(Bloomberg) – Corporate debt days show the signs of pale, and trade wars muffle what was a ruthless request for loans.

Most reading from Bloomberg

“The cracks that appeared on the credit market last week culminated in the fracture this week,” wrote strategist Bank of America Corp. Neha Khoda in the note, adding that markets now appreciate in recession.

Tariffs are expected to alleviate the growth of the world economy and the fears are growing that policies will lead to stagflation in the United States. Last week, worthless spreads were spreading last week, but they remain close to the historic lowest, which means that they could move out much more if the recession hit. Some hedge funds have already stumbled out that volatility is growing, and investors are piling up in refuge like gold.

“Below the surface, the fertilization levels just rose,” Victor Khosla, founder of the Opposition Credit Investor Strategic Values, told Bloomberg TV on Wednesday.

Here are five charts that emphasize the movement of feelings in the debt markets:

Premiums of worthless risks

With high yields in the US, Goldman Sachs Group Inc. They have already raised their forecasts for the premiums of the risk that tariff risks are increasing, and the white houses flags are ready to tolerate short -term pain in trying to solve the trade deficit. They are now expecting that the wider high yields will reach 440 base points in the third quarter compared to 295 base points. March 13 levels were 335 base points.

“We recently moved from the market that bought rumors and sold the facts to the market that buys facts,” said Gauthier Reymondier, head of Bain Capital Credit Europe.

CDS movement

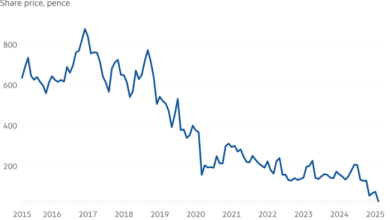

The portfolio leader Algebris Investments Gabriele Foa warned in February that swaps with high yields of default loans, which protect against non -payment, trade on levels seen only three times in the last 10 years, and each time a sharp expansion was followed at six to nine months later. Fast forward so far, the Markit CDX High American Index Index, which falls when it increases credit risk, has dropped to the lowest since August.

Private markets have hit

Whipsawing American economic policy makes it difficult for private capital companies to sell their stakes, and many have added more expensive debt to their portfolio companies in response, which is a large part of a private credit lender.

At a conference in London last week, numerous participants spoke about the sides of concern about the ratio to cover interest in private capital companies, the risk of their companies have too much influence and the need to diversify direct lenders from possible to overcome the corporate loan.

“Too much money flew into a class of private credit assets,” said Claire Madden, a management partner of Connection Capital, who invests in private funds. “We still haven’t had a cycle for a long time. There could still be a lot of problems down the road.”

Levers with levers fall

The fall in the merger and acquisitions was a plus for the publishers on the loan market under the influence of the loan in the last year or approximately, because the starvation investors have demolished all the contracts that came to the market, many of which were repricings. Money managers are now becoming more selective, pushing for aggressive prices and loans with lower ratings with five offers drawn from union in recent weeks.

Credit outflows

The decline is even because the influx is mainly supported by credit prices in recent months, contributing to the tension of spread. But US loans used their first outflows this year in the week until March 12, according to LSEG Lipper, while investors withdrew money from a high -yield of tall yields at the highest rate in about two months. Of course, this could be proven if investors are turning to a loan in the middle of the correction of the capital market.

Still, debt markets “go passive,” said Ted Goldthorpe, a boss of a loan at BC Partners. “This is not good,” because when these funds become too big, the market “becomes very oriented to flow relative to the basic orientation.”

Click here to listen to Podcast Credit Edge with Goldthorpe from BC Partners

A week in review

-

Credit markets have weakened globally this week because the shares sold out, in the midst of escalation of trade wars. A number of companies delayed the sale of bonds in the US. Barclays PLC forecasters for Goldman Sachs Group Inc. They had to revise their wider estimates.

-

Global banks seem to give top clients with private data to conquer corporate relationship trading, according to a new study, which showed that the $ 56 billion market is placed in favor of the most active investors with the widest sales network.

-

Investors are increasingly wanting to profit from bets on recently restructured European companies with high coupons, since they are widths on a high yield with a high yield close to the harshest years and is a little on the path of fresh debt. Money managers are scheduled by the trend of “garbage dash.”

-

Rio Tinto Plc sold 9 billion US bonds in investment, raising funds for its just closed acquisition of Arcadium Lithium plc.

-

By the way, Morgan Stanley sounded investors regarding a potential debt of debt of $ 4 billion for refinancing loans for Finrastra Group Holdings Ltd.

-

Ardagh Group talks to his creditors for a debt restructuring agreement in which Irish billionaire Paul Coulson will lose control of a part of the packaging company.

-

A group of banks led by UBS Group AG launched a $ 1 billion package on Wednesday to produce energy drink Celsius Holdings Inc.

-

EW ScripPY SERVICE PROVIDER has contracted a contract with a repayment loan or extension of its $ 1.3 billion and secured a loan from investors in the amount of $ 450 million, including KKR & CO.

-

Money managers buying sophisticated bonds supported by American corporate loans increasingly reveal that they do not only have to pay attention to how companies do, but also how the debt market in housing mortgage states. Loan obligations for collaterals began to look expensive compared to the colited m oming mortgages, which could limit future gains in closing.

-

The Deutsche Bank increases the size of a significant risk transfer related to the portfolio of the German -based German companies, according to the people who find out the issue, in the latest indicators of high demands of investors for the asset class.

On the go

-

Bank of America Corp. She promoted Neha Khod to the head of the US credit strategy, a newly created role after the departure of a loan strategist with a high yield of Oleg Melentyev.

-

JPMORGAN Chase & Co. He hired a banker for joining and receiving Jay Harris of Bank of America Corp. because the largest lender of Wall Street is pushed to cover smaller and medium -sized companies more thoroughly.

-

The Canadian Imperial Bank of Trade has appointed Harry Culham for the hereditary executive director of Victor Dodig, who will retire in November after running the fifth largest lender in the country for over a decade.

-

HSBC Holdings Plc appointed Alex Paul to lead his team of internal connections and acquisitions. Paul will be headquartered in Hong Kong and start a new role next month.

-

Deutsche Bank is hired by James Wilkinson’s bond dealer of Goldman Sachs as part of his reference loan.

-

Millennium Management eavesdropped on one of the most profitable Eisler Capital merchants for external funds management.

-

Citigroup Inc. He promoted Chris Cox to the investor services manager because he continued further growth in business with services after record revenue in 2024.

-

Banco Santander appointed Peter Huber with his new global insurance chief to replace Armanda Baquero, leaving the Spanish lender.

-

Goldman Sachs Group Inc. He hired Citigroup Inc. Veteran Tetsuya eye to strengthen the business of investment banking in Japan.

-With the help of Sonali Basaka, Kat Hidalgo and Rheaa Rao.

Most readings from Bloomberg Businessweek

© 2025 Bloomberg LP