How Trump’s tariffs threaten an iconic American truck

Unlock Bulletin on White House Hour FREE

Your guide for what American choices 2024 means for Washington and the world

Chevrolet Silverado is one of the most popular American trucks since it was launched almost three decades ago. But the iconic vehicle could now become one of Donald Trump’s biggest victims trade war.

The high -marge model General Motors, which costs approximately $ 40,000 to $ 70,000, relies on one of the most complex, international and interconnected cars for supply especially vulnerable Threats of the US president to impose 25 percent of Tariff Canada and Mexico.

Of the 673,000 Silverados produced last year, 31 percent were built in the GM GM factory Mexican city of Silao and 20 percent in its factory in Oshawa, Canada.

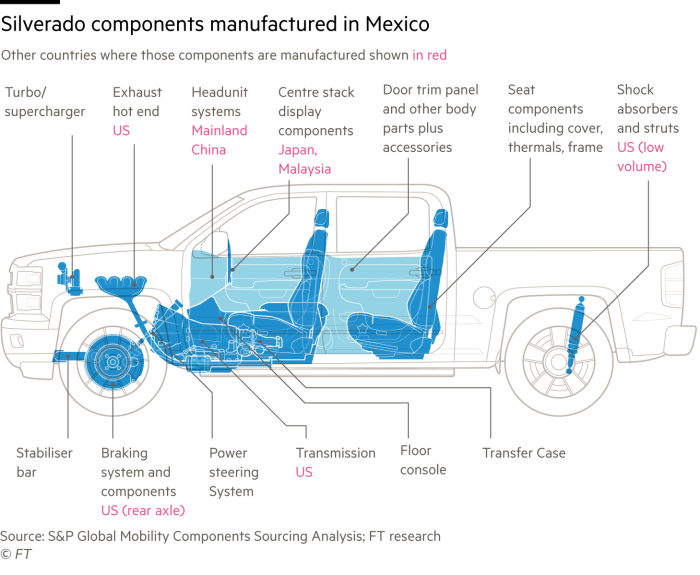

But even for about half manufactured in three American plants in Michigan and Indiana, it is likely that a power steering wheel and door for the door were built in Mexico; rear lighting in Canada; airbag module in Germany; and the Center screen in Japan, according to S&P Global Mobility.

GM is being prepared for Tariffs from Trump’s elections, said Chief Financial Director Paul Jacobson at the investor conference last month.

The car manufacturer moved some production and reduced supplies in plants outside the US for almost a third “because the last thing you want is a bunch of finished inventory that. . . Suddenly it became 25 percent more expensive only over time. “

If the tariffs become permanent, he said, the company should consider whether to move plants. But with current insecurities, GM cannot spend billions of “whipsawwawwaws, forward”.

The data compiled by the Export Genius show that key components in Silverados depend largely on parts imported from Mexico. The export of parts for vehicles in the country was worth almost $ 30 billion last year, and brake systems only made $ 4.3 billion.

Trump endangered Tariffs to Mexico and Canada in early February, then announced a 30-day return for a few hours before they needed to enter into force-but, on Thursday, he vowed to press in advance from March 4. The scallop will be worse if the levy extends to the goods imported from the EU and the rest of the world.

The great fear in the industry is that Trump will impose blankets without mechanisms that usually exist to alleviate their influence, such as the lack of duties through which the levies can eventually return if the import goods are subsequently performed again.

“This is not a trade action. This is border security Negotiations, “said Dan Hearsch, the leader of America in automotive and industrial practice in the AlixPartners consultation, referring to Trump’s argument that he imposed tariffs in response to the flow of illegal immigrants and drugs through Mexican and Canadian borders.”

Mike Wall, executive director of car analyzes in S&P Global Mobility, said the company in the supply chain did a “deep dive” in the supply chain to identify the throttle. “If I can and wherever I can, they will try to switch some of that source,” he added.

However, the movement of Mexico production in the US would take time and be expensive, while the higher labor force price would increase production costs.

Ford CEO Jim Farley warned that “billions of dollars in the industry” could be deleted if there were long -term tariffs to import from Mexico and Canada.

John Elkann, the chairman of the owner of Chrysler Stellantis, this week called Trump to keep the goods from Mexico and Canada without tariff. Instead, he urged to close what he described as a “hole that currently enables approximately 4mn vehicles in the country” without a US content requirement, as is the case with cars made in Japan and South Korea.

Willebaldo Gómez Zuppa, a professor of economics at the National Autonomous University of Mexico and researcher at the Work and Union Research Center in the union, said the tariffs would increase the price of vehicles like Silverda and hurt demand – and can even worsen the problem of immigration.

Highly paid workers at GM Silao factory earned $ 5.50 an hour, said Gómez Zuppa. But last month, the company cited the threat of tariffs when it rejected a proposal from the union of work at a wage increase factory.

Tariff “will change the course of integration with three countries since 1994,” he said.

GM, Ford and Stellantis manage their Mexican factories in the regions that have already occurred with significant migration, he added.

“In case these companies are closed and move on, it will affect the entire regional labor market, and therefore predict that migration from that region will increase,” he said.