How to save $ 10,000 in 6 months

What would you do with an additional $ 10,000?

This amount of money could help you pay off your debt, increase the emergency fund, cover the home repair, take a luxury vacation or progress to any higher financial goal. Ten thousand dollars can go a long way, but saving so much requires a serious focus.

If the savings of $ 10,000 seem unattainable, you are not alone: according to a study of federal funding federations, the middle balance of US families was 8,000 USD in 2022. However, savings of $ 10,000 is not impossible, and several strategic changes, you may be able to save $ 10,000 in six months.

Savings $ 10,000 in six months breaks down to $ 1,667 a month. Depending on your income and financial responsibilities, this may not be realistic (although you can be surprised!). If the savings of $ 10,000 seem insurmountable, you can adapt your six -month goal to something controlled.

Below, find five tips to help you save $ 10,000 – or any amount – in six months.

When you have a goal of savings with a short -term deadline, you can accelerate your progress by limiting monthly consumption. Living on a budget with bare bones is not sustainably long -term, which is why this strategy only works for a short time. But if you can reduce six months (or even several months), your savings can really be removed.

Start with a budget examination, bank statements and a credit card statement to see where your money goes every month. Then identify places where you can reduce. You may decide to completely remove some costs; You may want to stop membership in the gym, get rid of streaming services, or give up on sports events for the season.

Then transfer the focus to the necessary costs, pruning them where possible. For example:

-

Use a list of groceries and coupons to reduce consumption on food

-

Dinner half as often as you usually do

-

Limit the purchase of clothing for saving and shipments

-

Call your Internet and phone providers to negotiate accounts

-

Plan free or cheap activity for loved ones’ birthdays instead of spring for expensive gifts

Read more: How to save money in 2025: 50 tips for growth of your wealth

If you are like many people, you accumulate clutter in your home. And the chances are that there are some valuable items hidden among the clutter. Instead of taking over the space these things, think about sales.

Digest your house around the room, watching the things you can sell. Use the following search list:

-

Clothing, shoes and accessories

-

Books

-

Art and decor of home

-

Kitchen appliances and appliances

-

Craft supplies

-

Sports equipment

-

Children’s toys

-

Electronics

-

Furniture

-

Bicycles and outdoor equipment

After collecting any items you are willing to sell, decide how you will do it. Options include hosting sales of garage or publishing items on web locations such as Facebook Marketplace, Poshmark, Craigslist or Ebay. Alternatively, you may be able to sell certain items – such as clothing and furniture – in shipments as long as they are in good condition.

Cost reduction can be an effective way to save, but it’s worth looking at the other side of the equation: your revenue.

Find out first if you can get more in your current role. Is it time to negotiate a raise? Can you make more money in another company or in another industry? If you work on a clock, can you work a few additional hours each week? Although you do not need a dramatic career change, it is worth finding out if there is a potential to make more.

Then think about the side crowd. Although an additional gig can be unsustainable in the long run, it may be a valuable short -term strategy for rapid construction of savings.

There are a lot of side options for hectic outside, whether you want to run your own business or do a part -time job. Here are some ideas to think:

-

Rideshare ride

-

Home or pets

-

Offer Counseling Services

-

Sell homemade products on Etsy

-

Become a virtual assistant

Whether you get a raise at work or take a side crowd, you will be on your way to reach your six -month savings goal. Even earnings an additional $ 500 a month would add up to $ 3,000 in six months, which would achieve a significant recess in your $ 10,000 goal.

If you spent any time browsing blogs or social media for savings tips, you may have encountered various “savings challenges”. Although there are endless variations of these challenges, the idea is the same: gaming the savings process. Not only does it make the savings more fun, it can also easier to focus on its goal.

Savings Challenges can be structured in one of the following ways:

-

Savings of a certain amount of money: Savings $ 100 per week, Savings $ 1,000 in a month, etc.

-

Reducing consumption in certain areas: Not discretionary consumption There are no subscriptions for a month for weekend, not lunch for a week, etc.

-

Reinforcing your savings: Increasing the amount you save by 1% each week

You can also create your own challenge for consumption based on your lifestyle or habits. For example, if you are a frequent buyer at a local cafe, you could commit to save $ 1 for every $ 1 you spend on coffee.

Regardless of the challenge you choose, create clear parameters, set a reasonable goal and reward yourself when you achieve it.

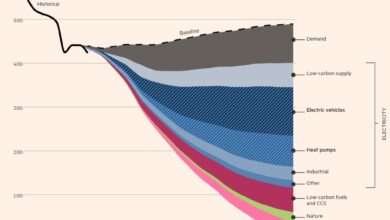

Earnings of revenue in exchange for your hard work is grateful, but it never hurts to earn passive income. Maintenance of savings in a high -yield savings account (HYSA) can help you to further enhance your balance.

High yield savings accounts act as well as any other savings account, but earn larger interest rates compared to traditional accounts. Internet banks usually offer these accounts because they do not have the cost of maintaining physical branches. Instead, they can convey savings to customers in the form of higher interest rates.

Today, the best savings accounts with high yield earns more than 4% of APy-Otrics 10 times more than an average savings rate of 0.41%. Meanwhile, some of the largest banks in the country offer only 0.01%.

Read more: 10 of the best savings accounts with high yield available today

The next table shows how much you could earn if you laid $ 5000 to a savings account and then made an additional contribution of $ 1,000 each month for six months:

As you can see, putting money on a high-speed savings account will not increase the balance for thousands of dollars in just a few months-it will allow you to maximize your return on that money without the need for additional work.

After opening a high yield account, set automatic transfers from your current account to your new savings account. This step ensures that you are progressing to your austerity goal, whether you consciously think about it.

Savings $ 10,000 in six months is definitely possible, but it may not be easy or immediately reached for everyone.

In order to save $ 10,000 in six months, you must save approximately $ 1,667 a month or about $ 385 per week. Reducing consumption, increasing revenue, sale of items around the house, trying out different challenges in savings, and laying money at the expense of a high yield, can help you achieve your goal.

Read more: 3 smart things to do when your savings account reaches $ 10,000