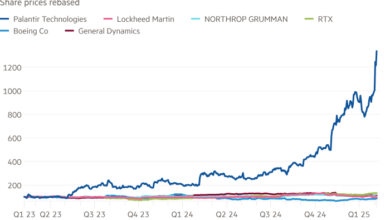

American entries often do not increase the estimates of European companies

The European companies that have added the American list often do not see the increase in their estimates, the Financial Times determined, in the challenge for the claims of some executives that the presence on the stock market in New York is a safe fire up to higher shares prices.

Analysis of 12 companies that have added US lists since 2016.-Understanding Ferguson, CRH and Flutter entertainment – They discovered that in half of the cases of assessment, there were fallen, while in numerous cases there were no progress in the number of analysts who followed supplies. However, two -thirds of companies enjoyed greater liquidity in their stakeholders after moves.

“The basic thesis to move to the US and the price of your stock improves is not right,” said Richard Werner, a partner at BCLP law firm. “Definitely not as simple as that.”

European companies and their investors have seduced A great increase in the American Stock Exchange In recent years, believing that-recent sales on the market-there is more to enjoy more profits.

UK Broker TP ICAP last week said he was planning Please provide your data on data in New YorkWhile Glencore said in February that Glencore had renamed London’s list if other places would-be in the “be” more appropriate “for trading its shares, in a potentially large strike of London’s historic status as a mining center.

A construction group on the London Ashtead list Plans to move His primary list of New York and Executive Director said “the benefits of primary intake in the US in other markets.. They have become more obvious in the last few years.” “Looked at” A switch while the French property manager Tikehau He also considers such a step.

Ft findings come while European policy creators are urgently trying to revive the domestic markets and encourage companies to stay home at home. In the UK are regulators overhauling rules For companies that are listed on the list in an attempt to make London more competitive.

FT companies analyzed all new American quotes – whether the primary or additional entry – while guarding their European lists.

The supplier of water supply equipment based in the UK Ferguson and the Flutter Entertainment Gambling Group are among groups that have added American lists in recent years, as well as fewer companies such as dry Himalaya Shipping operator and the individual’s pharmaceutical company.

FT found an Irish group of construction materials CRHThe individual and shipping group Okeanis Eco Tankers were the only companies that enjoyed the climb to all three analyzed measures – estimates, the volume of shares trading and analysts followed – while the Burford Capital Capital expert and the Spanish infrastructure group Ferrovial did not benefit. The others missed at least one measure.

The estimates of half of the analyzed companies were lower in New York than they were in local markets before the moves, and less supplies hit stronger. On average, the ratio of price/earning ratio for the lesser companies-none less than $ 10 billion in market capitalization-it was about 7 percent lower in New York, while for a larger company it was about 1 percent.

“For smaller or medium-sized European companies, a secondary list in the US cannot generate interest among American investors watching larger companies where the recognition of the brand is globally,” said Apostolos Thomadakis, chief of research at the Think-Tank Institute of European Capital Institute.

However, the CRH enjoyed a continuous increase in New York values. Its average P/E ratio increased from 12 times to 18 months before transferring its primary list to the US to an average of 15 times in 18 months.

But Flutter, who added an American quote in January 2024, and then made New York in May with his primary inclusion, did not improve – his P/E ratio dropped from an average of 29.8 times in the UK to 29.1 times.

Thus, the former FTSE 100 ingredients are Ferguson and Ferrovial, whose average estimate in the United States was 9 percent and 11 percent lower after we were moving.

Adding American entries can be a set step – Werner BCLP said the cost can range from around £ 500,000 to more than one million pounds, depending on the proportion of legal, accounting and investment banking services, plus fees charged with stock markets. Companies also have additional, current reporting costs to maintain a list that can last tens of thousands of dollars a year.

“There are a lot of direct costs and indirect costs,” said Kim Balle, the Terma Cinema Financial Director, who added a listing about the exchange of Nasdaq in 2017.

The FT Analysis did not take into account factors such as the edition of the company’s earnings, regulatory changes or shifts in the sector estimates, which could all affect the company’s ratio.

Most companies have benefited from greater liquidity – the ease with which the shares can be traded without the necessary price movement. Large companies, on average, experienced an incentive of about four times compared to the shares in the census in Europe with its American, while small companies testified about 45 percent of increase.

CRH -Liquity is now about seven times higher in New York. But Ferrovial -Liquity has brought it over there: about 37,000 of its shares are traded daily in the US, compared to more than 1 Mn in Europe and 10 months before and after the US relocation.

That was “as expected with the new list of Nasdaq,” Ferrovial told FT, adding that “the intention of the group is to build additional liquidity in the United States over time.”

FT also revealed that on average there was little or no progress in covering analysts for numerous analyzed companies, although bosses often cite greater visibility as a reason for the presence in New York.

Oliver Lazenby, a partner at Freshfields law firm, said: “All these things are final, banks analysts and institutional investors do not necessarily resource [to cover every single company]. “

The whole size of US markets means that investors and analysts tend to notice larger companies like Flutter or CRH, he added.

“In a bigger sea, attention tends to go for more fish,” said Paul Asss, a partner in Winston and Strawn. “If you are a tenth of that size, you will obviously need to work more to make waves.”

Methodology

New York Stock Exchange and Nasdaq have provided FT with companies list with European listings that have added US lists since 2016. Large companies are defined as those with market capitalization of more than $ 10 billion. The FT Analysis has taken the ratio of the company’s share of the company-a measured as a ratio of four-week trading volume in four weeks compared to the average number of its shares, expressed as a percentage-like liquidity measure. SPACS and ADR -are omitted.

In order for the time frames to be equal between the American quote and the European, FT used the number of weeks from the date of inclusion of the US to the present and applied that same number of weeks to the period before moving the US. In cases where there was a length of trading information, we used the complete series in both. Although any efforts were made to create an exhaustive set of data, there was no easy way to collect a comprehensive list of companies, and some may be missing as a result. Initially, we found 15 companies that added an American list since 2016, but three-Flex LNG, Nyxoah and Alvotech-Nis have had continuous figures for their advanced 12-month multiple prices, due to negative earnings forecasts, so they have been left out of analysis. Four databases in the torma, where the ratio of P/e briefly exceeded 50, are also excluded for visual purposes. A relatively small sample size in this case is inevitable, which can distort the results. Data 28. February.