Time for a backup truck?

Listen and subscribe to Opening Bid on Apple Podcasts, Spotify, YouTube or wherever you find your favorite podcasts.

Nvidia (NVDA) CES-induced sales attack plan.

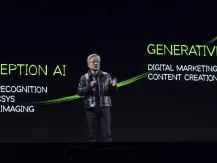

At the glittering tech gathering this Monday, Nvidia CEO Jensen Huang divided that the company has started production of its long-awaited Blackwell chip into high gear. “We’re racing to get Blackwells into every data center in the world,” he told the packed auditorium while wearing a shiny black alligator jacket.

The company also unveiled a number of new technologies to support its growing ambitions in robotics and driverless cars, Yahoo Finance Tech Editor Daniel Howley reported.

But the Street wanted more from its stock darling.

Read more: Why AMD looks undervalued

Ends: January 10th at 4:00:01 PM EST

Huang’s more muted words compared to high expectations combined with general investor timidity sent Nvidia into a whirlwind — with bears sending the stock down 6% on Tuesday despite hitting a record high the day before.

Shares are now down 8% from those highs mentioned above.

Wedbush technical analyst Dan Ives was in the room when Huang spoke at CES and thinks the hype is overblown.

“I think what Jensen is arguing is that this is early [in AI]”, Ives told the executive editor of Yahoo Finance Brian Sozzi on Initial offer podcast (watch video above; listen below). “It’s just the beginning of the revolution, but [the sell-off fear] were investors [getting] concerned.”

“We could go back to quarters where stocks sell off, the bears come out of hibernation, the stock drops to $100, and then suddenly, two months later, it’s back to all-time highs,” Ives continued. “These knee-jerk reactions, it’s easy to get scared because they don’t say anything about short-term demand.”

“The reality is you came out of it more optimistic, not less optimistic about what the market opportunity means in terms of robotics, autonomy and the future,” he said.

From Ives’ perspective, the future looks bright for Nvidia and AI. In one analogy, he put more traditional investments like health care or financials in a bucket akin to a “minivan going 40 mph,” while tech stocks like Nvidia were “Left-lane Ferraris.”

Comparing the excitement around Nvidia to the buzz that CES once saw when Apple (AAPL) co-founder Steve Jobs introduced the iPhone in 2007, he added: “There is something different. There is something new.” Nvidia’s current position as a supplier of chips for future in-demand products also puts it ahead of its competitors, Ives said.

“Generally speaking, we’re going to see some white knuckles in the next six months,” Ives said. “My view is that tech stocks are up 25% this year. I think Nvidia has more than $4 trillion along with Apple.”