Core Scientific CFO sells $12,544 worth of shares to Investing.com

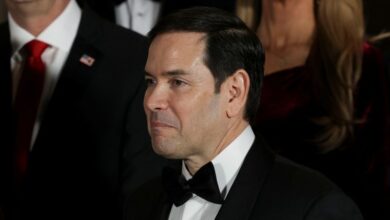

Sterling Denise Marie Brucia, Chief Financial Officer of Core Scientific, Inc. (NASDAQ: ), recently sold part of its stake in the company. The transaction comes at a time when Core Scientific is showing outstanding market performance, with shares up 375% over the past year and currently trading at $16.34. According to InvestingPro analysis, the stock appears to be overvalued relative to its fair value, although analysts maintain a positive outlook with price targets ranging from $17 to $26. According to a filing with the Securities and Exchange Commission, on January 22, 2025, Brucia sold 802 common shares at an average price of $15,641 per share, for a total transaction value of $12,544. This sale was made to satisfy tax obligations following the vesting of restricted stock units, as stated in the filing. After the transaction, Brucia holds 440,028 shares of Core Scientific. InvestingPro subscribers can access 14 additional investment tips and a comprehensive Pro Research Report for deeper insight into the financial health of Core Scientific, which is currently rated GOOD.

In other recent news, Core Scientific Inc . makes significant advances in the field of artificial intelligence and high performance computing (HPC). The company has begun construction on a new 100-megawatt data center in Muskogee, Oklahoma, as part of a larger deal with CoreWeave. This new facility will support CoreWeave NVIDIA (NASDAQ: ) GPUs for the confidential client, contributing a total of 500 megawatts of IT workload contracted for HPC hosting operations.

Craig-Hallum initiated coverage on shares of Core Scientific with a Buy rating and a $24.00 target price. The analyst praised CoreWeave’s recent deal with Core Scientific and highlighted the company’s growth potential. Compass Point also upped their target price on Core Scientific from $20.00 to $26.00, maintaining a “Buy” rating on the stock.

The company also announced plans for a $500 million convertible bond offering, aimed at attracting qualified institutional investors. This financial maneuver is part of the company’s effort to secure additional funds.

These recent developments underscore Core Scientific’s ongoing efforts to expand its high-performance computing capabilities, secure additional funding and diversify its customer base.

This article was generated with the help of AI and reviewed by an editor. See our T&C for more information.