How Trump’s Trade Policy puts pressure on US farmers

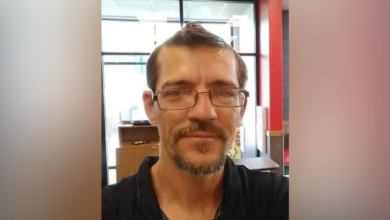

Soy Farmer Caleb Ragland at his Magnolia Farm, Kentucky

Kindness: American Soybean Association

Caleb Ragland, a soybean farmer in Magnolia, Ky, voted for president Donald Trump In 2016, 2020 and 2024, now, he must move in a tariff minefield at a time when the sector is already facing main winds.

Ragland cooperates with his wife and three sons and has deep roots in the community. His family farm on Earth for more than two centuries. But in the last few years, he has recorded a double -digit percentage of falling crop prices, while production costs are rising. Future soybeans have decreased more than 40% in the last three years, along with corn future.

Soy Futures vs Corn Futures of 2022

As the pressures increase in the industry as a result of tariffs imposed by other Trump administration – as well as retribution from other countries – is worried about the longevity of his business.

“My sons could potentially be the tenth generation if they can be grown,” said Ragland, who is also the president of the American Soy Association, for CNBC. “And when you have rules that are completely out of our control – to manipulate our prices 20%, 30%, and on the side, our costs are growing – we will not be able to stay in business.”

This is not the first time farmers have had to deal with new tariffs. Return to Trump’s first term, a trade war with China in 2018 – a time when Ragland said that the farm was “in a much better place than it was” – cost US agriculture of the industry More than $ 27 billionand soy made up almost 71% of the annual losses.

That trade war caused permanent damage. To date, the US has yet to completely regain its loss in the market share of soy exports in China, worldwide Customer Number Oneaccording to the ace.

“Tariffs break confidence,” Ragland said. “It’s much harder to find new customers than keep the ones you already have.”

‘An insult to injuries’

The White House has been imposed last week 25% of tariffs on goods from Canada and Mexico In addition to an additional 10% duties in Chinese imports.

While Trump soon turned the course Giving one -month delay of tariffs for car manufacturers Wednesday and then pausing tariffs a day later for Some Canadian and Mexican goods by 2 Aprilsaid in an interview aired on Sunday on Fox News da tariff “Could go up” with time.

Cinema tariffs were not involved in these exceptions. China revealed herself to her own name, which They generally target US agricultural goods. In particular, US soybeans are now subject to an additional 10% tariff, while corn hit an additional 15%.

“We are already in place that we are non -profit,” Ragland said. “Why for God’s sake, we try to add an insult to the AG sector basically adding taxes?”

Ragland pointed out that he “appreciates the president’s ability to negotiate” and wants Trump to be successful for the sake of the country. However, he emphasized that those in the industry, especially soybean manufacturers, have no “elasticity in our ability to give up the trade war that takes away our bottom.”

“People are upset,” Ragland said about the feelings of other farmers, emphasizing that they need relief through contracts that reduce obstacles to trade and a new five-year comprehensive proposal for the Agricultural Law-Lawnovation Law that provides manufacturers crucial Frequent Support Programsamong others. “You talk about people’s lives,” he noticed.

Brooke Rollins’ agriculture secretary said last week that Trump’s administration is alleged weighing exemption on some agricultural products from tariffs to Canada and Mexico. Trump’s custom measures on Thursday included a reduced 10% of potassium tariffsused for fertilizer.

Canada provides more than 80% of US agricultural needs, Ken Seitz said of Nutritious – Croper provider and services based in Canada – during BMO Global Metals, Mining & Critical Minerals Conference last month.

“As we look at the implications of the tariff on the nutrient, of course, the biggest discussion is around potassium, and this is because there are 10 million to 11 million tons in the market in any year, we deliver about 40% of that market ourselves,” the company’s executive director during the conference. “We believe that the cost of tariffs will transfer to the US farmer.”

Weighing outcomes

Even in the implementation of Trump’s tariffs, American farmers sounded an alarm. Despite the latest Purdue University/CME Group AG Economy Barometer Reading that shows that the feelings of farmers have improved in February total, 44% of the survey respondents revealed that month that trade policy will be most important to their farms over the next five years.

“Usually when you ask the shelf issue, far the most important polis is a crop insurance,” said Michael Langemeier, an agricultural economist at Purdue University. “The crop insurance is up there with Apple Pie and baseball. It’s a program that you like very well because it provides a very effective safety net.”

“The fact that crop insurance was distant in trade politics, he talks about the quantity,” he said.

A study in February also showed that almost 50% of farmers said that they thought that a trade war that led to a significant reduction in US agricultural exports “probably” or “very likely”. Langemeier estimated that between mid -February and early March, a fall of 33% per morning net refund for soy and corn associated with tariffs. This is at the top of the fact that 2025 “did not end up as an extremely profitable year before this,” he revealed.

The economist believes that in the short term it may be a little adjusting downward in the total mood of farmers. However, the constructive consequence of the tariff could be to accelerate the signing of the new Law on Agriculture, he said.

“Well, how can you think of trade payments in the world if you don’t even know what it will be for for a farm account,” Langemeier said. He expects a new signature of the Farm Law at some point this year.

Looking until the upcoming spring season, Bank of America analyst Steve Byrne wrote on February 25, noting that the tariffs could lead to “more conservative purchases of crop intake”. This would mean the risk of lower fertilizer shopping, which could affect not only a nutrien but also others like Mosaic and CF Industriesnoted an analyst.

Shares of these companies as well as other shares associated with agriculture like Agco and DeereEveryone sold out on March 3 and March 4th by the fifth of Trump’s Tariff announcements.

“I think we have seen the sale of AG shares just because of the general concerns that the farmer will not be so profitable this year,” Morningstar’s Seth Goldstein said in an interview with CNBC.

Over the past month, Mosaic has slid almost 8%, while CF Industries has dropped more than 8%. Nutrien also lost more than 1%. AGCO and Deere got better at that time, getting about 2%, or about 1%.

When it comes to the way this trade war will affect US farmers in the long run, Goldstein does not see this significant influence. It predicts that global trade flows will move and cancel each other over the next two to three years.

“Although there may be a short -term influence of soybean sitting in warehouses without really available customers, I think we would eventually see other countries and then start buying more US soybeans,” said the capital strategist. “Maybe China buys more soybean from Brazil, but maybe a place like Europe, and then buys more soybean from the US, and we get … It’s not so much difference.”

As it stands now, it is predicted that Brazil is the world’s largest soy manufacturer in front of the US for marketing year 2024/2025, which makes up 40% of global production during this period, according Department of Agriculture. For corn, on the other hand, now it is predicted to be in the first place, making it 31% of global production In the marketing year.

Others at Wall Street believe that the tariffs, however, will be consequently for the dynamics of trade.

Kristen Owen, an analyst from Oppenheimer, predicts that duties are likely to strengthen Brazil to become a major global manufacturer for both corn and soybean, while now he will become a kind of incremental supplier in the world.

“Brazil has a special capacity for the growth of its surface, more capacity to increase its share in the global cereal trade,” CNBC said. “Tariffs and some other decisions that the administration makes only accelerate some of that.”