Japan has not yet won deflation, warns the Minister of Finance

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

Japan has not yet defeated the deflation despite the years of persistently growing consumer prices and the largest circle of annual salaries in three decades, warned finance minister in the country.

A blunt assessment of Katsunobu Kato in an interview with the Financial Times enters 15 months in Bank of JapanThe efforts to “normalize” the economy and gradually re -introduce positive interest rates, after a fighter of a quarter of a century to take away the country from the fall of prices.

Kat acknowledged this Japan He experienced growing prices and that other trends had appeared positively, but said that the Government could declare a victory over deflation only when she did not see the prospect of sliding back.

“I believe we need to judge carefully if Japan has declined from deflation not only by looking at consumer prices, but also in a comprehensive way by looking at the fundamental price and background … Currently, our verdict is that Japan has not overcome deflation,” Kat said.

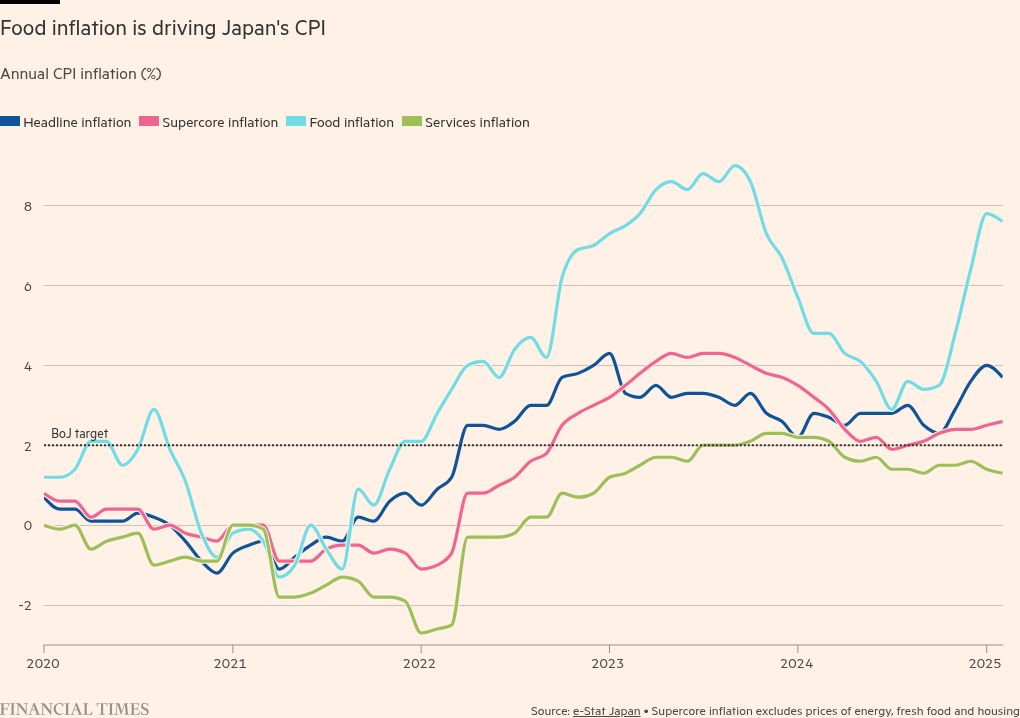

The Minister’s comments echo the fears of some economists that, although prices are growing, they largely represent a “wrong” type of inflation: guided by the weak and high costs of goods, not a virtuosic cycle of growing salary and consumer demand.

The title inflation remained above the goal of the battle of 2 percent for 35 flat months, and consumer prices excluding fresh foods increased in February 3 percent in February.

Last Friday, the Japanese union confederation, which claims to be a member of 7mn workers, said the negotiations resulted in an average salary gain of 5.46 percent, which was stated that the highest blow to 33 years.

However, the growth growth in the real sense is stagnant, the confidence of the consumer remained soft and, according to the Teikok Takoku Takok, the company conveyed a smaller proportion of their increased costs to consumers in February than last July.

During the deflamation period, Kat said, there was no price movement, salary or interest rates – a combination that suppressed economic growth and prevented the country to understand its potential.

“It was very slow,” Kat said. “However, things are changing now. We now notice the growth of prices, the salaries grow and in the sense of monetary policies, the battle is now studying what the optimal attitude of monetary policy will be for Japan. So now we see signs of change and normalization.”

Ktr talked to FT shortly after the battle decided Leave a short -term rate of policy on hold Last week because of the enormous insecurities created by US President Donald Trump’s tariff threats and growing risks for a global economic picture.

The fight process for normalization included the end of the negative rate at the beginning of 2024, followed by a small increase in July that year. In January 2025, battle Raised rates at 0.5 percent – The highest level in 17 years. Many economists predict at least one increase this year.

The process of transition to normal economy, Kat said, depended on ensuring increasing prices at the extent of the price over the long term.

He said it was encouraging that larger companies were increasing wages, but the real challenge was to ensure that small and medium -sized Japan companies could transfer growing labor and enter the costs of customers.

Stefan Angrick, a Japanese economist from Moody’s Analytics, said that, although the level of inflation is consumer prices, it seems that he excludes a return to deflation, the floors comments reflected the fact that Japan had not yet had the type of inflation he wanted.

“And it’s hard to feel very convinced he will,” Angrick said.

The shock of the supply would eventually fade, he added, and then only stronger domestic demand could retain inflation on the target.

“But domestic demand is quite weak. Consumer consumption has been flat in the last three years. Capex spending treading water. Labor markets are not as tight as it seems,” said Angrick, who expects inflation to fall below 2 percent by 2026.