the company Tariffs is through his share of Nissan, who is currently following the merger with Hondom.

But although the company is less exposed to rivals, Reitman added: “There is not much winners in all this.