How big is American bubble on the stock market?

A major increase in American shares from the global financial crisis means that they make up nearly two -thirds of the world market, causing concern that such dominance is creating too much risk for investors’ portfolio.

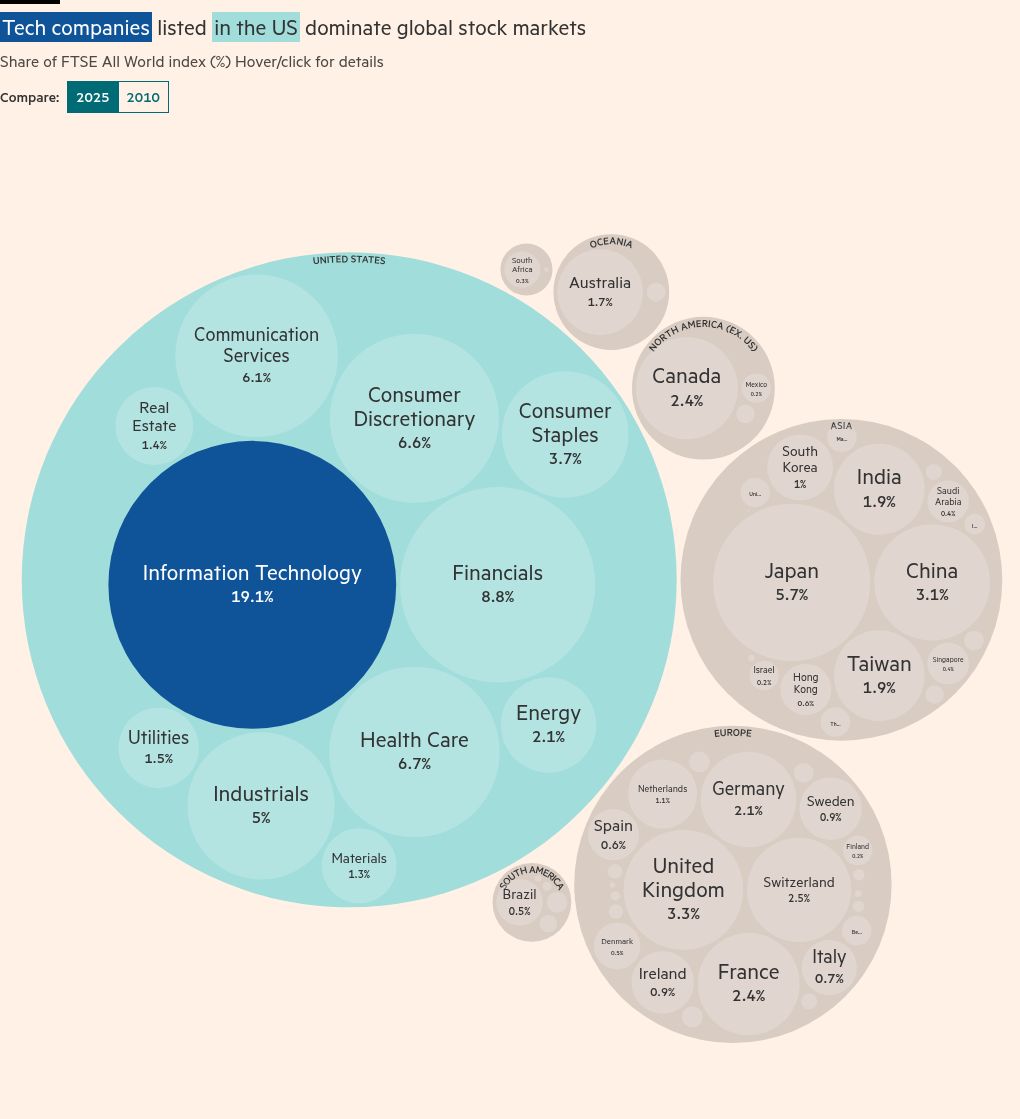

Wall Street has run in front of international rivals over the past decade and a half, which has been mostly guided by a gathering in the technological sector – and especially companies associated with artificial intelligence – which is now worth almost as much as all stocks in Europe.

However, the recent return of technological shares emphasized the growing nervousness about high estimates in the market that has swallowed the increasing share of the extracts of global investors.

“If you hold a global seeker, by definition, there are two -thirds of this now, and there is a lot of things in the Silicon Valley,” said Paul Marsh, a professor of finance at the London Business School, who spent the last 25 years accompanying long -term feedback.

“That means you are very vulnerable to this huge bet on Ai.”

Consistent yields have helped the US Balloon on the Stock Exchange since 2010, with the proportion of the global free flow market increased with about 40 percent after a global financial crisis to more than 64 percent by 2025.

Over the last century, they held the title of the world’s largest stock market, after reaching in front of the UK until the early 1900s – the dominant market during the 19th century.

By the top of the late 1960s, the US consisted of more than 70 percent of the global market invested, according to UBS annual Global Investment Returns.

This peak was led by the American flourishing of the post -war economy, but also the relative lack of competition: most of today’s “emerging markets” had yet to develop significant shares markets.

But global fall 1973-74. He hit the USA in particular. Wall Street stocks did not climb their peak in the late 1960s for over 20 years, said Professor of Banking and Finance of the University of Brunel Philip Davis.

This decline allowed to emerge a new global leader, though briefly: Japan became the only country in the last century that surpassed the US as the world’s largest stock market. The shift was created at the height of Japanese bubble price of the property of the late 1980s, which later crackled.

The end of this speculative mania left foreign and domestic investors deeply skeptical of the Japanese capital markets, and its economy has stood for decades. It was not until last year that Nikkei 225 broke out of the top from the bubble era.

“From time to time, finances are leaving the rails and this happened in Japan. People become predominantly, everyone feels rich, but then it turns out to be a ticket house,” said Richard Sylla, a professor of emeritus economy on the Nyu Stern School of Business.

The parallels between today’s stock market and these historical collisions make some investors uncomfortable.

“The number one question I am currently asking is about what to do with the US stock market. It appears in every single conversation I have conducted this year,” said Duncan Lamont, head of strategic research at the Schroders British manager.

However, the “striking persistence” of the success of the US market in the capital since 2008. It is difficult to push against the trend, because “Naysayers have been wrong repeatedly,” he said.

The S&P 500 index has brought average annual offenses of about 14 percent of 2010, surpassing all other major national reference values. This effect was clear to gains more than 20 percent of both 2023 and 2024, because the excitement of AI pushed the stock of Megacap Technology in the list of American lists, such as the manufacturer of Nvidia chips, to record peaks.

The beginning of 2025 brought a rare fight with a small effect on Wall Street, since not relatively loved European markets play compensation.

American dominance is also a consequence of foreign companies, especially in the technological sector, which has decided to list in New York in search of higher estimates.

Some investors claim that this trend has brought in many of the world’s best companies to the US and that the market will make the market more resistant to economic decline.

“I can pretty much create a global portfolio that only relies on US markets,” said Jack Abblin, Chief Director of Investing in a Private Investment Company Cresset Capital.

But for others, this is not only a big role of the US market, but also its concentration in a small number of shares that are a collapsing nerves. In particular, the skeptics indicate the huge gains of many giants of the silicon valley, for which Torsten Sløk, the chief economist of Private Capital Group Apollo, said he was “ridiculously overrated”.

Magnificent seven groups of giant technological stocks-Apple, Apple, Amazon, Meta, Microsoft, Nvidia and Tesla-groan almost a third of the market value of S&P 500 51.8tn USD, while the price of price and earnings is cyclically adapted, assessment measures since the beginning of 2000.

“The period come and go where the bubbles begin to form. And today we are in a bubble in the US -II bubble in the technology world,” said Sløk.

Bullish investors claim that the strong growth of the BIG Tech tech potential of AI -Aa to encourage productivity justify the high estimates of many of the world’s largest companies. In the meantime, bear commentators are drawing a comparison of today’s market and a bubble dotc that broke the beginning of the millennium.

The confidence of investors is shaken in January when Chinese Deepseek discovered AI Advances, which was obviously achieved using far less computer forces than US technological groups, casting suspicion of the need for huge capital expenditures made by magnificent seven companies.

This month, the renovated jerks hit the technological sector, pulling the US market little from all time maximum.

This is not the first time a sector has flooded Wall Street. In the 1800s, the hunger of railway companies for investing played a central role in the early development of the US stock market. By 1900. They represented more than 60 percent of the market value.

“Artificial intelligence is currently a wave of future, but a hundred years ago the wave of future were railway companies. Then we had a wave of everyone who buys electric companies, “said Sent’s Sylla.

The relative decline in the dominant industry is not necessarily bad news for investors. The investor who held railway sections since 1900 would surpass the wider US market, according to a study by Marsh 2015. This is despite the fact that the total railway proportion of the market reduced it as companies from the multitude of other industries.

Nevertheless, today’s technological dominance – and American domination – has left many investors nervous that even a portfolio accompanied by a wide spread of global shares leaves them with too many eggs in one basket.

“The essence is that if I open the page in my finance textbook, it says I should diversify myself,” Sløk said.

“People look at their shares.