How did the Medioban become prey for Monte dei Paschi

When the Italian financially powerful brokerage house helped its long -standing client Monte dei Paschi di Siena to structure capital collection without ceasing 2022, little knew would eventually become the target of taking over the former child of a failed banking system in the country.

On Friday, MPS surprised investors by launching an offer for all sections of € 13.3 billion for its larger rival with a premium of only 5 percent on Mediobanprice to close the day before.

The supply bid by a lender who is still partially in state ownership is another shock for the Italian banking system, the last in a series of attempts in consecutive arrangements that could reshape the financial landscape of the country.

“This is the last battle between the novel [politics] and Milan finances, ”said one government official.

Ever since she took power at the end of 2022, the Giorgie Meloni’s right -wing government has applied as a priority to portray herself as a friendly to the market, trying to alleviate the fears of observers that she will use a rough nationalist approach to business and financial policy.

However, a series of interventions in the financial sector – including an attempt to engineering sales MPS Being a competitor to BANCO BPM last year and controversial amendments to the Capital Markets Act in the country-as well as public statements against “international speculators” have again encouraged such concerns.

“It is simply inconceivable for a commercial lender whose whose [largest single shareholder] is the government, triggers an attempt to take over a larger rival in investment banking, with zero premium and without a clear strategic goal, ”said one veteran banking director in Milan.

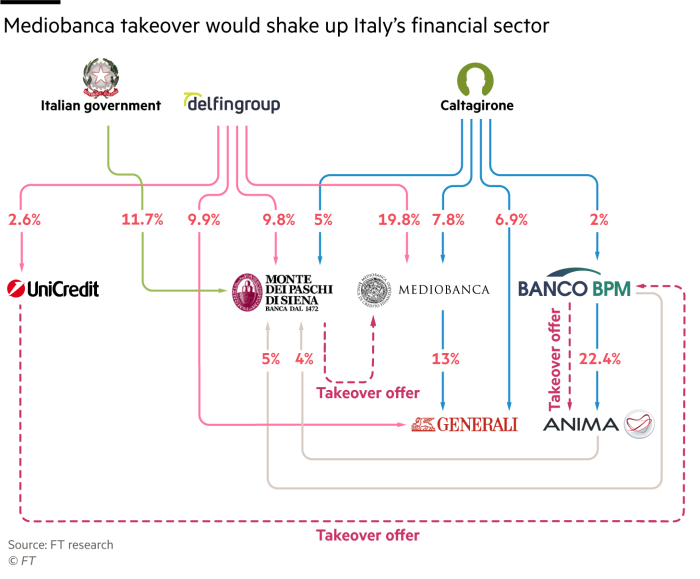

After a successful reversal of the lender, Italy reduced its share of MPS-which she saved in 2017-to fulfill the EU obligations to return the oldest bank in the world to private hands.

But the state remains the largest single shareholder with a share of more than 11 percent – and MPS seems to play an increasingly important role in government efforts to create a new center of financial power.

Last year, the Melonia’s Government was hoping to connect the Tuscan lender, once a symbol of the financial power of Italian leftist parties, with Bancu BPM to create a large domestic banking center.

Called “Third Pole”, the goal was to compete with the extended lender with larger rivals Unicredit and Intes Sanpaolo and retain a strong Italian print.

UniCredit’s offer to take over the BANCO BPM in November thwarted these plans and forced the Government to try to find ways to counteract the latest maneuver of executive director Andrea Orcel.

The addressed now say that the MPS move towards the Mediobanka shows that the Melonia’s government has given up the hope that unicredit can be stopped and accepted that he has to find an alternative to BPM for his efforts on consolidation.

On Friday, the MPS CEO Luigi Lovaglio said that the offer to take over was “an industrial project we have been thinking about since 2022”.

“We will create a third banking group in the country,” Lovaglio said. He called the move “brave”, “innovative” – and “friendly”. The addressed say that the head of the Mediobance Alberta Nagel does not see that.

“Obviously, the offer to take over a market transaction,” Meloni told reporters on Saturday. “The only thing I note is that the MPS, which is both institutions and citizens, is perceived as a problem, a perfectly healthy bank that moves into ambitious operations and that should make us proud.”

Replacement of BPM with Mediobanc and converting the MPS into a customer instead of in the target also gives Rome a new opportunity: capitalize the connections established with two large corporate Italy and expand their reach to the Insurance group Generali-a large investor in Italian public debt and one 13 percent in one 13 percent owned by Mediobanka.

At the last auction of the MPS shares in November, the Government sold significant parts of its remaining share of Dolphin, the Holding of the billionaire family of Del Vecchio, the construction tycoon Francesca Gaetan Caltagirone and BPM.

Together with their new proportions at MPS, Caltagirone holds 7.8 percent of Mediobance and 6.9 percent of generals. Dolphin has 9.9 percent of generals and 19.8 percent of Mediobans.

Both Caltagirone and Delphin have long been in conflict with the Nagel strategy and the head of General Philippe Donnet, but failed to try to replace them.

The decision of the generals to enter a joint investment for the management of assets with the French Natixis, which was first reported by the Financial Times in November and published on Tuesday, further approached Rome Caltagirone.

Melonia’s allies expressed concern about the risk of Italian savings more and more invested abroad and that the refinancing of a huge Italian public debt could face obstacles in the future.

Such concerns echoed throughout the Italian establishment, including Caltagirone. His representatives on the Board of Directors Generals voted against the agreement, according to people who were familiar with the discussions.

View Caltagirone’s hand behind the MPS moves at the Mediobanka, not the Lovaglia MPS chief. According to them, this is part of a wider attempt to take control of the general and revises the business and management of Mediobance, something that the late billionaire Leonardo Del Vecchio has thrown around the years earlier. Caltagirone’s son Alessandro is a newly appointed member of the Governing Board of the MPS.

People close to Caltagirone and people close to MPS have denied direct or indirectly involved in a Roman tycoon into a transaction.

The merging of Mediobanance and MPS would help resolve the long-term complaints of Caltagirone and Dolphin, while Rome would also be given a place for the most prestigious and most influential financial tables in the country.

There is no certainty that the deal will happen. MPS shares concluded 7 percent on Friday, while the Mediobance shares rose almost 8 percent.

The analyst’s answers were muffled. Marco Nicolai of Jefferies noted that synergy between two banks are limited and the risks are high. “Cultural differences between the two companies could result in the dissiner for revenue, especially on the front of investment banking and property management,” he added.

“Our first impression is that this offer has a limited chance of success,” said KBW analyst Hugo Cruz.

But people close to MPS claimed that the Medioban “stood in place for too long” and that she relied too much on her dividend from the generals, which is a longtime criticism of the Milan Bank.

“The path ahead is long and winding, not only for the MPS but also for the entire Italian banking sector: a lot of moving parts, a lot of unknowns and too many actors involved,” said one executive director.