How to Reduce British Social Welfare Account

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

British consumption for well -being is growing relentlessly. The Budget Liability Office has estimated That the total expenditure in the country will increase by more than 25 percent to £ 378 billion by 2030. This is encouraged by growing pension payments and increasing consumption on health benefits in work, which would have set up about 1.7 percent of GDP in the UK to 2.2 percent by the end of the decade. Extended costs are partly an inevitable consequence of the aging of the population, as well as modern diseases associated with obesity and mental health. But the wrong social welfare system in the country also adds unnecessary to the card.

British payments were transferred by consecutive governments. It went strongly to perform without political damage, and attempts to reduce often eventually increased costs and disturbed the efficiency of the system. What remains is an ineffective setting that, instead of acting as a security net, can become a trap. That makes him unsustainable. As is the case, the Government is already struggling to fulfill its fiscal rules and face an even stricter task given the dedication of Prime Minister Sir Keira Starmer to raise the consumption in defense.

The government should list plans for overhauling systems of health and disability systems later This month. They include payments of incompetence given to those who are unable to work and personal payments of independence for those with health conditions or disability regardless of their work status.

What improvements can be done? First, the government must repeat support in the offer. For example, an individual without a job because of severe bad health can get twice as much as someone simply unemployed. This inequality creates a distorted incentive that is categorized as ill and incapable of working and needs to be repaired.

As for PIPS, hectic changes in order to make it harder to qualify, which government Supposedly thinkingRisk of widespread pain. It is better to ensure that the rights are evaluated according to the additional costs that individuals actually face because of their illness. Payments are mainly evaluated on what people cannot do, not what they can, leaving them open to playing the system. The guarantee of this also increases the possibility of simplifying, by connecting the benefits of incompetence in Pips.

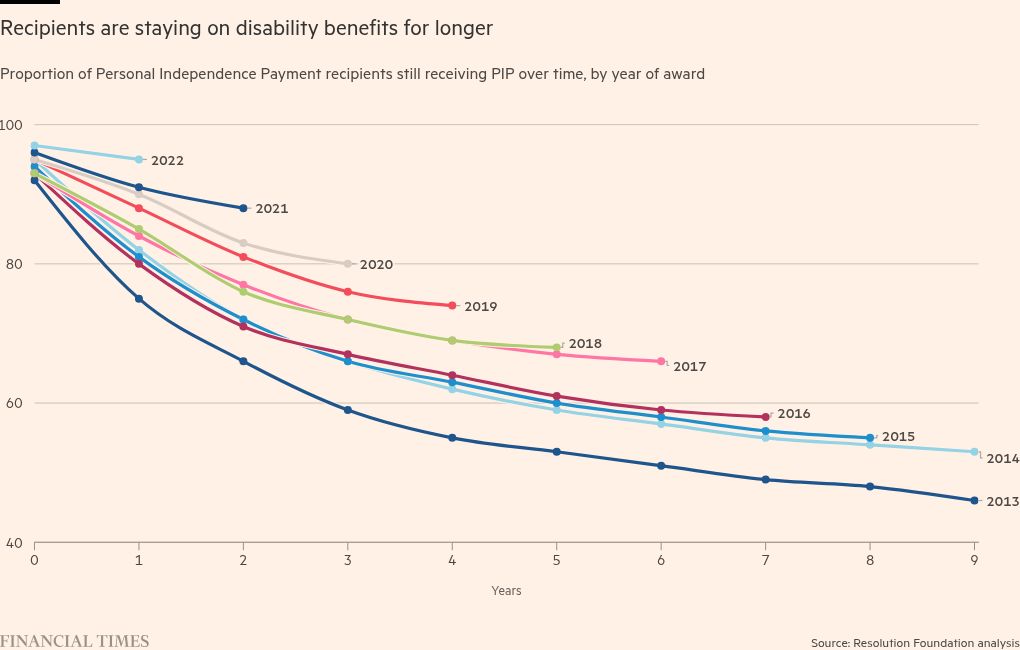

Second, further effort has to invest people Return to work and beyond health benefits. Less than 1 percent of those receiving the highest benefits of incompetence to go to work each month, according to Resolution Foundation. The proportion of people staying on Pip paying longer has also increased over time. Generally, re -evaluations must be more common in order to catch changes in circumstances, with greater emphasis on medical expertise and supporting individuals in finding employment opportunities. This would require restoring money to the well -being for staff. Increasing the number of people who leave the benefits system could save billions in the long run.

In addition to health and disability, there are other ways to save. The government should reform the generous British “triple locking” on state pensions, which guarantees payments annually for more total wages, inflation or 2.5 percent. It is not a sustainable or honest job for workers. Fiscal Studies Institute evaluated that up to £ 40 billion could be saved by 2050. If the mechanism is connected, more understandable, only with the growth of earnings.

The government should also recognize that some solutions lie outside the well -being system. Demand for residential benefit promotes a lack of affordable housing. Growing health -related payments arise from growing cases of mental diseases and chronic diseases. This requires improvement of health and social care. Savings from well -being system is not easy. This requires political will, attention to details and a holistic approach. But the temptation for fast cuts-significant reduction of rights or increasing the criteria of eligibility-not to make the long-term account disappear.