Japanese bond yields hit a 16-year-old

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

Japanese 10-year borrowing costs have increased on a 16-year maximum on Thursday, as Tokyo joined the global sales of bonds caused by the decision of Germany to spend more on defense.

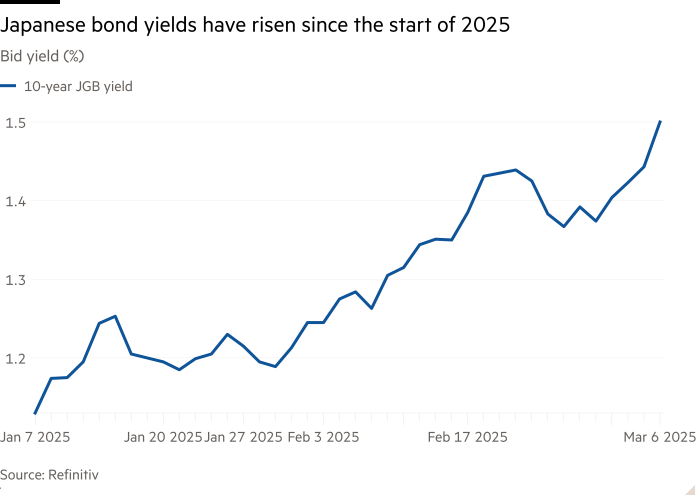

The yield on the 10-year-old Japanese state-owned taxpayer has increased 0.06 percentage points to 1.5 percent, which is the highest level since 2009. JGB has increased by almost 0.4 percentage points from the beginning of 2025.

Germany saw that on Wednesday The highest increase in borrowing costs in 28 years As his bonds sold out after the historical agreement between political parties to spend hundreds of billions of euros on defense and infrastructure.

The growth of German bond yields comes due to growing yields in other countries, including the UK, on the back of government plans to increase fiscal consumption.

Asia traders said that the move was strongly guided by a sense and that it was difficult to recognize who was behind the sale, especially since the main banks and institutions are usually customers of JGBS March before the end of the Japanese financial year.

“It’s a similar story all over the world – a bit of an infection from Germany,” said Mitul Kotech, a macro strategist at Barclays.

“Changing attitudes to Japan” after a stronger economic growth and greater inflation has also increased market expectations of multiple hawk policy than Japan Bank, he added.

Fight has increased interest rates in the last year, as he tries to normalize monetary policy after years of ultra -low rates.

Growth on Thursday follows the constant increase in the yield of JGB from the beginning of 2025 and comes as Japanese inflation continues to exceed the goal of 2 percent of the central bank.

The insecurities that revolve around the Japanese chance of interest rates and markets of the JGB was highlighted Wednesday by the deputy governor of the bank of Japan, Shinichi Uchida.

In a speech that touched on the current state of the global economy, Uchida pointed to increased geopolitical tension as one of the factors that could “affect economic activity and prices in the US, such as politics of a new administration.”

Some traders started betting to increase interest rates at their next meeting later in March. Most economists, however, continue to predict the next increase in July.

Jen was stable on Thursday through Tokyo morning, hovering around Y149.2 compared to the US dollar. Japanese supplies increased during the morning, with a wide reference value of climb to 1.2 percent.

Shares of two largest defense manufacturers of Japan, Mitsubishi Heavy and Kawasaki Heavy, rose by 10 and 9.8 percent, or expectations that Japan will further increase his military consumption.