We don’t actually know how many houses we are building

East Lindsey residents must have been in for quite a shock last year. According to the updated census, there were not, as previous numbers suggested, around 390 houses being built each year in their largely rural Lincolnshire borough, which surrounds the seaside resort of Skegness; there were 2,330 of them.

Yet even from the top of The Odyssey — the tallest rollercoaster at the local amusement park — you’d be hard-pressed to see any sign of these rafts of new homes: there aren’t many cranes dotting the skyline or roads clogged with trucks. No boom not even among the local population. So where are they?

Closer examination of the census data reveals a clue: the recount picked up a large number of static caravans parked near the North Sea coast, which then added to the housing stock.

It’s not clear whether these holiday caravans are responsible for all the increase, or whether there was an undercount in earlier data or some sort of classification problem, but it points to an uncomfortable and often overlooked truth: we don’t really know how many new homes we build in England each year. And the number depends on who you ask.

For a government with a clear house-building target – 1.5 million new homes by 2029 – that’s a problem. And this represents another sector, along with immigration and employment, where the quality of official statistics is quite poor.

If you go to the Office for National Statistics website and download their house building data for England, you will follow a long line of politicians, journalists and even academics using data that is not fit for purpose. Even if you look up the original source — the Ministry of Housing, Communities and Local Government — you’ll end up in a bind if you click on the wrong link: the most commonly used house building data for this country actually undercounts completed new builds, by a significant amount.

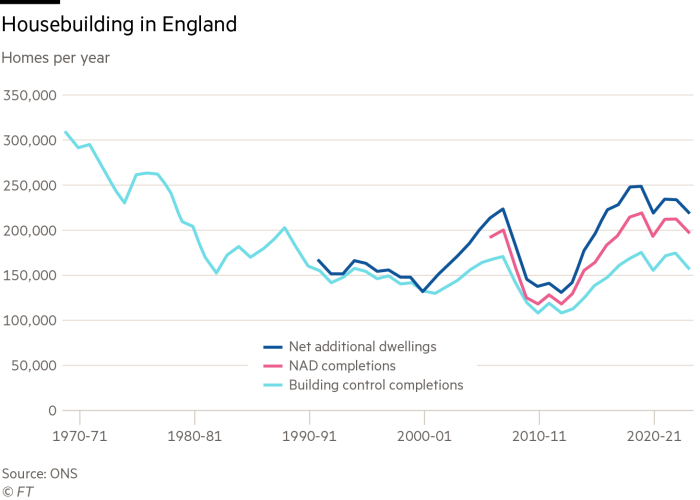

The ONS data is mainly based on Building Control figures, a market historically dominated by the National House Building Council (NHBC) — an organization set up to provide guarantees for new homes because of concerns about poor building quality in the 1930s. However, in recent decades, NHBC’s market share has deteriorated – from around 85 per cent to around 60 per cent. Although building control data has improved slightly since 2017, being less reliant on NHBC data, a significant undercount remains.

There is a more robust number of new homes, published as part of the government’s Net Additional Dwellings (NAD) reports. This allows us to understand both the scale and location of the small number in the building control data. For example, it shows there were around 158,000 completions across England in the 2023-24 financial year, while more accurate NAD figures for completions show there were 199,000 — a difference of 25 per cent, or 40,000, almost the size of Bath.

The shortage is greatest in areas with more home builders. Although the long-term trend has been the increasing dominance of large, publicly traded homebuilders, the market has actually become more diverse over the past decade. In many places, there was an increase in activity in everything from small housebuilders and housing associations, to rental investors and luxury entrepreneurs – at least until interest rates started to rise. And it seems they looked elsewhere for their building warranties.

This means for London that the building control data is seriously wrong. For 2023-4, NHBC figures show there were around 16,000 new build completions, while NAD figures show there were more than 28,000 — even more comprehensive Greater London Authority figures say there were almost 32,000 completions. So almost half of the London housing market appears to be missing from building control data!

In markets still dominated by traditional large homebuilders — for example, suburbs on the fringes of cities — building control data is still quite useful. Although, even in places like Milton Keynes, where there has traditionally been a good correlation between building control and NAD data, there have been signs in recent years that this may be failing, as build-to-let developers and others move in.

England is not the only country struggling to count how many homes it has built: Ireland has historically overestimated housing delivery because it relies on electricity connections to count new properties. Cowsheds, outbuildings and vacant homes being brought back into use contributed higher numbers of housing deliveries. When the methodology was revised in 2018, it reduced the number by nearly 58 percent.

Measuring how many homes we build isn’t just important because of government housing goals (which are actually based on net additions, a measure that includes changes of use and conversions). Understanding who is building new homes and where is key to ensuring policies are fit for purpose – not just hitting targets.

It can also affect your own investments. An increasing number of UK pension funds are investing in residential property, particularly through the build-to-let market. Lack of accurate public information about who is building what and where can lead to their investment not achieving the expected results. Meanwhile, other organisations, including a major listed housebuilder, still frequently refer to London Building Control figures to highlight the capital’s massive housing undersupply. The extent of undersupply relative to targets is still substantial, but not quite as large as is regularly suggested.

And while the NAD data is a clear improvement over the BC numbers, even this isn’t perfect. It comes out only once a year, with an eight-month delay. As the GLA data for London shows, the lack of historical audits before 2019-20. means the data probably doesn’t count completions as some take longer to register. We also don’t really know how far the undercount goes. The late dr. Alan Holmans, an expert in housing statistics, expressed doubt that housing completions in the 1990s – perhaps even earlier – were fully recorded.

To address missing endings, NAD data is revised every 10 years when the last census is published. However, we don’t know whether the homes missed were new builds or from another source, and we don’t know what ownership or who built them — hence the debacle in East Lindsey, where the number of homes added to the tally was a third of the national adjustment of 5,890 homes a year for the period between the 2011 and 2021 censuses.

If nothing else, it shows that if the government really wants to hit its house building target this parliament, perhaps it should focus on building static caravans outside Skegness.

Neal Hudson is a real estate market analyst and founder of BuiltPlace consulting firm