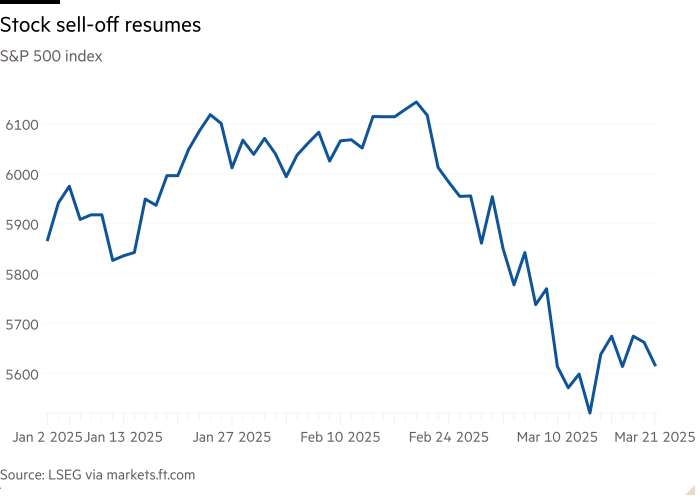

S&P starts in the fifth week falls because earnings pull in stock

Be informed about free updates

Simply log in to To American stocks Myft Digest – delivered directly to your arrived mail.

The US shares have fallen on Friday as a recent jump ejected, putting S&P 500 on the course of the fifth week in a row.

The S&P fell 0.7 percent in early trading, withdrawing disappointing corporate earnings, and the technologically difficult Nasdaq Composite lost 0.9 percent.

FedEx shares slid 10.4 percent after the company reduced their forecasts, accusing lasting “weakness and uncertainty in the US industrial economy.”

Nike fell 7.4 percent after warning that he expected sales to fall, citing the tariffs and the falling confidence of the consumer.

The move means that the reference value on Wall Street has given up small gains from earlier a week, and has headed to her longest series of weekly losses in almost three years.

In recent weeks, stocks have been shaken by concern about the economic fall of aggressive tariff Donald Trump, as well as sales in previously highly flying technological sectors, pulling the S&P to the territory of correction.

Return earlier in the week after the federal reserves kept interest rates on hold, but it signaled openness to reducing later in the year proved to be Kogis.