House prices in the UK grow to record high

Be informed about free updates

Simply log in to House prices in the UK Myft Digest – delivered directly to your arrived mail.

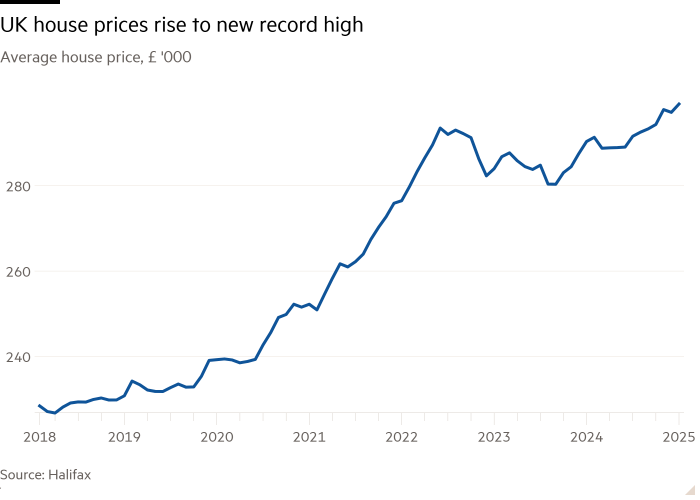

The average price of a house in the UK increased more than expected in January, to a new record, enhanced by approaching property taxes and showing resistance despite the tense accessibility, according to the Halifax mortgage.

House prices in December increased by 0.7 percent after a fall of 0.2 percent in December, which is an average property price on Friday on Friday, according to new data.

The ascent was much stronger than a growth of 0.2 percent that the economists who surveyed Reuters.

However, the annual increase in prices has slightly reduced to 3 percent, which is 3.4 percent in the previous month compared to 3.4 percent.

Amanda Bryden, Manager of the Mortgage on HalifaxHe said the apartment market in the UK “started the year positive.”

“Accessibility is still a challenge to many potential customers, but the market resistance is noticeable. There is a great demand for new mortgage and loan growth, “she said, adding that some customers who could first be eager to complete the purchase before the customs rise at the end of March.

Since April, among other changes, customers who will start paying customs on real estate for the first time costing £ 300,000 or more, which is less than the current threshold of £ 425,000. This comes with the completion of the temporary holiday at the customs office introduced into the October budget.

Bryden said that, despite geopolitical insecurities and disappeared, the consumer confidence, the real estate market supported with the recent decrease in interest rates and wages growing faster than inflation.

Thursday, Bank of England She reduced her interest in a quarter percentage point to 4.5 percent, which is the lowest level since June 2023. It was the third decrease since August last year.

Dave Ramsden’s deputy governor said that the gradual reduction rate of diet in a mortgage was gradually reduced, supporting demand.

“We think the apartment market is lifted,” he told reporters after a cut on Thursday.

Although they were still under their peak in the summer of 2023, the mortgage rates marked the late last year and others more than in 2021, before Boe began to increase the costs of borrowing from the historic lowest.

The data on Friday contrary to separate data from the mortgage lender across the country, which showed that the house prices in January increased only 0.1 percent, which slowed down the growth rate.

Halifax has a larger sample than a wide country, with about 15,000 transactions compared to 12,000, and focus on northern regions that can create short -term differences.

However, both the whole country and the Halifax show that the house prices have increased during the pandemic, and then they have fallen as the mortgage rates have increased in the last two years and then recovered in 2024.

In January, the average price of the house was 25 percent higher than in February 2020, before the pandemic, Halifax said.

The lender said that Northern Ireland still has the strongest annual increase in the price of assets in the UK, although it was 5.9 percent in January, this was alleviated by 7.3 percent in December.

London retained the highest average price of a house in the UK, with £ 548,288, which is 2.8 percent compared to the year earlier.