German consumption plans raise the bond market growth forecasts

The dramatic increase in Germany’s financing costs this week is far from rejecting Fiscal Bazooke Friedrich Merz, investors say, with many believe that a chancellor consumption plan can increase growth without stretching Berlin finances outside the sustainable level.

German had the largest one day sold out In the decades on Wednesday, while markets have adapted to the dramatic change of German fiscal policy and the big increase in debt issuing, after Merzovo “Whatever it takes“Plan to spend on defense and infrastructure.

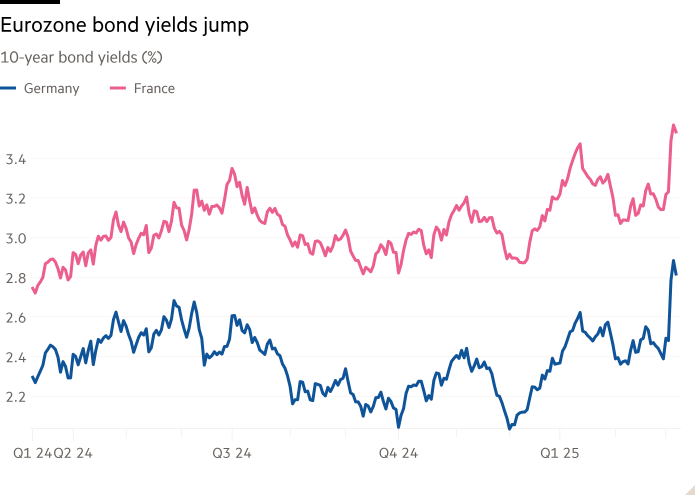

Despite the fact that he descended at the end of the week, 10-year-old Bund remained elevated above 2.8 percent on Friday, after a week lower than 2.5 percent.

“The German authorities finally woke up with the fact that they needed to take drastic actions to revive their economy,” and strengthen their defense, said Nicolas Trindada, a senior portfolio manager at AXA’s investment hand. “This is positive for growth in the medium term, and Germany definitely has enough fiscal space to adjust this very high additional consumption.”

Economists started revising their growth forecasts on Thursday morning. The BNP now provides that German GDP will increase by 0.7 percent this year and 0.8 percent in 2026, instead of increasing 0.2 percent and 0.5 percent. Raising expectations also helped to encourage German supplies to a record maximum on Thursday.

The Bunda Bund Rasting Growth was the price of the shares “the approval of a positive impact that this policy movement would have in German growth,” said Gordon Shannon, a fund manager at the twenty -four Asset Management.

The yields increased while the traders moved to reduce their expectations to reduce the European Central Bank rate on stronger appearances, even before the meeting reduced the Eurozone Reference rate on Thursday, by a quarter to 2.5 percent. Merchants now completely appreciate in just one further decrease in quarter, according to the levels on Swaps markets.

The second main factor in the jump jump, investors said, was a huge increase in the publication of a pumpkin, a property setting for debt prices in the euro area, but is often the absence of a German “debt brake” that limits a government obstacle.

That scarcity – also because of the central banks posture A large proportion of available shares – is one of the reasons why the yields in which were sold below zero longer in the past decade.

Merchants seriously started betting on a greater BUND issuance last year because speculations rose due to a debt brake reform, taking 10-year yields above The rate for the interest rate of the euro for the first time because investors have prepared a larger offer.

Larger yields reflect the risk that the wider eurozone debt market could have “difficulties” in absorbing supplying “if the new fiscal head space is really used,” said Felix Feather, economist of Aberdeen’s property managers.

This is not, he said, prompted by an increased increase in credit risk. “The possibility of Germany does not fulfill or restructure his debt is not for us to care for us,” he said.

That was kilometers, investors said, from the experience of the UK in 2022, when the vicious “mini” budget of Liz Truss caused a Gilts crisis. A similar extreme scenario in Germany would have consequences throughout the eurozone.

“Germany is the backbone of the eurozone. If the German budget is out of control, the euro will be toast,” said Bert Flossbach, co -founder and head of the German manager of Flossbach von Storch.

Light -long load in the country – with a debt of about 63 percent of GDP, opposite close to 100 percent for some other great economics – means that such a scenario is considered very unlikely.

Among investors are more concern about the potential consequences of moving higher in borrowing costs for other eurozone countries, which are already much more influenced.

The spread between German yields and those of other eurozone borrowers like France and Italy remained stable this week, which is a sharp contrast to historical moments of stress, such as the crisis of debt in the eurozone. But the rise of yields to Lockstep -us German will continue to put pressure on countries with higher debt loads.

The UK bonds were caught in sale, with a 10-year yield over 4.6 percent on Friday, which is below 4.4 percent compared to the low last month, as it only comes a few weeks before the Government made a statement of public finances on March 26.

The increase in yields has exerted more pressure on Chancellor Rachel Reeves to “reach a tax increase or a reduction in consumption to stay within its fiscal rules,” said Mark Dowding, CEO of Fixed Income at RBC BlueBay Asset Management.

The key factor in which they will come from here whether the hoping of German economic growth will appear.

In one of the most optimistic prospects, the German economic research center IMK predicted that the German economy could return up to 2 percent of the expansion just above 1.8 percent annually seen in 15 years before the pandemic during the medical period.

Analysts also warn that a debt investment will not be enough to overcome the German permanent growth crisis, which many attribute deeper issues such as old labor, bureaucracy and outdated industrial structure.

Export sector that depends on exports is also strongly affected by geopolitical tensions. “A wider deficit just won’t solve any [those challenges]”, Said Oliver Rakau, a main German economist from Oxford Economics.

But other analysts are more positive. The Bank of America called a fiscal impetus for the “Games exchanger” for the German growth, which, paired with greater issuing of bonds, pointed to the “meaningful greater” forecast for a 10-year Bund yield than previously predicted.

“Bund yields do not come out of fear, because Germany has a lot of fiscal space,” claimed Mahmood Pradhan, head of Global Macro from Amundi. “Markets treat it as a positive growth outcome.”