European carmakers brace for tough 2025 despite launch ‘fireworks’

Europe is poised for a rebound in sales of electric vehicles this year with carmakers set to deliver more than 160 models, but executives warn that profits could fall further due to regulatory costs and discounts.

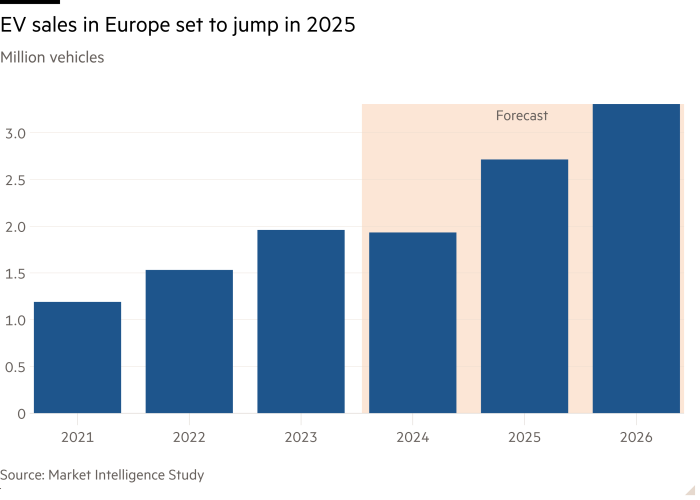

Growth in EV sales in key European markets ground to a halt last year as governments slashed their subsidies and companies held off on new EV models until 2025 in anticipation of tougher new emissions rules on the continent.

Matthias Schmidt, an independent car analyst, forecast sales of electric vehicles in Western Europe, including the UK, to jump 40 percent to 2.7 million vehicles in 2025, as carmakers rush to meet CO₂ targets. He predicted that the share of battery-powered cars will break through from a range of 15 to 17 percent to 22 percent of the total market this year. “We certainly expect the market to recover in 2025 due to regulatory pressure from the EU,” he said.

But the return to electric vehicle sales growth will also come with high costs to meet stricter emissions rules and more discounts as consumers seek affordable cars. With underlying demand still weak, executives say the overall outlook for Europe’s auto industry remains challenging at a time of growing Chinese competition and growing protectionism in the US.

“As for the offer between electric vehicles and hybrids, we are ready,” said Fabrice Cambolive, who heads the Renault brand, where 13 percent of sales are electric vehicles. “In terms of demand, we see signals that are very volatile. The level of hesitation is really high among our customers.”

European car industry body Acea estimated that fines, carbon credit costs or loss-making sales of electric vehicles could cost carmakers €16 billion if the 2025 fines are not delayed. Its preliminary data showed that registrations of new electric vehicles in Europe fell by almost 6 percent last year.

Shares in electric car maker Polestar fell 11 percent on Thursday after it revealed it would take another two years for its free cash flow to turn positive and scaled back its plans for market expansion.

Schmidt expected more than 160 electric vehicles to be available in Europe this year, including cheaper sub-€25,000 offerings such as the Renault 5 and Citroën ë-C3. The lineup also includes 20 new models such as BMW’s electric SUV Neue Klasse and Mercedes-Benz’s new electric CLA, while Tesla’s updated Model Y released on Friday in China will also go to Europe.

With a record number of product launches in the company’s history starting in 2025, Ola Källenius, CEO of Mercedes-Benz, said the company will “launch a fireworks display of products, most of which will be fully electric.”

But he warned that “natural demand” from consumers is unlikely to increase in 2025 to a level that would allow the industry to sell battery-powered cars at a healthy profit margin.

From this year, the EU will require car manufacturers to reduce carbon dioxide emissions by increasing the proportion of electric vehicles sold. Automakers and analysts have been closely watching the UK, which last year launched its electric vehicle quota scheme requiring 80 percent of car sales to be zero-emission vehicles by the end of the decade.

Performance in the UK during the first year of EV targets gives an early indication of how regulatory pressure may affect sales and profits.

New electric vehicle registrations jumped 21 percent to a record 382,000 last year, with the UK narrowly overtaking Germany as Europe’s biggest market for battery-powered cars for the first time.

However, discounts on EVs attract buyers reluctant the switch from petrol vehicles is costing car manufacturers billions of pounds. Despite the price cuts, businesses accounted for a large share of electric vehicle sales, with only one in 10 private buyers choosing an electric model.

“The amount of money available to stimulate demand will be under severe pressure when manufacturers have very limited resources,” warned Mike Hawes, chief executive of the Society of UK Motor Manufacturers and Traders.

Analysts had predicted that weaker profits in Europe would drag down the carmaker’s global results. UBS estimated that earnings before interest and tax for European car groups will fall 7 percent compared to 2024.

While companies have had strong interest in selling more electric vehicles this year, “the question is how much additional discount will we see from automakers to sell more electric vehicles,” said UBS analyst Patrick Hummel.

In addition to discounts and promotions, some manufacturers will face additional costs to purchase carbon credits from Tesla and Chinese rivals leading the way in the electric transition, in order to meet the new EU regulations.

This month, Stellantis, Ford, Toyota, Mazda and Subaru announced plans to “pool” carbon emissions with Tesla, allowing them to buy emissions credits, while Mercedes-Benz wants to work with Volvo and Geely-owned Polestar.

Hummel estimated that these various measures, including rebates and carbon credits, would have as much as 4 billion euros in the industry’s profits to achieve the targets.

While Europe’s auto industry is calling on Brussels to consider relaxing regulations, it is also hoping governments will help revive consumer demand for electric vehicles by reintroducing incentives.

Registrations of new electric cars in Germany fell 27 percent last year after subsidies for purchases were abruptly withdrawn at the end of 2023. France suffered a 3 percent drop year-on-year and a 21 percent drop in December alone.

Some governments have begun to raise concerns about the targets with Britain considering ways to make it easier to meet its mandatory electric vehicle sales targets. France has proposed that carmakers be spared heavy fines that would be imposed if they fail to meet EU emissions rules.

But it remains unclear where the political debate will stop.

In France, a popular leasing scheme for less affluent families to buy electric vehicles ended in February 2024, after 50,000 applications in two months were more than double the total expected over the course of a year.

Paris cut subsidies for the purchase of electric vehicles from a maximum of 7,000 euros to 4,000 euros last month, but as the French government has yet to adopt a 2025 budget, further support for electric vehicles or fines for polluting vehicles remains unclear.

In Germany, uncertainty about subsidies has affected sales of electric vehicles.

Gilles Le Borgne, head of engineering at Renault, said the German government had withdrawn the incentives “for now”. He added that, first of all, car manufacturers “need the stability of public policy around electric vehicles” and “often it is 1,000 or 2,000 euros [in support] it may change things one way or another”.