US shares bounce while fears to turn off the Government withdraw

Be informed about free updates

Simply log in to To American stocks Myft Digest – delivered directly to your arrived mail.

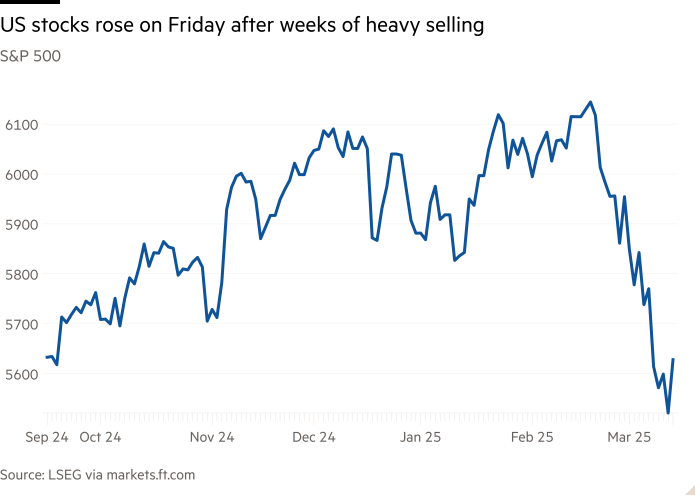

Wall Street supplies gathered on Friday at the end of the unstable trading week, as hope grew that the US government would avoid expensive stopping.

Blue Chip S & P 500, which Thursday fell into a technical correctionrecovered 1.9 percent by noon in New York. All 11 sectors have acquired, with energy and financial services among the best performers. Technologically heavy Nasdaq Composite rose 2.3 percent, deleting losses from the previous session.

The moves followed after Chuck Schumer, a top Democrat in US Senate, hinted at his support For a Republican stop funding account, increasing the likelihood that Congress will avoid the risk of closing the Government.

Market rally on Friday indicates a bright place for US investors in capital that has suffered bruises for several weeks such as Donald Trump messy tariff announcements They measured the ghosts of animals and forbidden concern for slowing growth in the world’s largest economy.

Data published by the University of Michigan on Friday morning showed us the mood of consumer collapsed in MarchWith long -term expectations for inflation, they increase at the highest level in more than three decades, and the fear of unemployment has increased to the levels of the last seen in 2008. The capital investors, however, decided to buy market fall.

“The Volatile week ends with a small tumultuous what merchants interpret as good news,” said Thierry Wizman, Global FX and the Strategy Strategy at Macquarie.

“The US government is not excluded, China may try to further support its consumer sector, Germany has advanced to fiscal reform, and Canada and now rejected the heat of the tariff discussions.”

Wizman warned, however, that uncertainty triggered by Trump’s tariff threat remains “problematic”.

On Friday, JPMORGAN became the latest bank on Wall Street, which reduced its growth prognosis in 2025, echoing with the recent fall of Goldman Sachs and Morgan Stanley.

“Consumer concern about the impact of Trump’s administration policy is growing,” Harry Chambers said of the capital economy, adding that the University of Michigan poll “further fan flames” will.

European shares have completed a day higher, with Stoxx Europe in the entire region of 600 rise by 1.1 percent and the German Dax rose by 1.6 percent. The London FTSE 100 increased 1.1 percent.

Asian shares also closed more. Hong Kong’s Hang Seng Index added 2.1 percent, while the Chinese CSI 300 index in Shanghai-and Shenzhen increased by 2.4 percent on the section list after Beijing promised fresh measures to “increase consumption”. The Japanese Topix received 0.6 percent.

In the commodity markets, prices for Brent Nafta, international oil reference value, increased by 1 percent, at $ 70.58 per barrel. Gold rose to a record $ 3,000 in a three -pointed ounce before returning to $ 2,988.