FTSE 100 hits a record high before expected decrease in interest rates

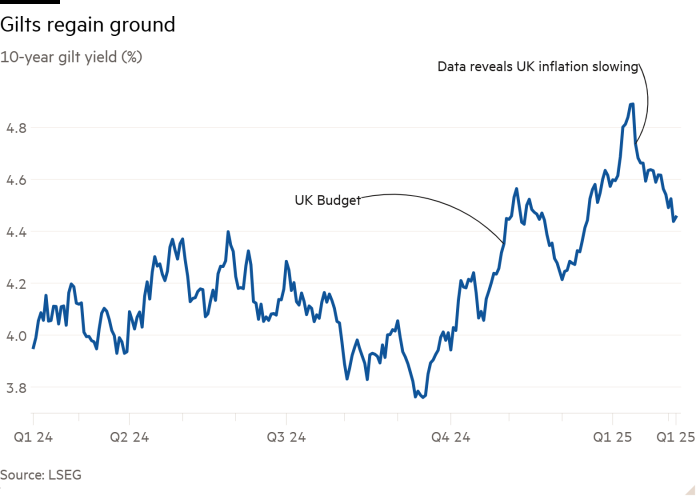

The costs of borrowing in the UK-which increased to the 16-year maximum in January, as the world’s bond sale in combination with concern due to the Great Britain’s economy-the last weeks fell significantly, given that hope increase the deeper reduction of interest rates in the UK.

A strong gathering in Gilts has increased prices on a positive territory for a year, taking a 10-year yield of 0.12 percentage points from January 1 to 4.45 percent. The yields go the opposite for prices.

The key to this was a number of weaker economic data, including inflation more slowly than expected, increasing the likelihood of a rate reduction. Concerns of growth threat from Tariff Donald Trump enhanced bets on deeper reductions, providing the tail winds of the Gilts, helping gains in American treasures.