Donald Trump trade tariffs on Canada, Mexico and China visually explained | News explanants

The United States are deferred Planned 25 percent of tariffs on Canadian and Mexican imports for a month, after the call of 11. Hours between President Donald Trump and the leaders from Canada and Mexico.

Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum agreed to increase border security to prevent drug trafficking and migrants in the United States, so far and so far in the trade war.

But 10 percent of tariffs on Chinese goods came on Tuesday, attracting retribution from Beijing. Chinese goods have already been subjected to previous tariffs starting with Trump’s first term between 2017 and 2021.

The US Tariff War by the US, the second largest merchant in the world after China, has withdrawn markets around the world. From January to November 2024. Value goods Trading between the US -Ai world reached $ 4.88 trillion, with an export of $ 2,98 trillion and $ 1.90 trillion dollars of imports.

The best trade partners of the United States – Mexico, Canada and China – make up more than 40 percent of the total goods being traded, worth more than $ 2 trillion.

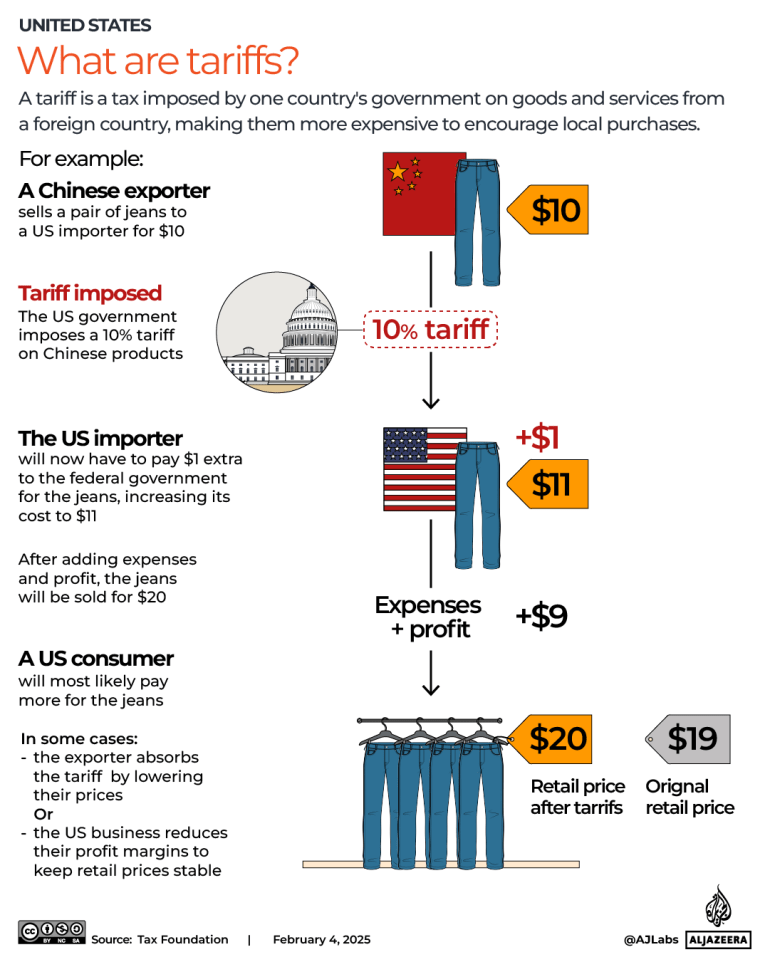

What are tariffs and how do they do?

Tariff is a government tax on imported goods and services paid by companies that bring them to the country. Designed to protect the domestic industries, tariffs often increase the costs for consumers by making foreign products more expensive, potentially reducing demand.

For example:

- The Chinese exporter sells a couple of jeans to the American importer for $ 10.

- The US government imposes 10 percent of tariffs on Chinese products.

- The US importer will now have to pay $ 1 additional federal government for jeans, increasing costs at $ 11.

- After adding costs and profits, jeans will be sold for $ 20.

- The US consumer is likely to pay more for jeans.

What does a break on tariffs in Canada and Mexico mean?

After talking to Trump, Mexican President Sheinbaum and Canadian Prime Minister Trudeau have committed themselves to strengthening security on their common limits with the USA.

“I was just talking to President Claudia Sheinbaum from Mexico. It was a very kind conversation in which she agreed to deliver 10,000 Mexican soldiers on the border separated by Mexico and the United States immediately,” Trump wrote on Truth Social on Monday.

After a call with Trump, Trudeau announced that Canada would move forward with his previously mentioned plan of a border plan of $ 1.3 billion, while also committing himself to the appointment of “Fentanil Cara” and officially appoint cartels as a “terrorist” organization.

“Basically, it is very good news that the tariffs paused and Canada must do everything possible to engage with Trump – to work on border security issues, etc.,” said Vina Underlyibull, Vice President, Research and Strategy in the Canadian Foundation of the Asia Pacific Foundation , Al Jazeera.

“But outside the immediate crisis, we have to work on the structural questions that led to this excessive addiction in the US. We need to build a capacity for export [to places other than the] We are investing us in our own competitiveness, “Nadjibulla added.

Are the tariffs a new idea?

No, Tariff used several countries before. Historically, in the United States from 1790 to 1860. The tariffs brought 90 percent of federal revenue.

Tariffs can also be used to “punish” a foreign producer of goods because it does not adhere to international trade practice. In 2018, the US began to place tariffs on Chinese goods worth hundreds of billions, citing dishonest trade practices and theft of intellectual property. This marked the beginning of the US-Kin trade war, where objects such as semiconduct, batteries and electronics such as washing machine were taxed.

In the same year, Trump also introduced a 25 -pointed steel levy and 10 percent of aluminum tariffs, which affected numerous countries, including Canada, Mexico, India, Brazil and Argentina.

Why are tariffs used?

Tariffs are often used to protect certain domestic industries from foreign competitors. This happens by increasing the price of those imported goods. The term tariff is that customers will choose domestic products due to expensive foreign imports, which in turn will help the domestic industry grow. However, this is not always the case.

For example, in order to produce avocado now – 90 percent of which are imported from Mexico – would be a long and arduous feat, since avocados are produced in only three countries: California, Florida and Hawaii.

Why did Trump impose tariffs?

During Trump’s presidential campaign, he promised to impose tariffs with the largest American trade partners in retaliation due to unfathomable migrants and drug flow, especially fentanis.

Trump also emphasized the use of tariffs as a means of strengthening domestic production and encouraging foreign companies to establish factories within the US territory.

The tariffs are also used to generate revenue for the country with additional tax income charged on imported goods used for public consumption. For example, in 2019, $ 79 billion in revenue was generated in tariffs, doubled the 2017 value, according to Brookings institution. However, most of this cargo was transferred to consumers who paid higher prices.

“During 2018-2020, President Trump mostly used tariffs as a negotiating chip,” Nadjibulla told Al Jazeera. “This time the motivation looks wider, including the desire to restore more production to the US, the redirection of tax burden on income tax and on tariffs, and they use the tariffs as an influence and as a punishment. We look at a much larger scale than we saw under Trump’s first term. “

Which products will be influenced by tariffs?

The range of goods will strongly affect Trump’s imposed tariffs. Based on what they now import from Canada, Mexico and China, this will include objects such as cars, fuel, computers and electric equipment. Food products like avocado are also likely to see price increase.

What are the tariffs that Trump planned to impose Canada, Mexico and China?

Trump has signed three executive commands that put 25 percent of tariffs on all goods from Canada and Mexico, as well as 10 percent of tariffs on Canadian oil and an additional 10 percent of tariffs on Chinese goods.

Canada is a large exporter of raw oil with 97 percent of oil exports to the US 2023, while Mexico exports a large amount of products such as fruits and vegetables, as well as car parts.

China is the main exporter of electrical equipment and electronics, including chips, laptops and smartphones.

What are the retaliation of the tariffs?

Canada, Mexico and China stated that they would react with the retaliation of the tariff. Trudeau said on Saturday that a 25 -pointed levy would hit the murder of American imports, which then stopped.

Beijing criticized the latest tariff, saying that it would challenge the tariffs at the World Trade Organization (WTO), an intergiene body responsible for the regulation of international trade. China set up Contratarians on American imports that will enter into force on February 10th.

Which tariffs have already been imposed on China?

According to section 301. It has been at the heart of the Washington trade war with China since 2018, when the tariffs were placed on the world’s largest exporter.

In a significant move, the Bidana Administration spread these tariffs in September 2024. To target items such as electric vehicles, batteries, semiconductors and solar panels, and the collection ranges between 25-100 percent.

Can tariffs lead to a trade war?

“There seems to be a temporary pause of tariff against Mexico and Canada. However, tariffs on China are likely to enter into force on February 4, and President Trump hinted at additional tariffs against the EU others. So yes, we could go to a trade war” , Nadjibulla told Al Jazeera.

“In response, countries are likely to adopt a series of strategies – from direct retaliation to protecting their trade relations between the US, China and other partners. Globally, we can expect inflationary effects and significant disorders to supply chains. “

Will this increase inflation?

“Yes. And the tariff itself and all the measures of mitigation – such as subsidies or support programs for the affected sectors – will contribute to inflation,” said Nadjibulla. “Higher prices associated with tariffs, in combination with the cost of the drug effort, will lead to inflation pressures.”

What can consumers do to protect/plan for it?

“If this is possible, buying local products and avoiding a certain import can help consumers manage growing costs,” Nadjibulla told Al Jazeera.

But I cannot completely avoid the inflationary pressure launched by the tariff war.

Will the prices of other items increase?

Yes, in most cases, the cost of objects will increase. This is not only the final goods of the product, but also the capital goods, which would increase production costs and result in higher costs for final products. In addition, higher costs for raw materials and parts would increase the prices through the supply chain.

According to the Analysis of the Peterson Institute of International Economics (PIIE), a non-profit organization based in the US exploring the global economy, machines and electronics will face the largest import tax-s, since they are mostly obtained from China and because it is currently being They face low prices.

Other American imports from China that are likely to be the hardest would include toys and sports equipment.

Who pays the price?

Finally the consumer. Companies based in the US will face the payment of larger taxes. In most cases, consumers have indirectly picked up the cost of tariffs, as the import of companies is likely to increase the price of the said goods for managing taxes charged.

“Consumers will transfer most of the load to higher prices, but companies will also feel the impact. Industry such as Canadian and American auto sectors can be particularly difficult to hit, “said Nadjibulla of the Canadian Foundation of the Asian Pacific Foundation.

Can tariffs affect jobs?

Theoretically, the imposition of tariffs would stimulate more domestic production, which in turn would require more employment. Similarly, if foreign companies are encouraged to bring their factories to the United States, this would increase employment.

For example, after Trump has imposed 20-50 percent of tariffs on the washing machine, several jobs have been brought to two regions where the devices have not previously produced: Clarksville, Tennessee and Newberry, South Carolina.

In 2018, LG completed the investment in a new smart factory in Clarksville to be employed with 700 employees. Similarly, Samsung built a plant for the production of devices in Newberry in South Carolina in 2018, employing 1,000 employees.

The American administration would be hoping that the last tariff war would encourage corporations to establish multiple factories and businesses in the US.