It’s time for another fiscal event in the UK. Will the latter repair their Boe Bond-Translations Projects?

The UK is just a few days from a new fiscal event, and Rachel Reeves is full of her past decisions.

After committing himself to bring Britain to one budget a year, the Chancellor held a budget liability office to produce fiscal forecasts twice a year, which means that he must now respond to updated forecasts without luxury tax settings.

So this time, seeing fiscal rules of the gods means mitigating many people of their benefits. Everyone has the right to their own views on whether it is good or bad, but we hope we can agree on this: it is not a great thing to be in force on formed by fictional rules.

But these are all political things big pictures, which is why we have decided to deliberately miss the tree here at FT Alphaville and intensely stare at the branches of a particular tree.

The last time we wrote about the assumptions of OK for a quantitatively splashing of the Bank of England, we were quite bamboo. Let’s remember why, let’s get back to the basics.

Return to the basics

As part of their twice an annual forecast, analysts of the budget guards assess future losses from the BOE plant to buy property. Currently, Boe lowers the APF crowd in two ways: through passive rolling of bond maturation (“passive QT”) and active sales of others (“Active QT”).

Predictions of OR -A are much important because the UK fixation is in maintaining a “fiscal head space” – which is currently extremely tight – So every billionation is calculated when the Budget Day comes.

In the first two years of QT (2022-23 and 2023-24), the Moetary Policy Committee aimed at reducing a total of £ 100 billion a year, which consisted of passive overturn plus regardless of the active level of sales needed to achieve this 💯.

It went as £ 42 billion active sales in the first year, and £ 54 billion for the second. At his March forecast last year, Oba decided that the best way of extracting these forward numbers was to look at the active levels of sales and average. And so, neatly predicting that future active sales will be £ 48 billion ((42+54)/2) annually during a five -year forecast.

Significantly, this resulted in a striking figure for the current year (2024 – 25), during which about 87 billion passive pounds are expected. 85+48 = 135 billion pounds, which was a lot of QT for prediction, especially after two fixed £ 100 billion.

Within a few short months, it has been proven that the prediction of PRA is completely wrong: at its August meeting, MPC supported even more than £ 100 billion, implicitly consisted of £ 87 billion and £ 13 billion active.

As we noticed Last fall, this gave the opportunity to study for Ob. Having embarked on the October budget, analysts speculate in four possible ways to predict the USA’s future active sale:

– average first three years planned active sales ((42+54+13)/3 =36.3 billion pounds a year through forecast).

-EkstraPosing active sales figures of the latest year on the project 13 billion pounds a year through a forecast window.

– ExtraPulation of Boe’s previous decisions to predict a £ 100 billion envelope.

– The next time they expect markets, as they do with things like a banking rate.

The difference between them was very material in the fiscal context. It was projected spread of £ 15.5 billion Between the most common of these (13 billion £ active forward) and the most strict (£ 100 billion envelopes) in the sense of how it will affect Reeves’ head space.

Absurd, the Eye did not do any of this, deciding instead to ignore the third year envelope and simply maintain its prediction of 48 billion in the amount of 4 years, based on the first two years of active sale. As we wrote then::

The effects that will have on Reeves’s head room are not as extreme as if the invert assumed that a continuous envelope of £ 100 billion was £ p/a – in fact, nothing has changed except the current year – but it is definitely a harder end to things compared to some possible alternatives.

Return to the near future

Of the five apparent ways in which ORA could make up for that number, they chose the second most beautiful-harash in the sense that it decreased in Reeves’s fiscal head room.

Now, first, let’s correct four things:

1) The eyelash is not guilty of a sad situation in which their QT predictions could somehow contribute to things like a reduction in well -being.

2) The latter should not be pressed on the selection of the model, which is the most favorable chancellor of the day.

3) Other factors (such as the expected road of the banking rate) may be as important as the overall scale of active sales.

4) Much can be shown to academic if Boe reveals that he has reached the minimum sustainable level of reserve and stops QT early for the reasons of stability. Based on the current trajectory, by the end of the year it will reach the top scope of its preferred minimum reserve range.

Writing for f entirely in front of that Fiscal event, t rowe Price’s Tomasz Wieladek advocates for the eyebrow monitoring trail scheduled marketas indicated in the study of Boe Market Participants (MAPS).

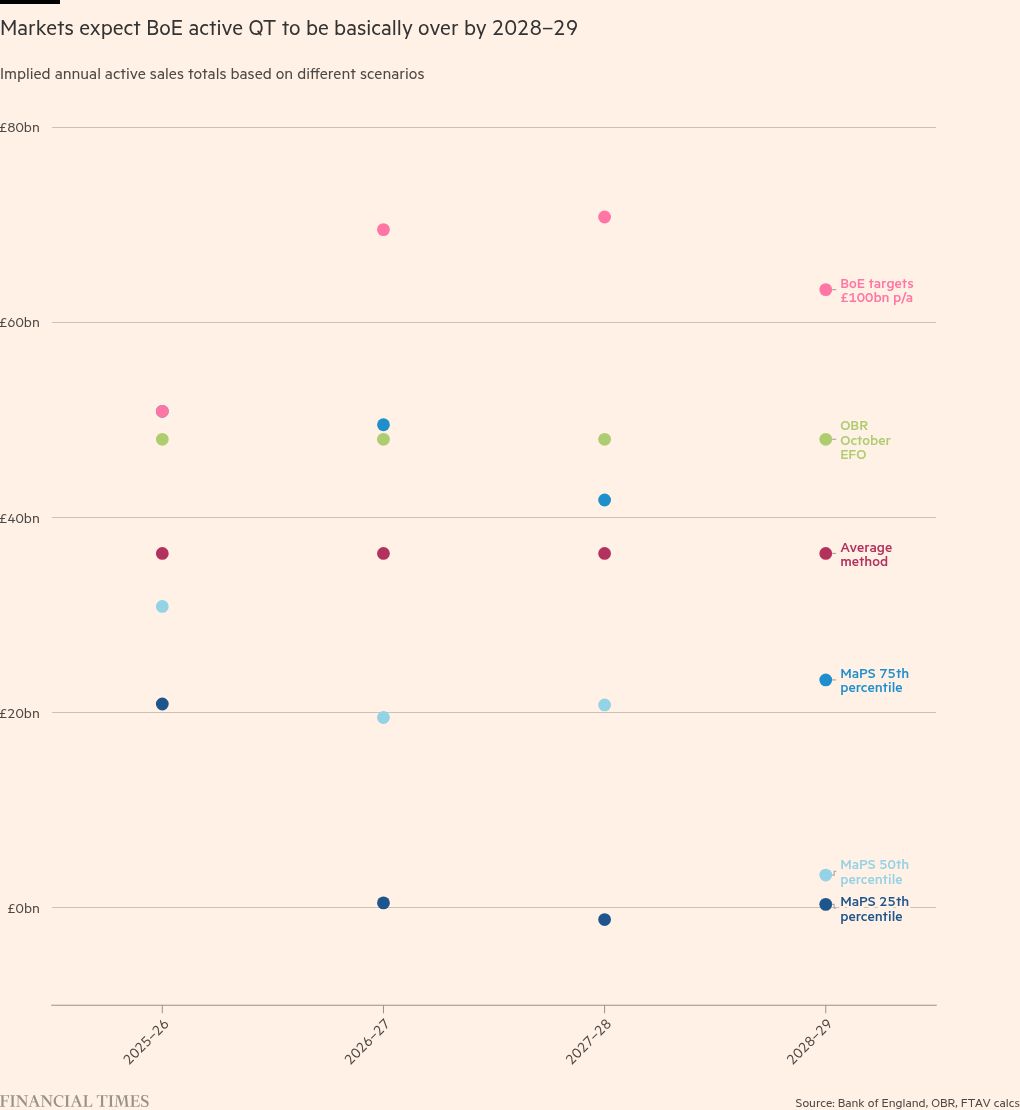

It is a decent moment to revise tickets. According to the latest research, published last month, the middle prediction should be almost zero active QT by 2028-29:

Even a 75 percent assessment Less than half Current assumption of ORA. In the meantime, the assumption of 25. The percentage is that the active QT was completed to the ends of the next fiscal year. Who is to believe, the total view of about 70 companies interested in this right or arbitrary average?

Let’s say without ambiguity: How the Obi predicted active sale in October was irrefutable fiscal NumbersAnd that should change. The current frame does not help anyone, and the eyelash loses credibility using it.

We asked an eyebrow if it would revise its QT assumptions as part of the upcoming economy and fiscal appearance. A spokesman told us:

I am afraid that we cannot provide any guidelines about what we can consider for the upcoming prognosis, but of course, we will explain all the necessary changes in EFO on March 26.

Roll on Wednesday!

Update: Over Bluesky, Executive Director of the Ruth Curtice Resolution Foundation has made an important observation As for our analysis above. She points out that the current rule of deficit is introduced in October, faster the demand for demolition is now a better option in terms of head space (inverting of the former dynamics) because it reduces interest payments below:

In our opinion, this does not change the comprehensive point that the system of creating the number is extremely flawed, but means that the direction and proportion of influence are now different from the ones we described before October.