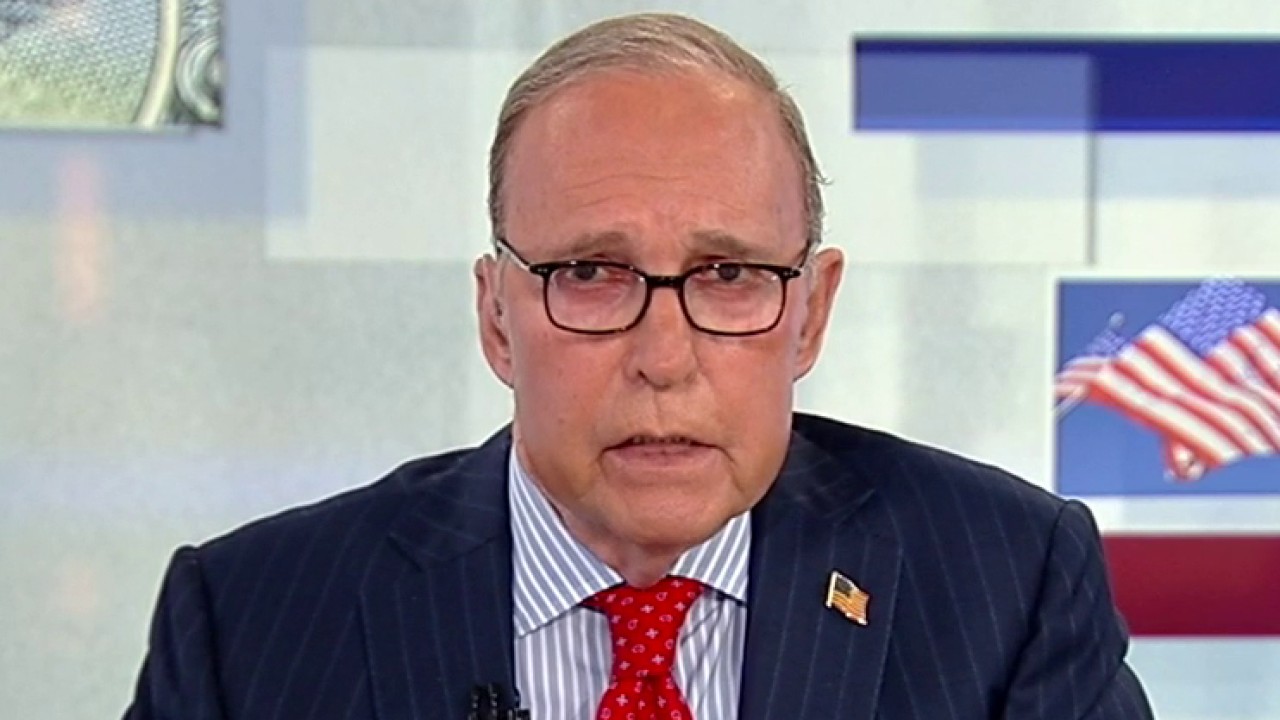

Larry Kudlow: Republicans have to stick to the Laffer curve

Congress Budget Office [CBO] They have just repeated their 10-year budget forecast and here, they increase the basic value of tax revenues by $ 1.9 trillion.

It is the same clothing that has been telling us for years that lower tax rates always reduce tax revenues and increase the budget deficit. But wait a little: the reduction of taxes for 2017 has been around for over 7 years. So, CBO has now suggested that they are not wrong admitting that the Laffer curve really succeeded? AND lower tax rates produce higher tax revenues? This seems to their new prognosis.

In fact, since the big decrease in the income of President Trump’s income rates from 35% to 21%, in the last 7 years, has been revenue of income taxes, they have doubled. And indeed, insert lower income taxes and other growth measures, the overall federal database for tax revenues increased about 50%. So how in the CBO world can it be returned immediately and now say that if Trump’s tax reduction is easy to extend, a 10-year cost will amount to $ 4 trillion? Cost of what? No costs.

US Minister Scott Besent unpacked the power of power in world negotiations on “Kudlow”.

Keep taxes low and revenues will remain high. There will be less tax avoidance and better growth. Laffer was right for about 50 years. CBO has been wrong for about 50 years. And here they are again, trying to tell us that the extension of Trump’s tax reductions will increase the budget deficit by $ 4 trillion as the income will be lower.

These are absolute nonsense and Republicans in the home, the Senate and the White House should fight this CBO nonsense. So far, one of the fighters has been Senator Mike Crapo (R) from Idah – who continues to claim that if you only expand your current law, we do not increase taxes or reduce taxes. There is no new deficit in the amount of $ 4 trillion. But if the tax account is not extended, then you will have an increase in taxes in the amount of 4 trillions and will worsen the budget deficit over time. Mr. Crapo calls him current politics and hopes the Republicans will fight for the official change of budget rules.

Senator Mike Crapo, R-IDAHO, unpacked the proposal of the tax law and the tariff under the elected President Donald Trump on ‘Kudlow’.

There is a precedent. In 2012, the Congress and President Obama expanded the reduction of George W. Bush tax using the current argument of a policy that assumed that the reduction of bush tax would continue – and not to be expelled. Mr. Crapo said again that CBO does not achieve permanent consumption increases as a hiking deficit every year – and therefore should not achieve a permanent tax increase. Otherwise, the whole federal fiscal system is like a fliper -storm on a permanent slope: they always promote higher taxes, higher consumption and even greater deficit.

Republicans should work hard to reduce unnecessary and counterproductive federal consumption. They should reduce Government size and scope. But if they let the tax reduction expire, they will simultaneously find themselves with a terrible economy and a larger deficit.

It’s a loss.

Mr. Trump said we should never get tired of winning. Let’s start with Expanding Trump’s tax reduction and the growth of the economy by 3 or maybe as much as 4% per year.

Call him a blue collar.