Explainer-How billionaire caltagirone could influence Italy’s banking M&A wave by Reuters

MILAN (Reuters) – Italian billionaire Francesco Gaetano Caltagirone has emerged as a leading player in the ongoing reshaping of Italy’s financial sector.

Battles in Generala and Mediobanca

Caltagirone expanded its investments in the Italian financial sector last year and is now a key shareholder in the rescued bank Monte dei Paschi di Siena (MPS) and fund manager Anima Holding.

On Friday, MPS launched a surprise €13.3 billion bid to buy Merchant Bank Mediobanca (OTC:), in which Caltagiron has become the second largest investor in the past five years.

He is the third largest shareholder in Italy’s top insurer Generali (bit:), with a 6.9% stake. Mediobanca is the main investor in Generali with a 13% stake.

Caltagirone has repeatedly complained that MedioBanca has excessive influence over Generali through the Board and a governance system that allows outgoing directors to appoint their successors.

As a long-time investor and board member in Generali, in 2022 and the late fellow billionaire Leonardo del Vecchio, they searched in vain for CEO Philippe Donnet.

Prime Minister Giorgio Meloni’s conservative government has approved contested corporate governance changes championed by Caltagirone and criticized by fund managers, which tighten the conditions under which a company’s outgoing board can submit a list of successors.

Donnet’s term comes up for renewal in the spring and is expected to be presented for another term backed by Mediobanca.

What is his role in the Italian banking consolidation?

Caltagirone’s holdings potentially set it against Unicredit CEO Andrea Orcel, who launched a takeover bid for Banco BPM in November, shortly after BPM launched its own bid for Anima and bought a 5% stake in MPS.

The Rome-based treasury has long favored combining BPM with MPS, which is also an Anima partner, and building a core of long-term shareholders as it reinvigorates the Siena-based bank it rescued in 2017, the sources said.

Before Unicredit offset Rome’s plans, Caltagirone, with a 5% stake in MPS, 5.3% in Anima Holding and 2% in BPM, looked set to become a significant shareholder in the combined entity.

In December, Caltagirone appointed two MPS representatives, including his son Alessandro.

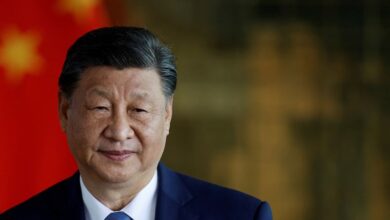

Who is caltagiron?

An Italian entrepreneur with interests in construction, the cement industry, real estate, publishing and finance, Caltagirone was born in Rome on March 2, 1943, to a family of Sicilian descent.

According to the Forbes Wealth 2024 ranking, Caltagirone is the tenth richest person in Italy with an estimated fortune of 5.6 billion euros ($5.9 billion).

It owns the Rome-based daily IL Messaggero, Italy’s eighth-largest newspaper Cross, which broadly supports Meloni’s government, and several regional newspapers.

Despite his wealth and influence, Caltagirone maintains a relatively low profile and rarely gives media interviews.

He started by reviving his late father’s business along with his two brothers and cousins. In the 1980s, it expanded with the acquisition of Vianini Group, a Milan-listed cement and infrastructure firm.

His cement company Cementir, listed on the Italian stock exchange, has a presence in 18 countries with 3,000 employees worldwide. It is the largest cement producer in Denmark, the third largest in Belgium and among the main international gray cement operators in Turkey.

Caltagirone has three children – Francesco, Alessandro and Azzurra – all involved in his operations, but no designated heirs.

($ 1 = 0.9529 euros)