China’s currency fell to a 16-month low on Trump’s tariffs

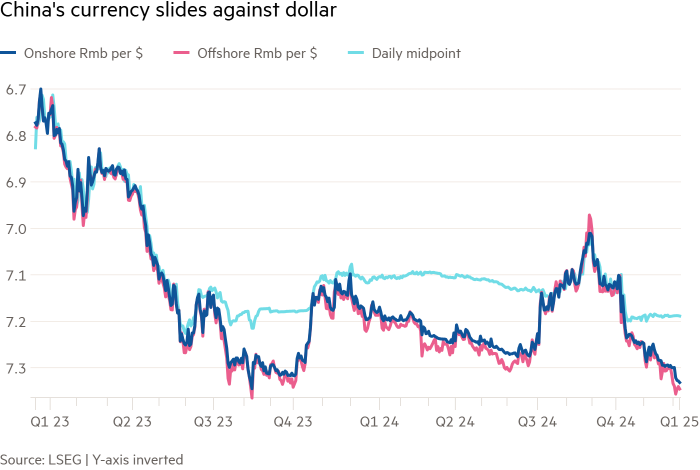

China’s currency weakened to a 16-month low as the potential for sharp tariff increases from the incoming Trump administration increased selling pressure on the renminbi.

land renminbi it weakened 0.1 percent to 7.34 Rmb against the dollar on Wednesday, the weakest since September 2023, despite the People’s Bank of China keeping rates steady ahead of Donald Trump’s inauguration this month.

The Chinese currency is allowed to trade within 2 percent of the daily exchange rate set by the central bank, and the exchange rate is approaching the lower end of that trading range.

“The market is impatient and wants the renminbi to appreciate,” said Wee Khoon Chong, senior market strategist at BNY.

On Wednesday, the PBoC announced a daily fixed rate of Rmb7.1887 against the dollar, almost unchanged from Tuesday’s fixed rate of Rmb7.1879. But pressure on the exchange rate increased after strong US economic data boosted the dollar on Tuesday.

The selling pressure on the renminbi “is essentially a reflection of the Trump trade,” said Ju Wang, head of foreign exchange and broader China exchange rate strategy at BNP Paribas. “The market has been doing this since the US election. . . we think a lot is at stake, but the market doesn’t want to give up.”

The central bank wants to keep the exchange rate steady while it waits for more clarity on Trump’s trade policy, analysts said, adding that any easing of the fixed rate could risk a bigger sell-off in the Chinese currency.

Trump said he would China to introduce tariffs of 60 percent on his first day in office.