US stocks jumped more than 20 percent for the second year in a row

The U.S. S&P 500 rose more than 20 percent for a second straight year, as investor excitement over artificial intelligence fueled strong gains in megacap tech stocks.

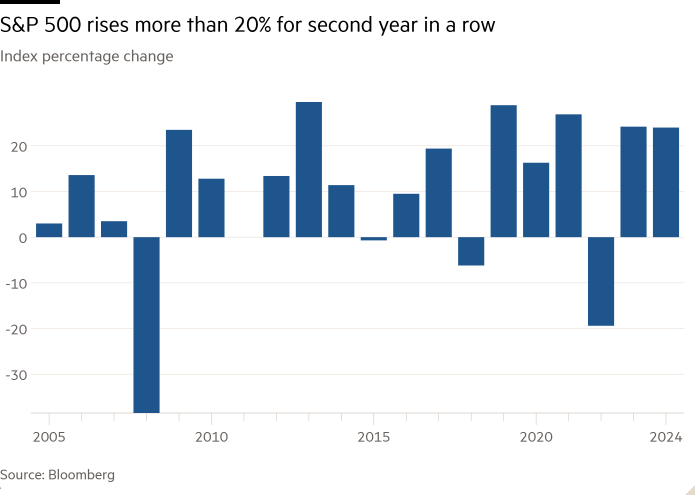

Despite December’s selloff, the basket of blue-chip stocks ended 2024 up 23.3 percent, after rising 24.2 percent the previous year, its best two-year streak this century. The index has now posted annual gains of more than 20 percent four times in the past six years.

The rise was led by large tech stocks with exposure to artificial intelligence. Shares in chip maker Nvidia have risen 172 percent over the year, while Meta, which has also bet heavily on the new technology, is up 65 percent.

The performance of the S&P 500 contrasted with European markets, with the Stoxx 600 up 6 percent and the FTSE 100 up 5.7 percent. The MSCI index of Asia-Pacific shares rose 7.6 percent.

“USA [market] has rarely been so exceptional,” said Michael Metcalfe, head of macro strategy at State Global Markets.

Wall Street stocks also rose as the Federal Reserve cut interest rates for the first time since the coronavirus pandemic and resilient economic data reassured investors that the US is headed for a soft landing. Expectations of tax cuts and looser regulation during Trump’s second term have also fueled gains in recent months.

Bank of America strategist Benjamin Bowler said Trump’s “laissez-faire economy, tax cuts and deregulation,” along with a potential “artificial intelligence revolution,” means growth is likely to continue in 2025. While 2024 was undoubtedly “a good year ” for the US stock market, “may be just the beginning,” he said.

But Chris Jeffrey, head of macro at $1.4 trillion fund manager Legal & General Investment Management, said there were “a lot of red flags that we should be a little bit cautious about”.

The difference between forward price-earnings ratios in American and European stocks could be justified only if you “believe that the last 10 yrs. [of tech-driven US earnings growth] he can continue, and for an awfully long time,” he added.

Investors also had to drop their expectations of rate cuts over the next year. With inflation still above target, forecasts released by the Fed that interest rates will fall less than previously hoped in 2025 sent the S&P 500 to its worst session in four months in early December. That dampened investor enthusiasm after Trump’s election victory in November and helped the index slide 2.5 percent in December.

Megacap tech stocks including the so-called “Magnificent Seven” – Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia and Tesla – were once again the dominant force in the US market.

Bulls argue that big tech’s earnings growth and AI’s potential to boost productivity justify valuations.

Mike Zigmont, co-head of trading and research at Wisdom Investment Group, said that despite falling revenues, the Magnificent Seven will remain very popular in 2025 because of the outsized returns they have generated in the past. “Investors are simply looking for them,” he said.

But their gains have prompted bearish commentators to draw comparisons between today’s biggest market and the tech bubble that burst spectacularly at the turn of the millennium.

In contrast to gains in the technology sector, industrial materials companies were among the S&P 500’s worst performers in 2024 as China’s struggling economy and fears of a yet-to-materialize U.S. recession dampened investor appetite.

Bursts of volatility briefly interrupted the otherwise steady rise of the S&P 500. In addition to December’s decline, stocks suddenly sold out in early August, with declines extending beyond the technology sector.

Even so, in early December asset managers’ net debt exposure to the S&P 500 index rose to the highest level in more than 20 years, according to Bank of America’s monthly survey of global fund managers, indicating “super-bullish sentiment.” Meanwhile, retail investors’ enthusiasm for gains in the stock market over the next year has never been higher, according to Deutsche Bank.

However, Citi’s closely watched U.S. economic surprise index has slipped in recent weeks, indicating that economic momentum is weaker than expected. Some analysts say slow growth in the amount of money circulating in the US economy, high Treasury yields and a strong dollar point to a potential economic contraction in 2025.

Investors have sold tech stocks in recent days, while the Russell 2000 index of small-cap stocks has slipped further from its record high in November. The equally weighted S&P 500, which gives each component a weight of 0.2 percent, fell 6.6 percent in the past month.

Concentration of returns in big tech will remain a “painful trade” for mutual funds that can only hold so many stocks, said Charlie McElligott, strategist at Nomura.

Investors “simply can’t own enough” of the biggest names, he added.