What should Reeves and Starmer say and do next?

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

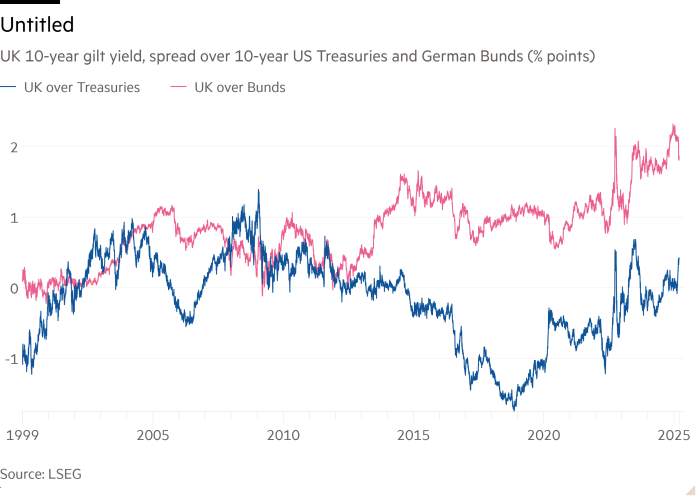

It’s hard not to be sorry Rachel Reeves. He tries to be responsible and pro-Rest. But she chaired by standing economy With the great borrowing and expensive fiscal rules she set herself just a few months ago, but now it seems she is likely to break. Her tax is growing At the time of the budget were (and others) extremely unpopular. Still, they look insufficiently. It is limited by promises, in particular, it does not increase income tax or added value, made before the last general elections. Financial markets are now committed to reducing consumption In response to growing spreads through US and German bonds, while need to increase the cost of defense He became irresistible. What chancellor do? What is the prime minister to let her go?

The fiscal situation was set by Ruth Curtice, a new head of the resolution Foundation, UA Blog published last Friday. Interestingly, she was previously the head of the Fiscal Treasury Department. Still now leading a research-tank that focuses on the problem of stagnant life standards. It seems that it would put it on both sides of today’s discussion of savings opposite generosity.

Curtice claims that the budget liability office very probably told the Chancellor, before the spring statement on March 26, that “her aim to cover her daily consumption with taxation in five years” (known as the “balance of the current budget”). “

She also produces two interesting points about the fiscal history of the UK since 2010. One is that this is nine years since the last discretionary change in fiscal policy was in the direction of tightening. The second is that the eyebrow is almost always predicted by the current budget excess five years. This in turn enabled that long history of loose. But margin, suggests the curtain, she diminished and now she may have completely disappeared.

One conclusion from this is that the fiscal policy in the UK has been poorly performed in the last 15 years. There were tightness during the fall of the post -financial crisis and loose during the recovery after the crisis (given that the expansion during the pandemic was a special case). This is the opposite of what was supposed to happen. But to be honest with Reeves’s predecessors, the “recovery” was also miserable, as he showed the work of the Life Standard Resolution Foundation.

One of the answers would be for the chancellor to play their own rules, as others did before her, promising incredible curbs at future spending, and yet those who show how they fulfill their goals. If so, she would prove that the goals of the deficit have been five years, so they are funny. At the same time, relaxing your rules a few months after you place them would also be ridiculous. If Reeves They were guided by that, she would certainly just throw them in favor of new ones.

Alternative approach, As I quarreled two weeks agoIt would be if the prime minister and the chancellor say, rightly, if this was a new world. The country must now contribute to the defense of its continent. Still, he must do everything he can to support economic growth and maintain social cohesion at home, in what are already difficult and unhappy times. In this context, past promises cannot be binding. It will be necessary to borrow more for the defense in the short term, as well as increase the widespread income taxes, sales and property and reduce ineffective spending more than indicated. The government must also carry out the deregulation and investment of pro-Rest more enthusiastic than before and be open to far deeper integration in the European initiatives in defense and new technologies than it had previously been conceived.

Reforms are not hard to imagine. It is unnecessary for the Bank of England to pay interest on the entire banking reserve, for example, As my colleague Chris Giles He claimed. The UK should follow other central banks in layers of these reserves. It would not be banks on banks, but one to mediate through banks. We have to move from the banking system of financial mediation anyway. Again, We should not spend huge sums holding young inactive. Again, triple -based pension locks must also be abandoned. Moreover, many enjoyed huge gains from property ownership. Some of this property wealth must now be taxed.

These are, however, details. It is a fundamental view that the government should observe the difficult times that come to us as a chance, as well as the crisis. The country needs leadership. The bold government would state that the restrictions in which we lived in taxation, consumption and regulations should be re -evaluated. Must make relevant new ones. This is not only important for the UK. It is also important for Europe. They changed times. Do we have to.