Wall Street hopes to “Trump to put” raise the sliding market

Unlock Bulletin on White House Hour FREE

Your guide for what American choices 2024 means for Washington and the world

Investors are afraid that Donald Trump’s tolerance for steep sales of stock is far greater than it was in his first term, as Wall Street loses the faith that the financial markets will restrain the presidential tariffs and reduce consumption.

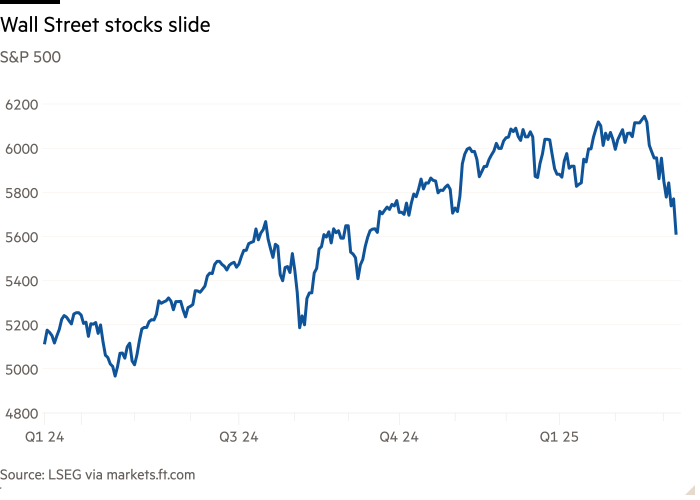

Now supplies They have collapsed in recent days, with S&P 500 more than 8 percent from a record high hit less than three weeks ago, as Trump’s Tariff Trump has been tricky over the trajectory of the world’s largest economy.

Many investors and banks on Wall Street have betting Trump will ultimately distract his most difficult tariff threats And it reduces the federal government if the markets react violently, but hopes the so -called Trump have put in the muffled while the markets trembled.

“The markets call into question the idea that Trump’s administration would adapt politics in response to the volatility of the market in capital or economic growth concern,” the UBS Monday night, Monday night, said Monday night.

Alex Kosogliadov, chief of global derivatives in Capital in Nomura, added that at the end of February “people wondered if they were wondering [Trump] He went to take his foot off the gas pedal on tariffs and some federal decreasing consumption that were a spooky market. ”

“In the last few trade days, feelings have turned in the sense that there are very clear signs that Trump” said “or did not exist or set lower than where people thought it was,” he said.

The growing sense of darkness is not limited to the stock market: Goldman Sachs and Morgan Stanley have reduced their expectations for the economic growth of the American economy due to the care of tariffs and retaliation from trading partners. Delta Air Lines also warned on Monday night that economic “uncertainty” hit its job, which encouraged the carrier sharply reduced its prospects for sale and earnings in the first quarter.

The VIX index, a measure of expected volatility in US stocks, rose from 12 to 27, above its long -term average of 25. Nasdaq composite focused on technology, which increased in the previous two years, reduced more than 13 percent compared to a record record record.

During Trump’s first term, restlessness in the financial market was considered a key protective fence in forcing the reversal of the policies the investors considered harmful, at least in the short term, to US economic growth.

“Everyone thought it was the only way to come back was if the stock market flew,” said one trading director at a bank on Wall Street. “What people didn’t see was to change their narrative if the stock market rushed.”

The White House doubled on its rejection tumo financial market after Monday’s steep part of stock sale.

“We see a strong deviation between the ghosts of animals on the stock market and what we actually see how they take place from businesses and business leaders, and the latter is obviously more meaningful than the former economy in the medium to long -term economy,” said the White House official.

Since US shares have fallen suddenly in response to the threat of tariffs against multiple shopping partners, Trump has made one turnaround, delaying most of the levies to Canada and Mexico by April. But others, including steel and aluminum that would enter into force on Wednesday, and increased tariffs on China, remain in place.

Because the comments of top Trump’s officials who descend the fear of trouble on the stock market were consistent.

The Scott Bessent Treasury Secretary broke through the concern for investors over the weekend, when it seemed to dismiss the idea that Trump would reduce some of his economic policies if the stock market continued to beat.

“No,” he said. “Trump’s call is upside down, if we have good policies, the markets will increase.”

Bessent also said that the American economy may need a “detox period” to be less depending on state consumption.

“A natural adjustment will come as we leave public spending for private consumption,” he said. “The market and the economy has just become hooked. We have become dependent on this state consumption. And there will be a detox of the period. “

For Trump, “Time is the only limit,” said Barry Bannister, a major capital strategist at the Stifel US bank. “The first year of any new administration is time to break some eggs to make an omelette and [Trump] Administration ambitions are a wide renewal of economic order. “

But the risk of growing and increasing inflation – known as a stagflation – it increases as Trump progresses on tariffs on the largest American trade partners, he added, leaving US shares exposed to “movement of forceps” potentially slowing down earnings and ratio of lower prices until earning.

“Want [Trump] Is there any courage to hurt seriously? This is an open question, “said Shep Perkins, Chief Director of Investment in Putnam Investments.