Buffett advertises record payments to Berksshire, calls the Government to spend wisely

The main investment strategist of BMO capital markets Brian Belski is considering whether the market refund is something that investors should worry about making money.

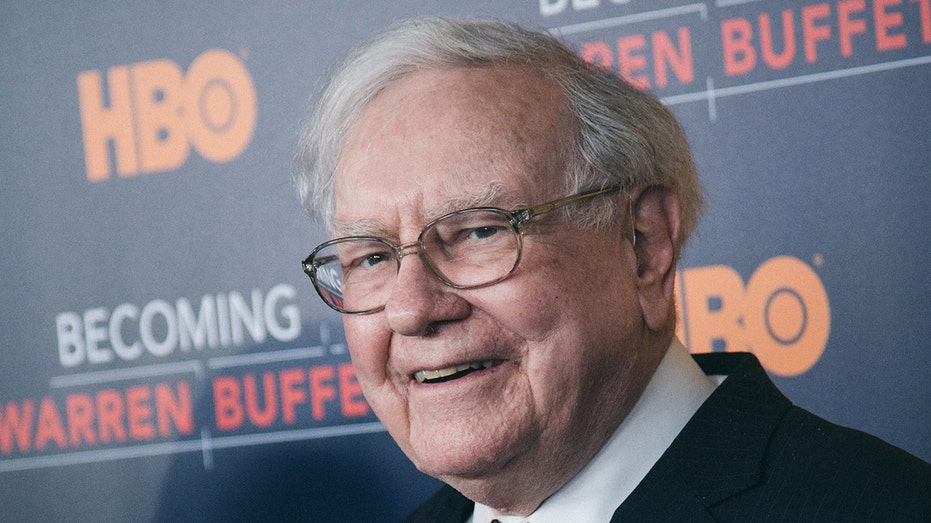

President and CEO of Berksshire Hathaway Warren Buffett On Saturday, it published its annual letter, which posted a record payment tax on a record company last year and invited the Federal Government to spend the money wisely.

Buffett recalled that when he first bought Berksshire Hathaway 60 years ago, his longtime business partner Charlie Munger warned him that what was a great textile job then “headed for extinction”, as indicated by the inability to generate profit and payment of taxes at the time.

“The American Treasury, all places, has already received quiet warnings about Berksshire’s fate,” he wrote. “1965. The company did not pay the number of income taxes, a shame that mostly prevailed in a company for a decade. Such economic behavior can be understood for glamorous startups, but it is a blinking yellow light when it happens on the Honorable Pillar of the US industry. Berksshire headed for the ash bucket. “

“Fast forward 60 years and imagine a surprise in the treasury when that same company – still acts under the name Berksshire Hathaway – paid far More in profit tax than the US government had ever received from any company – even US technological titans who ordered market values in trillion“Buffett wrote.

Annual Letter to Warren Buffett to shareholders Berksshire Hathaway: Read HERE

Chairman Berksshire Hathaway and CEO of Warren Buffett published a record payment tax on the company in his annual letter. (J. Kempin / Getty Images / Getty Images)

“To be precise, Berksshire made four last year IRS payments This was $ 26.8 billion. This is approximately 5% of what all corporate America paid. (In addition, we paid considerable amounts for foreign government taxes and 44 countries.) “

Buffett added that the total payment of the company’s income tax is in American treasury Over time, they reached a total of $ 101 billion and noted that the company had paid only one dividend in the last 60 years enabled a conglomerate to build its base of taxable income over time.

Buffett’s surprise November is a letter to a personal tone

The value of the investor, known for holding the shares in the long run, also advertised its top -notch investment.

“We have a small percentage of a dozen or so large and very profitable companies with household names such as Apple, American Express, Coca-Cola and Moody’s.

| Dice | Security | Last | Change | Change % |

|---|---|---|---|---|

| Aapl | Apple Inc. | 245.55 | -0.28 |

-0.11% |

| Ax | American Express Co. | 295.37 | -8.40 |

-2.77% |

| Who | Coca-Cola Co. | 71.39 | +1.34 |

+1.91% |

| MCO | Moody’s Corp. | 500.03 | -11.54 |

-2.26% |

Buffett continued to talk about Value of capitalismHe said he had mistakes and abuse that “in certain aspects they are now more feverish than ever,” but “they can also do wonders unrivaled in other economic systems.”

“True, our country in infants sometimes borrowed abroad to supplement their own savings. But at the same time, many Americans needed to save consistently, and then they needed those savings or other Americans to wisely deploy capital so accessible. If America consumed everything if she had produced, the land would spin her wheels. “

“The American process has not She was always beautiful – our country forever had many thieves and promoters who seek to use those who mistakenly believe them in their savings. But even with such abuse – which still remains in full force today – and also a lot of capital deployment that eventually flew over the brutal competition or disturbing innovation, the savings of Americans delivered the amount and quality of production outside the dreams of any colonist. “

“From a base of only four million people – and despite the brutal inner war, early, inserting one American against another – America changed the world of the flash of the heavenly eye,” Buffett wrote.

Buffett urged the Federal Government to spend wisely and secure a stable currency. (Photo Kevin Dietsch / Getty Images / Getty Images)

He explained that in “very The smaller way “Berksshire shareholders participated in an American miracle giving up dividends. What was initially “tiny, almost pointless” re -investment “over time.

“Berksshire activities now affect all the corners of our country. And we are not finished. The companies die for many reasons, but, unlike the fate of people, the age of the very age is not deadly. Berksshire is far youth today than it was in 1965.” He wrote.

“HoweverAs Charlie and I always admitted, Berksshire would not have achieved his results in any place, except America, while America would be any success like Berksshire never existed. “

Get a job with Fox on a clicking movement here

“So thank you, I’m uncle’s. One day your nephews and nephews in Berksshire hope to send you even more payments than we did in 2024. You spend it wisely. Watch many who, without any guilt, get short straws in life. requires Both wisdom and alertness on your part, “Buffett wrote.