How did the gold lever be flourishing an American alarm

Last week, data showed that the US trade deficit increased to a record $ 131.4 billion in January because companies were supplying goods in front of President Donald Trump Schrodinger’s tariffs.

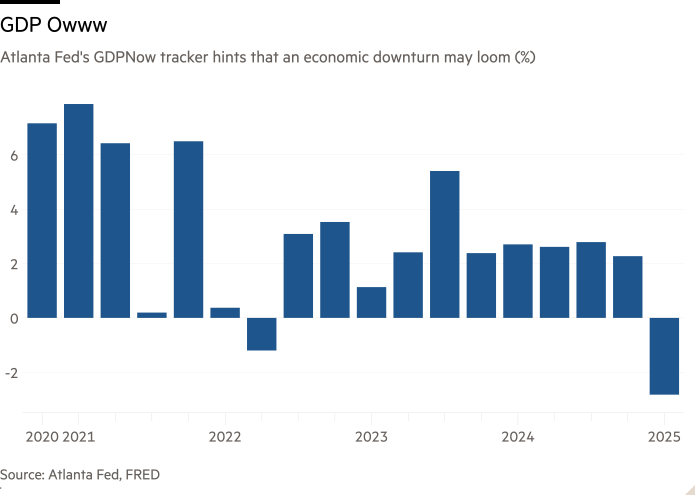

American economic data is generally disappointing, but exacerbating imports of imports have particularly aroused some anger. Due to the mechanics as measured and calculated by the gross domestic product (import is deducted because the point of avoiding double counting and measuring domestic output) has helped with a wide monitoring of Atlanta Feda’s wide monitoring.Bremnow“A model of economic prediction in real time in the tail.

2.8 percent contraction The model was spun after that was revised to -2.4 percent and then to -1.6 percent on Friday, after the latest job numbers in the US. But the nasty reading of the BDNow naturally launched a lot Alarming titles About how it seemed that now they were directing a short recession.

Here’s Thomas Ryan, Economist in Economics Consultancy Capital:

Balloning a trade deficit to a record maximum of $ 131.4 billion in January once again resulted in an increase in imports while companies hurried to fast orders before entering into force of tariffs regarding new countries and products.

. . . This huge withdrawal from the net trade is what caused most of the damage to our assessment of GDP’s first quarter, which is now -2.5% per year, as there was no increase in the accumulation of supplies in data. The good news is that this should be reversed in the second trimester because imports normalize without the appropriate fall in stock, which is why we predict a strong jump in GDP growth.

The main culprit, however, was a truly massive rush in the import of gold in the United States, as traders also sought to progress from the potential tariffs. And that is important a many When we think about economic implications.

Although motivation is the same (avoiding tariffs), the economic impact of the movement in gold and other goods is significantly different. The vast majority of imports are consumed or used in the production of other things, while gold is generally inert and useless in the vault.

Tl;

The influence of gold in American trade balance is not easy to spot because the movements in golden bars are well hidden in us statistics. They are unusually embedded in the “finished metal forms” category, which in January was $ 20.5 billion from an increase in goods in the amount of $ 36.2 billion.

“Unprecedented” is an overly used word, but you can see how much information about January is here.

The import of other goods also increased, but in a far smaller degree. Pharmaceutical imports jumped, for example, $ 5.2 billion a month, but that was only a 1.5 times increase from January last year. Importing passenger cars climbed to $ 1 billion, but remained lower than in January last year.

In other words, Bullion was a boss in January trade numbers. As David Mericle, economist at Goldman Sachs said:

We have noticed that most of the expansion of a trade deficit since November reflects greater imports of gold, which are excluded from GDP because they are not consumed or used in production. The details of the trade balance reports really indicated that elevated gold imports contributed to most of the imports of imports in January.

If you are still not convinced of the importance of gold, let’s look at the US store with Switzerland.

Switzerland is the world’s largest refinement and transit center, and is the home of the world’s largest gold trading center (along with the UK). And the US trade deficit with Switzerland exploded to $ 22 billion in January – Nearly the size of American goods with cinema.

Information on the import of US goods correspond to the Swiss customs data, which showed exports of gold from the country to the United States, increased to 192.9 tons in January, with 64.2 tons in December.

You can enter different countries on the ground above to see similar trends elsewhere. For example, now they have mostly enjoyed a trade excess with Australia in the past decade, but a rush in Australian gold export He helped in January pushed a trade balance into a negative territory.

But Switzerland seems to be great, further evidence of how gold distorted things in January.

Maybe the fear of seeing to be seen wrongly predicted “Trumpcesi”, Atlanta posted on Friday explained his Gpnow model and gold draft:

Although Bdpnow distinguishes gold from other imports, Economic analysis bureau Includes total net export, separation within GDP. The removal of gold from imports and exports leads to an increase in the growth of GDNOW growth forecasts with a contribution of net exports to this forecast, of about 2 percentage points.

The highest -line growth forecasts have also increased the -2.4 percent to -1.6 percent today, the “Gold -Adapted to Gold” -0.4 percent to 0.4 percent -because the data from today’s labor market report became stronger than the model expected on the basis of the limited data of February that the model received before that edition.

So, the prognosis of GDP “adapted to gold” of 0.4 percent of growth. Which is not great, but it is very different from the terrifying number of titles, which is still displayed by the Atlanta Fed model.

Goldman Sachs’s GDP forecast for the first quarter was a more optimistic 1.3 percent, but on Friday it reduced the growth forecast 2025 and increased its “recession likelihood” to 20 percent.

Here are the main points of the latest economic update of the investment bank, in case you are curious, with an emphasis on Alphaville below:

– Larger tariffs will give a greater impetus to consumer prices. In the absence of tariffs, we would expect inflation from one year to one year from 2.65% in January to 2.1% by December 2025. According to our previous tariff assumptions, we expected that the basic inflation of the PCE would remain in the middle of 2s by the end of the year. Our new tariff assumptions mean that instead it will increase slightly and reach about 3% at an annual basis, and in a risk scenario would reach about 3.3%.

-This Tariffs are also likely to hit GDP through its tax effect on available income and consumer consumption and their impact on financial conditions and uncertainty for companies. Although our previous tariff assumptions implied the peak of GDP growth year by year from -0.3PP, our new assumptions imply a top shot of -0.8pp. In the risk scenario, this would rise to -1.3Pp.

-Considering this additional 0.5 PP to grow from our new larger tariff assumptions, we have reduced the GDP growth forecast from GDP from 2025 Q4/Q4 to 1.7%, from 2.2% earlier. This implies that GDP growth will be slightly below the potential, not a little above. In the response, we increased the prognosis of the unemployment rate by 0.1 PP to 4.2%.

-We have increased the likelihood of a 12 -month recession from 15% to 20%. At this point, we have only raised a limited amount because we see policy changes as a key risk, and the White House has the ability to pull back if the lack of risk starts to look more serious. If politics moves in the direction of our risk scenario or if the White House remained dedicated to its policies even despite much worse data, the risk of recession would increase further.

We will find out more when the first three months of the year is the first official estimate of the US GDP to be published on April 30.