Safety is now a scarcity in markets

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

It’s a writer Main Executive and Main Investment Director Richard Bernstein Advisor

Each introductory student of the economy knows that prices are increased when demand exceeds the offer. Accordingly, investing in scarcity was usually a good long -term strategy.

The economic term “deficiency” is often used to describe physical capacity or resources, but the stock market has historically taken a wider view. Earning growth, for example, usually becomes limited during profit review, so estimates are expanded to those companies that can continue to increase earnings despite the challenging background.

In today’s financial markets, security seems to be an extremely scarce resource. Capricular policies from Washington have created a very unpredictable economic environment in which prognosis is almost impossible.

While investors have accepted speculative investments in the last few years like Magnificent seven technological stocksCrypto currency and corporations of Shell, now they realize that pies forecasts are useless in heaven when they cannot be predicted that tomorrow’s changes are a policy change.

Most of the impartial investors are not interested in whether or not government policies are appropriate. Instead, they want clear communication to evaluate business and investment opportunities. Such clarity suddenly became transient.

Investors should always try to ignore politics, but the current American administration seeks to mix much more into the private sector than they have in the past. Fluctuating policies significantly interrupt the sector’s ability to strategically plan.

More importantly, changes in impulsive policies hold investors speculate whether the possibilities are real or mirage. I am not sure how any analyst can predict the quarterly or annual earning of a company with any condemnation in these conditions.

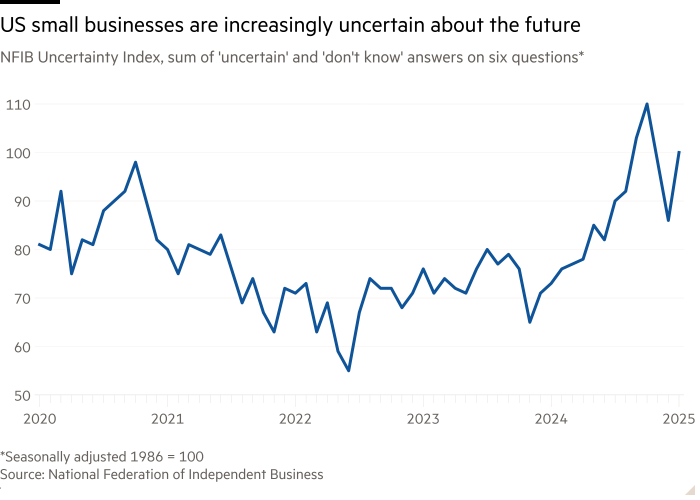

Standard barometers of uncertainty are appropriate in a record maximum. The NFIB Uncertainty Index Index Index Baker, Bloom and Davis for trade policy are two of the most famous measures. They both suggest that uncertainty is on or near high in their history for several decades.

There is never a perfect insight, and some level of uncertainty should be expected in any investment. Risk premiums are naturally adjusting the market. Lower qualities or more unpredictable investments tend to offer more expected yields to make investors compensate for relatively unstable scores.

The dramatically increased unpredictability is the cause of the recent market volatility. The US stock market simply resets its premium and risk assessment based on a sudden and wider range of uncertain outcomes. Perceived safety triggers greater assessments, but political fiquity triggers multiple contraction.

From January 1, the ratio of advanced price/earnings S&P 500 decreased from 25 to 20, which is a 20 percent devaluation. This reflects the desire of investors for a higher risk of risk for investing in US shares because earnings and cash flows become all fog.

If safety is indeed scarcity, then the stable, forecasts of earnings should begin to start premium estimates. The stock market seems to have not fully appreciated it yet.

Consider the S&P ladder, sometimes a neglected metric of growth and stability of earnings and dividends. Quality non-technological companies-none companies with A+, and or A–trades are sold with a discount of 25-30 percent in the S&P 500 technology sector.

Money yields are safer than those related to future growth, and these high quality non -technology supplies also have a dividend yield that is almost four times higher than American technological supplies.

Similar statistics are applied to European shares. European shares are more quality for sale with a discount of 15 percent of the US technological section and have a dividend yield three times higher.

In other words, security is not only scarce, but also cheap.

If consistency and clarity do not become the norm of politics, then investors should expect that recent revaluation will continue. If Washington continues to change trade, geopolitical and employment policies and do not allow companies and investors to fully evaluate the economic foundations, investors are likely to transfer a portfolio according to the safety of stable streams of earnings.

Scarcity has tendency to encourage secular contributions. Sometimes growth is scarce, sometimes the value is scarce. Today, safety and confidence are really a very scarce resource.