Gilts set for best week since July after string of poor economic data

Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

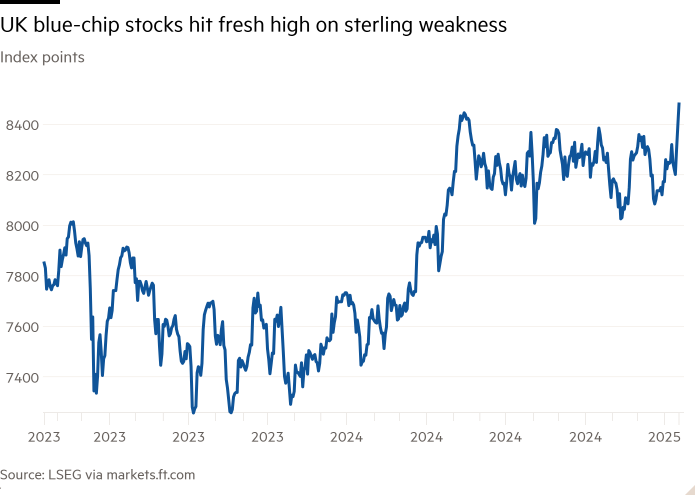

Gilts were on course for their best week since July and the FTSE 100 hit a record high on Friday, after a series of weak economic data weighed on the pound and fueled bets that the Bank of England will cut interest rates more aggressively to spark growth.

The rise in UK government bonds accelerated on Friday after official figures showed an unexpected fall in retail sales in December, raising the risk of an economic downturn late last year.

The yield on the 10-year gold coin fell another 0.05 percentage points to 4.64 percent after the announcement, bringing it down 0.2 percentage points this week. Yields move inversely with prices.

Signs of weakness in major markets follow disappointing November GDP data and lower-than-expected inflation in December.

By late morning the FTSE 100 was up 1.2 percent, beating the previous record high in May, helped by a weaker pound. Many of the blue-chip companies in the index make their earnings in dollars, meaning they benefit from a stronger US currency.

“Better inflation news allows gilts to be the safe haven that the market now increasingly feels is needed in the UK,” said Gordon Shannon, portfolio manager at TwentyFour Asset Management.

Growing expectations of interest rate cuts to support the stagnant economy “facilitated the withdrawal of foreign buyers [and buy gilts]Shannon added.

The two-year yield fell 0.04 percentage points to 4.34 percent on Friday, bringing it down to 0.19 percentage points this week.

Traders now expect at least two quarter-point rate cuts this year from the current level of 4.75 percent, and a two-thirds chance of a third cut, in line with implied levels in swaps markets.

Despite a rebound in the gilt market, 10-year yields remained well above the 3.75 percent level they hit in mid-September, before a sell-off fueled by both government bonds and fears that the U.K. is struggling with stagflation – where steady price rises make it was difficult for the Bank of England to cut rates.

That pushed UK borrowing costs to a 16-year high last week, higher yields attracting wave of small investors but also forcing Chancellor Rachel Reeves to defend her economic plans before the representatives.

Rising borrowing costs have severely reduced the chancellor’s room against her self-imposed fiscal rules. Big gold investors have warned that the government may be forced to raise taxes or cut spending to maintain credibility in the market.

Traders who bet on a drop in the exchange rate were encouraged by a speech this week by one of the central bank’s policymakers that it may need to cut rates five or six times over the next year to support the economy.

Alan Taylor, a member of the Monetary Policy Committee, warned that recent data for the UK pointed to an “increasingly bleak outlook for 2025”, as he argued that the central bank needed to take precautionary measures to support the economy with lower borrowing costs.

While the chancellor’s lower rate expectations will somewhat ease the UK government’s borrowing costs, the accompanying weaker growth outlook could have a negative impact on fiscal forecasts if the weakness is judged to be persistent.

The Government’s Office for Budget Responsibility is due to present its new economic and fiscal outlook on March 26, and the chancellor is due to respond with a statement to parliament.

British plantations were helped by tailwinds from Treasuries, which also gained as data showed weaker inflationary pressures in the US economy. This led to a decline in the yield on 10-year treasury bonds by 0.18 percentage points to 4.59 percent.