Yields, (long -term) borrowing?

When interest rates are high, people should think twice about borrowing. When they are low, they should throw out a metaphorical (or literal) credit card. This is Central idea supporting the monetary policy of central banks.

Of course, the central banks only set a short -term interest rate. Bond yieldsWhile the centers of the central bank are anchored, they are established on the secondary market through a kind of continuous auction process. And in a world in which government bond yields describe the probable course of future central bank action, the government should be indifferent in the one where it issues it on this curve.

This, according to several long -lasting recent strategist’s strategist reports, Moyeen Islam from Barclays and Marko Capleton of Bank of America – is not the world we live in.

Prior to the global financial crisis, the 10 -year -old GILTS have often given more than thirty years (contrary to a conventional logic that is longer duration = higher risk = more yields). Most of the bond types have understood this as a reflection of permanent demand from life insurers and pension funds in the UK, and is being implemented in investment strategies. As such, it made sense for HM Treasury to move longer to issue debt, fulfilling this request and reducing your own so -called “risk for refinancing”. Doing it, the UK ended with the highest average maturation bond in the world.

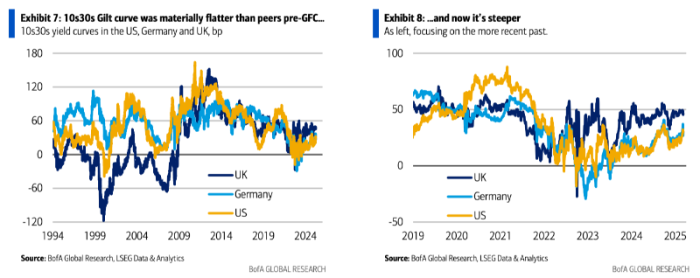

Quickly forward to the post-Cosing period, and longer gifted with a yield with a yield not only higher than 10-year-old vortex, but is a yield that spreads over 10s larger than those in the United States or Germany. Graphs via Bofa:

Despite Capleton’s “skepticism about whether smart mathematical chromatography can really take a yield and deconstruct it into various unusual (and perhaps hypothetical) component parts,” he believes this new gap of the yield is a large OL ‘chanky term premium-Aka Safe signature that are long signature that are long-lasting for the government issuing. He supports his gaze with a pile of gilts-sonia forward and drawn forward charts that are too much geeky even for FT Alphaville.

Barclays Islam has no such problems with directly stating that the growing term premium “explains most of the moves in higher [thirty-year] yields ”.

Why could that be? It rests a lot on the burning of 800 LB questions that hangs over the market for the ancient GILTS: is a long -standing demand for them from pension funds in the UK quite completed. While ‘The highlight of the LDI‘There is invited Previously, arguments are worth printing.

First, a massive so -called “debut” transition from shares to bonds, which has been almost every existence of managers in the UK in the last two decades. So this cannot be repeated. According to Capleton, the amount of potential delatation is de minas.

Second, with pension schemes with defined fees almost all closed to new participants, people withdraw and eventually die. This is now displayed in reducing membership data. As Capleton writes:

Ons “funded professional schemes in the UK” shows that the total membership fell by 16% between 3Q 2019 and 1.Q 2024, and within the total number the composition is aging, with the proposal of pensioners increased from 42% to 49% in the same short period.

Third, the current value of the pension fund’s obligations was Absolutely jerk to… a bond yield increase. So, if each scheme of a defined fee would invested the entire assets in GILTS, it would only represent about around the trillion of pounds of demand, which is less than a ceiling of demand of about two trillion pounds several years ago.

The bottom line is that there is no new demand for pension funds for the long -term GILTS that come around the corner. And this fact is shown in bond prices.

Barclays does this mathematics. Although gilded auctions have gone quite well, the ability to digest risk, Islam claims, is a function of fundamental liquidity. One of the ways in which Barclays takes a measure to draw lines along different parts of a gilded yield curve and calculating root medium square error which are generated from these lines of the best match. The underlying intuition is that all kinks will be arbitrated on the massive liquid market.

But that doesn’t happen. And part of the curve in which this liquidity measure quickly worsened the long. Last year We showed Increasingly disturbing the curves because it may have something to do with the tax value offer attached to GILTS with low cow. But something else seems to happen. Barclays:

As such, Bofa’s Capleton accounts:

Gilded editions must be adjusted, radically and quickly. … This is committed to the material reduction of long -term gilding issues.

And that basically puts them on the same page as Barclays.

It is not as if governments have not made major changes in issuing before on the back of ancient bonds become expensive to issue. Older readers will recall that on Halloween 2001 the US Treasury caused a mass rally when it Canceled all long -bond issues until further notice. By defending the decision, Peter Fisher, the then assistant treasurer explained that:

This is an attempt to gain carefully by taxpayers’ money. … This is a relatively expensive borrowing tool that is simply not required for current financing requirements or the ones we expect.

Moreover, as much as Capleton reminds us of us at the State Pension Age-American move was the echo of the decision of Geoffrey Howe to cancel the issue of long gilding in its 1983 budget. And while Barclays hits the measured ton-toning of DMO to shorten the duration of issuance to improve market liquidity and reduce taxpayers’ costs more radical examples of dismissal at the wholesale issuing of long relationships are those who think that DMO should view today.

Instead of issuing expensive bonds with ancient dates whose main users are literally dying, Bofa is committed to transferring issuance to British treasury accounts. The UK Market T-Bill is quite quite ahead of international standard, and Capleton is the case that the quantitatively will develop, there will be a great demand for banks’ accounts that want to find a replacement property that behaves like Bank of England reserves.

Barclays and Bofa both [ed: try saying that several times quickly] A good case for the Government of the UK, if it is a company, re -examined and shortened, its debt issuance profile.

Capleton also raises the idea that they should buy long-standing captains who trade with a deep discount, “taking profit” on bonds sold on the market with low coupons, and maybe 16 percent of debt/GDP in the process.

But he jumps off a shark when he writes:

With some of these questions, the obvious temptation would be consulted by the market. Our main concern with this is the risk of being delayed, potentially long time, if it is a very formal consultation process … We would suggest experimental operations, not complete consultation.

Experiment, not consult? Sorry, we are British.

All in all, these are two fascinating and imaginative reports full of interesting ideas for debt control. But whether the UK Government will respond to the market prices for bond markets in the way they should make normal economic agents.

Waiver: The author has direct gilded shares among his personal investments, one of which is long dated. 😢